Introduction: The allure of the U.S. stock market has always been a significant draw for international investors. But, can non-US citizens buy U.S. stocks? The answer is yes, with certain conditions and requirements. This article delves into the process and regulations surrounding non-US citizens purchasing American stocks, providing a comprehensive guide to help you make informed decisions.

Understanding the Basics:

Eligibility: Non-US citizens can purchase U.S. stocks, but they must meet specific criteria. This includes having a valid passport, a U.S. bank account, and, in some cases, a visa.

Account Types: There are different types of accounts available for non-US citizens to buy U.S. stocks. These include individual brokerage accounts, joint brokerage accounts, and trust accounts.

Regulatory Compliance: Non-US citizens must comply with all U.S. regulatory requirements, such as reporting their foreign income and paying taxes accordingly.

The Process:

Open a Brokerage Account: The first step is to open a brokerage account. This can be done online through a reputable brokerage firm. Make sure to provide all necessary documentation, such as your passport and proof of address.

Transfer Funds: Once your account is set up, transfer funds from your foreign bank account to your U.S. brokerage account. Ensure that you have the correct banking details and use a secure payment method.

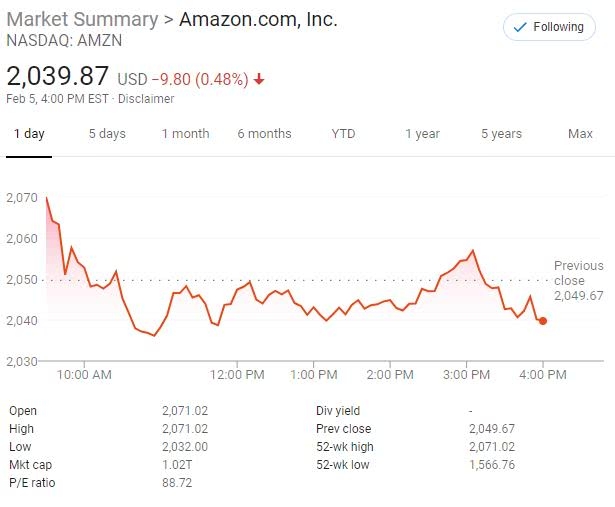

Research and Invest: Conduct thorough research on the U.S. stock market and individual stocks before making investment decisions. Consider consulting with a financial advisor for personalized guidance.

Key Considerations:

Tax Implications: Non-US citizens are subject to U.S. tax laws when investing in U.S. stocks. This includes paying taxes on any dividends or capital gains earned from their investments.

Currency Exchange: Be aware of currency exchange rates and fees when transferring funds between accounts. This can significantly impact your investment returns.

Diversification: Diversify your portfolio to minimize risk. Consider investing in a mix of U.S. stocks, bonds, and other assets.

Case Study: Let's consider a hypothetical scenario involving a non-US citizen named John. John is a citizen of Canada and wants to invest in the U.S. stock market. He opens a brokerage account with a reputable firm, transfers funds from his Canadian bank account, and starts researching U.S. stocks. After careful consideration, John decides to invest in a mix of technology, healthcare, and consumer goods stocks. He also consults with a financial advisor to ensure his portfolio is well-diversified and complies with U.S. tax regulations.

Conclusion: In conclusion, non-US citizens can certainly buy U.S. stocks, but they must understand the process, comply with regulations, and be prepared for the associated risks and responsibilities. With thorough research and proper planning, investing in the U.S. stock market can be a rewarding opportunity for international investors.

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....