In recent years, the US stock market has experienced unprecedented volatility, leaving investors both excited and apprehensive. This article aims to delve into the factors contributing to this volatility, analyze its impact on the market, and provide insights for investors navigating this turbulent landscape.

Understanding Stock Market Volatility

Stock market volatility refers to the degree of variation in stock prices over a certain period. High volatility means that stock prices fluctuate significantly, while low volatility indicates a more stable market. Several factors contribute to stock market volatility, including economic indicators, geopolitical events, corporate earnings reports, and investor sentiment.

Economic Indicators

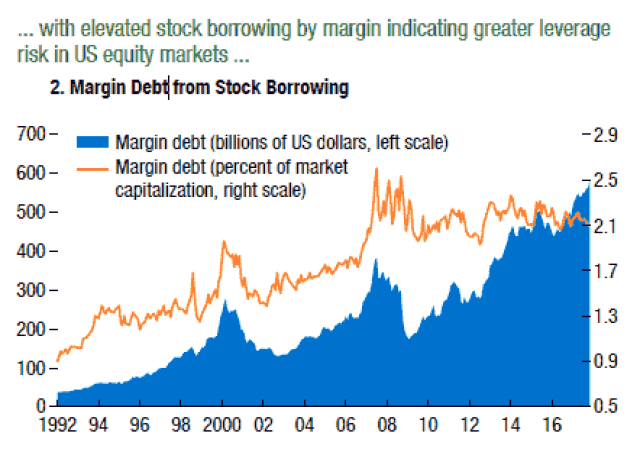

One of the primary drivers of stock market volatility is economic indicators. For instance, when the Federal Reserve raises interest rates, it can lead to higher borrowing costs for companies, which in turn can impact their profitability and stock prices. Similarly, economic data such as unemployment rates, inflation, and GDP growth can also influence investor sentiment and market volatility.

Geopolitical Events

Geopolitical events, such as elections, trade disputes, and international conflicts, can also contribute to stock market volatility. For example, the US-China trade war in 2019 led to significant market fluctuations as investors worried about the impact on global economic growth and corporate earnings.

Corporate Earnings Reports

Corporate earnings reports are another crucial factor in stock market volatility. When companies report better-than-expected earnings, their stock prices often rise, while disappointing results can lead to declines. This is particularly true for high-growth companies, whose stock prices can be highly sensitive to earnings reports.

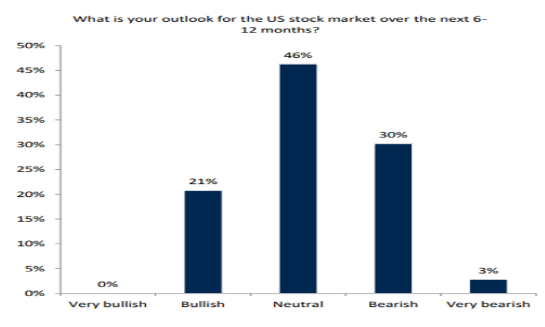

Investor Sentiment

Investor sentiment plays a significant role in stock market volatility. When investors are optimistic about the market, they are more likely to buy stocks, driving prices up. Conversely, when investors are pessimistic, they may sell their stocks, leading to price declines.

Impact of Volatility on the Market

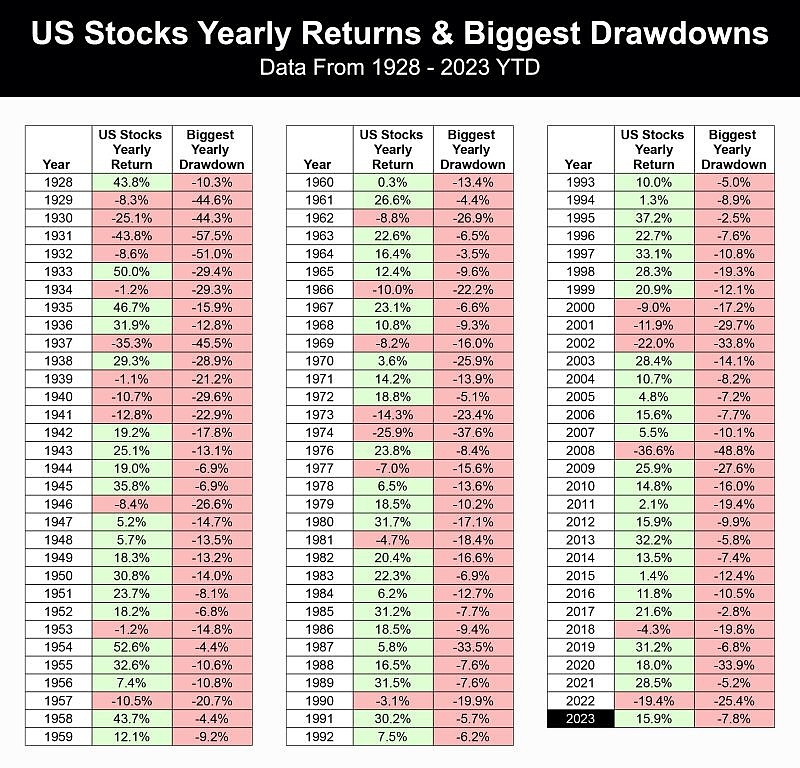

Stock market volatility can have both positive and negative impacts on the market. On one hand, it can create opportunities for investors to buy undervalued stocks and sell overvalued ones. On the other hand, it can lead to increased uncertainty and anxiety among investors, leading to panic selling and further volatility.

Navigating Volatile Markets

For investors navigating volatile markets, it is crucial to focus on long-term investing rather than short-term fluctuations. Here are some tips for managing volatility:

- Diversify Your Portfolio: Diversifying your portfolio can help reduce the impact of volatility on your investments. By investing in a variety of asset classes, you can mitigate the risk associated with any single stock or sector.

- Stay Disciplined: Avoid making impulsive decisions based on short-term market movements. Stick to your investment strategy and maintain a long-term perspective.

- Monitor Economic Indicators: Stay informed about economic indicators and geopolitical events that can impact the market.

- Consider Low-Volatility Strategies: Some investors may find success in low-volatility strategies, which focus on investing in stocks with lower price fluctuations.

Case Study: The 2020 Stock Market Crash

One of the most significant stock market crashes in recent history occurred in March 2020, triggered by the COVID-19 pandemic. The S&P 500 index dropped by nearly 34% in just two months. However, as the pandemic situation improved and economies began to recover, the market rebounded strongly, with the S&P 500 index regaining its pre-crisis levels by the end of the year.

This case study highlights the importance of long-term investing and the potential for market recovery in the face of significant volatility.

In conclusion, understanding the factors contributing to stock market volatility and navigating this turbulent landscape is crucial for investors. By focusing on long-term investing, diversifying their portfolios, and staying informed about economic indicators and geopolitical events, investors can mitigate the risks associated with market volatility and achieve their investment goals.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....