Investing in the US stock market can be an exciting opportunity for foreign investors looking to diversify their portfolios and gain exposure to one of the world's largest and most dynamic economies. However, navigating the complexities of the US stock market can be daunting for those unfamiliar with the local regulations and procedures. In this article, we'll explore the steps and considerations for foreign investors interested in investing in US stocks.

Understanding the Basics

Before diving into the investment process, it's essential to understand the basics of the US stock market. The US stock market is divided into two primary exchanges: the New York Stock Exchange (NYSE) and the NASDAQ. These exchanges list thousands of publicly traded companies, ranging from large multinational corporations to small startups.

Opening a Brokerage Account

The first step for foreign investors is to open a brokerage account. A brokerage account allows you to buy and sell stocks, bonds, and other securities. There are several brokerage firms that cater to international clients, offering a range of services and fees.

When choosing a brokerage firm, consider the following factors:

- Regulatory Compliance: Ensure that the brokerage firm is registered with the relevant regulatory bodies, such as the Securities and Exchange Commission (SEC) in the US.

- Language Support: Look for a brokerage firm that offers customer support in your native language.

- Fees and Commissions: Compare the fees and commissions charged by different brokerage firms to find the most cost-effective option.

Understanding Risk and Diversification

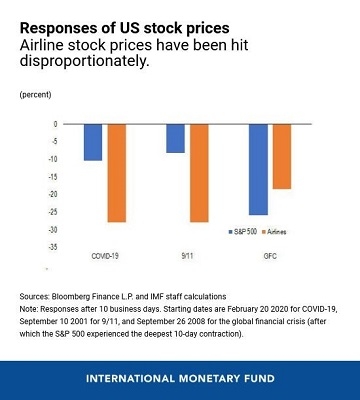

Investing in the US stock market involves risks, including market volatility, currency exchange rates, and political instability. To mitigate these risks, it's crucial to diversify your portfolio. This means investing in a variety of stocks across different sectors, industries, and geographic regions.

Currency Conversion and Tax Implications

Foreign investors should be aware of the potential impact of currency exchange rates on their investments. When you buy or sell US stocks, the transaction will be converted into your local currency. Fluctuations in exchange rates can affect the value of your investment.

Additionally, foreign investors must consider the tax implications of investing in the US stock market. The US government imposes capital gains tax on profits from the sale of stocks held for more than a year. It's essential to consult with a tax professional to understand the tax obligations and potential tax credits available to you.

Case Study: Investing in US Tech Stocks

Consider a hypothetical scenario where a foreign investor decides to invest in US tech stocks. They choose to open a brokerage account with a reputable firm that offers excellent language support and low fees. After conducting thorough research, they decide to invest in a mix of tech giants like Apple, Microsoft, and Amazon.

As the US tech industry continues to grow, the investor's portfolio appreciates in value. However, they must be mindful of currency exchange rates and potential tax obligations. By diversifying their portfolio and seeking professional advice, the investor can mitigate risks and maximize returns.

Conclusion

Investing in the US stock market can be a lucrative opportunity for foreign investors. By understanding the basics, opening a brokerage account, diversifying your portfolio, and considering currency conversion and tax implications, you can navigate the complexities of the US stock market with confidence. Remember to seek professional advice and conduct thorough research before making any investment decisions.

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....