Introduction: The US midterm elections are a pivotal moment for the nation, and their impact extends beyond the political landscape. The stock market, a barometer of economic health and investor sentiment, often reacts significantly to the election results. In this article, we delve into the potential effects of the midterm elections on the stock market, providing insights into how these events can shape investor behavior and market trends.

Understanding the Midterm Elections and Stock Market Dynamics

The midterm elections occur every two years in the United States, during which all House of Representatives members and one-third of the Senate seats are up for grabs. The outcome of these elections can have a profound impact on various aspects of the economy, including the stock market.

Historical Precedents

Historically, the stock market has exhibited different behaviors during and after midterm elections. Some studies suggest that the market tends to perform well in the lead-up to midterm elections, as investors anticipate potential policy changes and economic reforms. However, the immediate aftermath of the elections can be unpredictable, with market reactions often influenced by factors such as political uncertainty and investor sentiment.

Potential Impacts on the Stock Market

Political Uncertainty: One of the primary concerns for investors during midterm elections is political uncertainty. A closely fought election can lead to uncertainty about the composition of Congress and the potential for policy changes. This uncertainty can cause volatility in the stock market, as investors react to the shifting political landscape.

Policy Changes: The midterm elections can result in significant changes in policy, particularly regarding taxation, regulation, and spending. These changes can have a direct impact on various sectors of the economy, leading to both opportunities and challenges for investors.

Investor Sentiment: The mood of investors can shift significantly following the midterm elections. A perceived victory for one party over the other can influence investor sentiment, leading to increased optimism or pessimism in the market.

Market Volatility: Midterm elections can lead to increased market volatility, as investors react to election results and potential policy changes. This volatility can create opportunities for skilled investors but also pose risks for those less experienced.

Case Studies

To illustrate the impact of midterm elections on the stock market, let's consider two case studies:

2018 Midterm Elections: The 2018 midterm elections resulted in a Democratic sweep of the House of Representatives. The stock market experienced significant volatility in the days leading up to and following the election. While the market initially fell, it eventually recovered, suggesting that the impact of midterm elections can be short-lived.

2010 Midterm Elections: The 2010 midterm elections saw a significant gain for the Republican Party, leading to increased optimism among investors. The stock market experienced a rally in the days following the election, with many sectors benefitting from the perceived shift in policy.

Conclusion:

The impact of US midterm elections on the stock market is a complex and multifaceted issue. While political uncertainty and potential policy changes can create volatility and uncertainty, historical precedents suggest that the impact of midterm elections on the stock market may be short-lived. Investors should closely monitor the political landscape and stay informed about potential market shifts to make informed decisions.

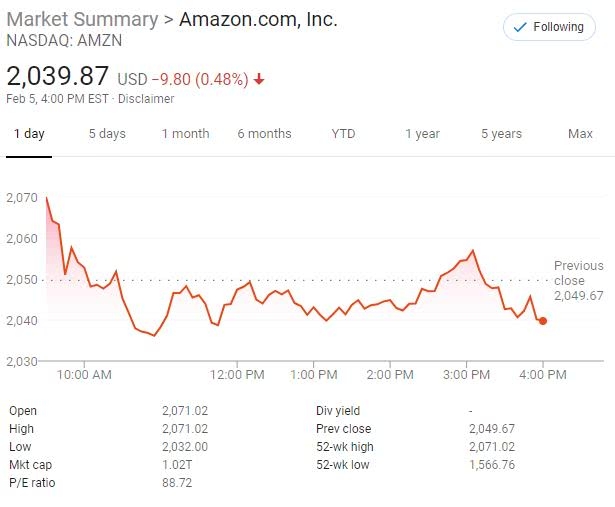

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....