In the fast-paced world of the stock market, identifying stocks with momentum is crucial for investors looking to capitalize on short-term opportunities. Today, we delve into the stocks that are currently driving the US market, providing insights into their potential and risks.

Top Stocks with Momentum

Tesla, Inc. (TSLA) Tesla, the electric vehicle (EV) giant, continues to dominate the market with its innovative products and strong performance. The company's recent earnings report exceeded expectations, sending its stock soaring. TSLA is currently one of the most momentum stocks in the US market.

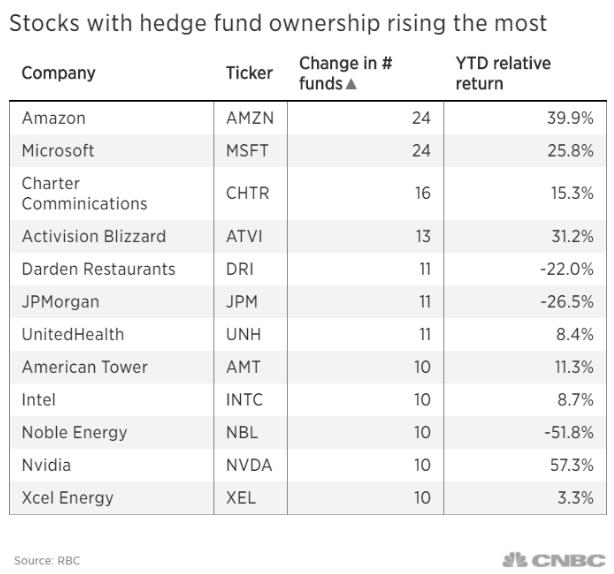

Amazon.com, Inc. (AMZN) As the world's largest online retailer, Amazon has been a key driver of the US stock market. The company's recent expansion into new markets and the launch of its subscription service, Amazon Prime, have further boosted its momentum. AMZN is a top-performing stock with significant potential for growth.

Meta Platforms, Inc. (META) Once known as Facebook, Meta has been making waves in the tech industry. The company's shift towards virtual reality (VR) and augmented reality (AR) has generated excitement among investors. With a strong user base and a growing revenue stream, META is a high-momentum stock worth watching.

NVIDIA Corporation (NVDA) NVIDIA, a leader in graphics processing units (GPUs), has been a major force in the tech sector. The company's strong performance in the gaming and data center markets has propelled its stock to new heights. NVDA is a momentum stock with significant upside potential.

Berkshire Hathaway Inc. (BRK.B) As one of the world's most successful investment companies, Berkshire Hathaway has a strong track record of investing in high-quality businesses. The company's recent investments in healthcare and technology have contributed to its momentum in the stock market.

Analyzing Momentum Stocks

When analyzing stocks with momentum, it's essential to consider several factors:

Fundamental Analysis: Look for companies with strong financials, including revenue growth, earnings per share (EPS), and return on equity (ROE).

Technical Analysis: Analyze the stock's price movement and trading volume to identify patterns and trends. Look for stocks with rising prices and increasing trading volume.

Market Sentiment: Pay attention to the overall market sentiment and investor sentiment towards the stock. Positive news and strong investor confidence can drive momentum.

Sector Trends: Consider the broader trends within the industry and how the stock fits into those trends.

Case Study: Tesla, Inc. (TSLA)

To illustrate the concept of momentum stocks, let's take a closer look at Tesla, Inc. (TSLA). As mentioned earlier, Tesla has been a significant driver of the US stock market. The company's strong financial performance, innovative products, and expansion into new markets have contributed to its momentum.

In the past year, Tesla's stock has seen significant growth, with its share price more than doubling. This growth can be attributed to several factors:

Innovative Products: Tesla's electric vehicles (EVs) have been well-received by consumers, with strong demand driving sales.

Expansion into New Markets: Tesla has been expanding its presence in new markets, including China and Europe, which has contributed to its revenue growth.

Strong Financial Performance: Tesla's recent earnings report showed strong revenue and EPS growth, exceeding market expectations.

By considering these factors, investors can identify stocks with momentum and capitalize on short-term opportunities.

In conclusion, identifying stocks with momentum is crucial for investors looking to capitalize on short-term opportunities. By analyzing fundamental and technical factors, investors can make informed decisions and potentially profit from high-momentum stocks like Tesla, Amazon, Meta, NVIDIA, and Berkshire Hathaway.

us stock market today

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....