Introduction: The United States stock market, often referred to as the most significant and influential in the world, has been a key driver of economic growth and investment opportunities. One of the most crucial metrics to understand the market's size and potential is the total US stock market capitalization, also known as US market cap. In this article, we will delve into the concept of US market cap, its significance, and how it has evolved over the years.

Understanding Total US Stock Market Capitalization (US Market Cap): The total US stock market capitalization represents the total value of all publicly traded companies in the United States. It is calculated by multiplying the market price of each company's shares by the number of outstanding shares. This metric provides a comprehensive view of the overall size and health of the US stock market.

Significance of US Market Cap:

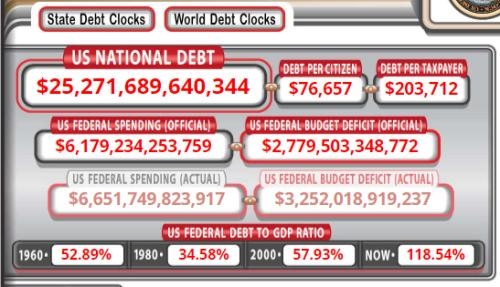

Economic Indicator: The US market cap serves as a vital economic indicator, reflecting the overall health and growth potential of the US economy. An increasing market cap often indicates a strong economy, while a declining market cap may suggest economic challenges.

Investment Opportunities: The total US stock market capitalization provides investors with insights into potential investment opportunities. A higher market cap may indicate a more stable and established company, while a lower market cap may suggest a growth opportunity.

Market Comparison: Comparing the US market cap with other major markets allows investors to assess the relative size and potential of the US stock market.

Evolution of US Market Cap: Over the years, the US market cap has experienced significant growth and fluctuations. Let's take a look at a few key milestones:

Early 20th Century: In the early 20th century, the US stock market was relatively small, with a total market cap of around $100 billion.

Post-World War II: After World War II, the US economy experienced a period of rapid growth, leading to a substantial increase in the total market cap. By the 1970s, the US market cap had reached over $1 trillion.

Dot-com Bubble: In the late 1990s, the dot-com bubble saw a surge in technology stocks, significantly boosting the US market cap. However, the bubble burst in 2000, leading to a sharp decline in the market cap.

Financial Crisis: The 2008 financial crisis had a profound impact on the US stock market, causing a significant drop in the total market cap. However, the market quickly recovered, and by 2013, the US market cap had surpassed its pre-crisis levels.

Current State: As of 2021, the total US stock market capitalization stands at over $40 trillion, making it the largest stock market in the world.

Case Studies:

Apple Inc.: As one of the most valuable companies in the world, Apple's market cap has played a significant role in the growth of the US stock market. From a market cap of around

200 billion in 2010, Apple's market cap has surged to over 2 trillion today.Amazon.com Inc.: Similarly, Amazon's market cap has experienced remarkable growth, contributing to the overall increase in the US market cap. From a market cap of around

100 billion in 2010, Amazon's market cap has reached over 1.5 trillion today.

Conclusion: The total US stock market capitalization, or US market cap, is a crucial metric that provides insights into the size, health, and potential of the US stock market. Understanding the evolution and significance of the US market cap can help investors make informed decisions and gain a better understanding of the overall market dynamics.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....