The recent verdict in the United States against Bayer AG over its controversial herbicide Roundup has sent shockwaves through the global market. The German multinational pharmaceutical and agricultural chemicals company has seen its stock plummet following the landmark ruling. This article delves into the implications of the verdict, the impact on Bayer's stock, and the broader implications for the agricultural industry.

The Verdict and Its Implications

The jury in the Superior Court of California, County of San Francisco, found that Roundup, which contains the chemical glyphosate, was a substantial factor in causing cancer in a school groundskeeper, Edwin Hardeman. The jury awarded Hardeman $2 billion in damages, a decision that has sent shockwaves through the agricultural industry and investors alike.

The ruling is a significant blow to Bayer, which acquired Monsanto, the developer of Roundup, for $63 billion in 2018. The company has faced numerous lawsuits regarding the potential carcinogenic effects of glyphosate, and this latest verdict is just one of many legal challenges it is facing.

Impact on Bayer's Stock

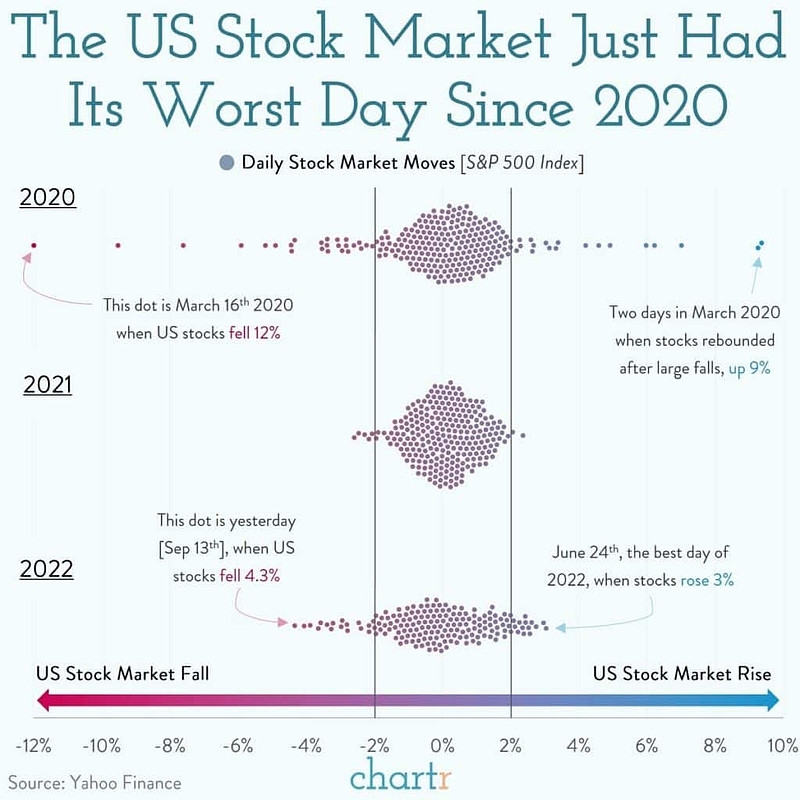

The impact of the verdict on Bayer's stock has been dramatic. Since the ruling was announced, the company's shares have plummeted, with investors reacting to the potential financial implications of the damages awarded. At the time of writing, Bayer's stock has fallen by over 12%, wiping billions off the company's market value.

The drop in stock is a clear indication of investor concern over the potential financial burden that Bayer may face as a result of the verdict. The company has already set aside $10 billion to cover potential liabilities related to glyphosate, but the latest ruling could see this figure soar.

Broader Implications for the Agricultural Industry

The verdict against Bayer and Roundup has broader implications for the agricultural industry. It raises questions about the safety of glyphosate and other herbicides, and could lead to increased scrutiny and regulation of these chemicals.

The ruling could also prompt other lawsuits against Bayer, as well as other companies that produce glyphosate-containing products. This could lead to a significant increase in legal costs and potential damages for these companies.

Case Studies

One notable case study is that of Dewayne Johnson, another groundskeeper who won a $289 million judgment against Bayer in 2018. The jury in that case found that Roundup was a substantial factor in causing Johnson's non-Hodgkin's lymphoma.

These cases have highlighted the potential health risks associated with glyphosate and have sparked a broader debate about the use of herbicides in agriculture.

Conclusion

The recent verdict against Bayer and Roundup is a significant event that has sent shockwaves through the global market. The implications of the ruling are far-reaching, with potential financial and legal consequences for Bayer and the broader agricultural industry. As the debate over the safety of glyphosate continues, it remains to be seen how the industry will adapt to these new challenges.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....