Introduction: In the world of finance, understanding the money stock measures is crucial for investors, economists, and policymakers. Money stock measures provide insights into the liquidity and availability of money in an economy. This article delves into the various types of US money stock measures, their significance, and how they impact financial markets. So, let's explore the intricacies of US money stock measures.

Understanding US Money Stock Measures:

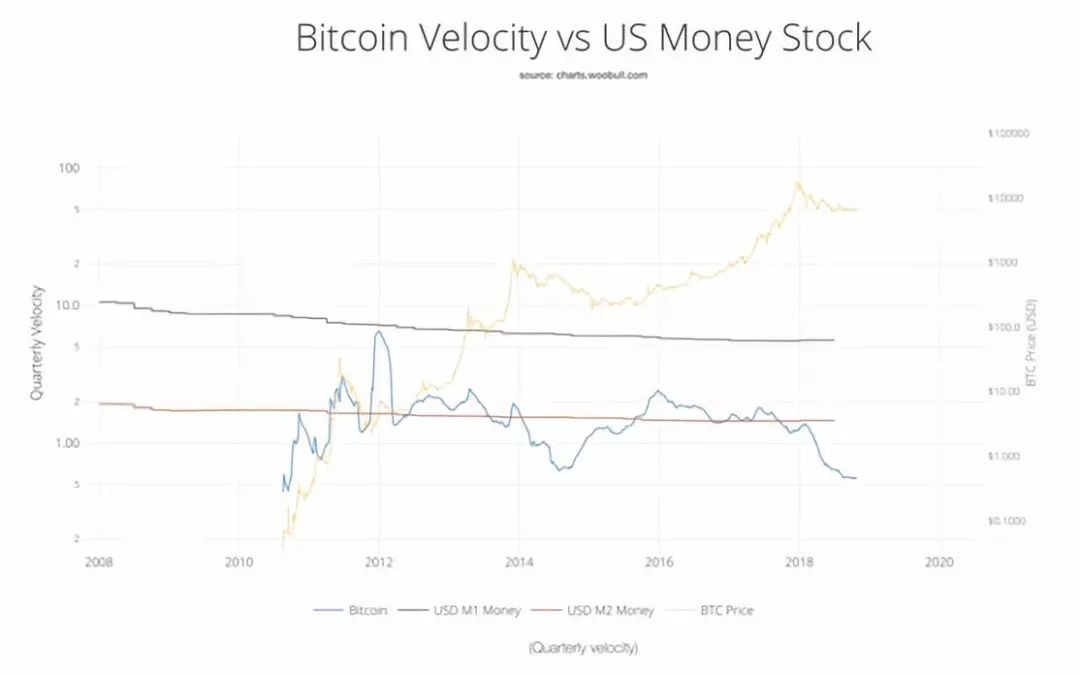

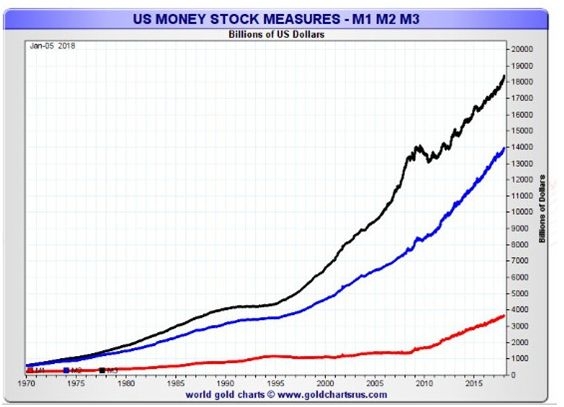

M1 Money Stock: M1 money stock is the narrowest measure of money supply. It includes cash, checking deposits, and other easily accessible funds. This measure is widely used to gauge the immediate liquidity of the economy.

M2 Money Stock: M2 money stock is a broader measure that includes M1 plus savings deposits, money market mutual funds, and other less liquid assets. It provides a more comprehensive view of the money supply, reflecting the overall liquidity of the economy.

M3 Money Stock: M3 money stock is the broadest measure, encompassing M2 along with large-denomination time deposits and institutional money funds. M3 offers an in-depth perspective on the money supply and is often used to assess long-term economic trends.

The Significance of US Money Stock Measures:

Economic Activity: Money stock measures provide valuable insights into the level of economic activity. By analyzing the growth rate of these measures, economists and investors can anticipate changes in the economy.

Monetary Policy: Central banks use money stock measures to assess the effectiveness of their monetary policy. By adjusting interest rates and controlling the money supply, central banks aim to stabilize inflation and stimulate economic growth.

Investment Decisions: Understanding money stock measures helps investors make informed decisions. By analyzing the liquidity and availability of money, investors can identify potential investment opportunities and risks.

Consumer Spending: Consumer spending is closely tied to the money supply. By monitoring money stock measures, policymakers can gauge consumer confidence and spending patterns, which are vital for economic growth.

Case Study: The Great Recession of 2008

During the Great Recession, the US experienced a significant decline in the money stock measures. The M1 money stock shrank by 8.2% from 2008 to 2009, reflecting the liquidity crisis. As a result, the Federal Reserve implemented expansionary monetary policy to stimulate the economy. By increasing the money supply, the central bank aimed to restore confidence and encourage consumer spending.

Conclusion:

Understanding US money stock measures is essential for comprehending the dynamics of the economy. By analyzing these measures, policymakers, investors, and economists can make informed decisions, predict economic trends, and respond to potential risks. Whether you're an investor looking for investment opportunities or an economist analyzing long-term economic trends, grasping the significance of US money stock measures is crucial.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....