Investing in a diverse portfolio is a crucial strategy for long-term financial success. One of the most effective ways to achieve this diversity is by incorporating US stocks. In this article, we will explore how US stocks can diversify your portfolio and provide some valuable insights to help you make informed investment decisions.

Understanding Portfolio Diversification

Before diving into the benefits of US stocks, it's essential to understand the concept of portfolio diversification. Diversification is the process of spreading your investments across various asset classes, sectors, and geographical regions to reduce risk. By doing so, you can minimize the impact of any single investment on your overall portfolio.

The Role of US Stocks in Portfolio Diversification

US stocks play a significant role in portfolio diversification due to several factors:

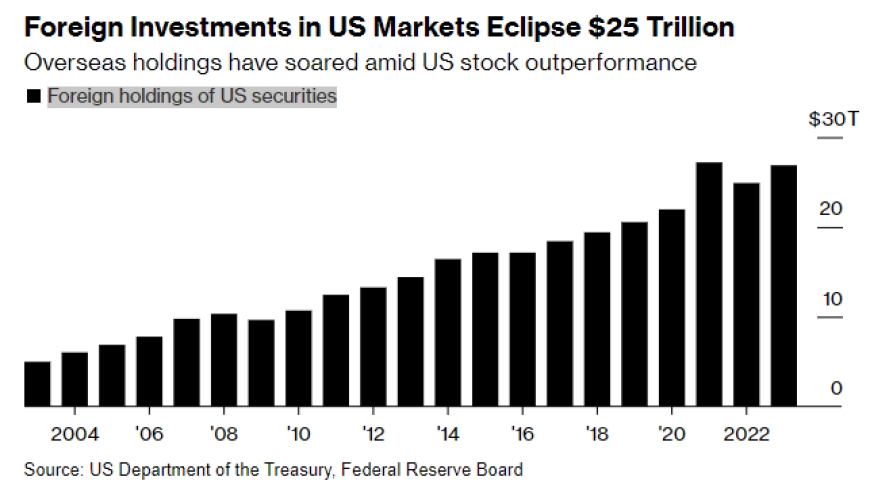

Market Size and Liquidity: The US stock market is the largest and most liquid in the world. This means that there are numerous opportunities to invest in a wide range of companies across various industries.

Economic Stability: The US economy is one of the most stable in the world, offering investors a relatively low risk of economic downturns.

Innovation and Growth: The US is home to some of the most innovative and successful companies globally. Investing in these companies can provide access to high growth potential.

Benefits of Investing in US Stocks

Access to Diverse Industries: The US stock market offers exposure to a wide range of industries, including technology, healthcare, finance, and consumer goods. This allows investors to diversify their portfolio across various sectors.

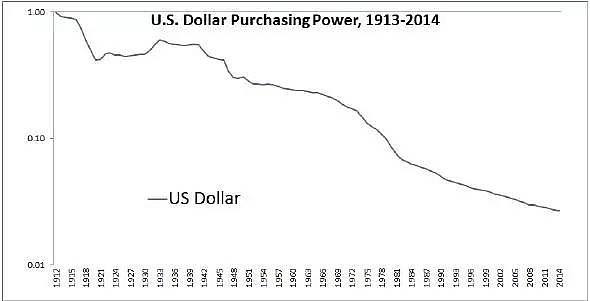

Hedging Against Inflation: Over time, stocks tend to outpace inflation, providing investors with a hedge against rising prices.

Potential for High Returns: Historically, US stocks have provided higher returns compared to other asset classes, such as bonds or cash.

Strategies for Diversifying Your Portfolio with US Stocks

Index Funds: Index funds, such as the S&P 500, offer a simple and cost-effective way to invest in a diversified portfolio of US stocks. These funds track the performance of a specific index and provide exposure to a wide range of companies.

Sector Funds: Investing in sector funds allows you to focus on specific industries that you believe will perform well. For example, technology or healthcare sector funds can provide exposure to companies within those industries.

International Stocks: While this article focuses on US stocks, incorporating international stocks into your portfolio can further diversify your investments and reduce risk.

Case Study: Apple Inc.

Apple Inc. is a prime example of how US stocks can diversify a portfolio. As a leading technology company, Apple has provided investors with significant returns over the years. By investing in Apple stock, investors gain exposure to the technology sector, which has historically outperformed the market.

In conclusion, incorporating US stocks into your portfolio can provide a valuable source of diversification. By understanding the benefits of US stocks and utilizing various investment strategies, you can create a well-diversified portfolio that aligns with your financial goals.

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....