In recent years, the stock market has seen a surge in the popularity of so-called "meme stocks." These are companies that have gained significant attention on social media platforms, particularly Reddit, for their quirky or humorous qualities. The term "meme stock" refers to stocks that have become cultural phenomena, often driven by online communities. This article delves into the world of US meme stocks, exploring their rise, impact, and the risks involved.

Understanding Meme Stocks

Meme stocks are not your typical blue-chip investments. They are often small-cap companies that have seen their share prices skyrocket due to the influence of online communities. These stocks are typically chosen for their unique characteristics, such as having a strong social media presence or being associated with a popular meme.

One of the most famous examples of a meme stock is GameStop (GME). In early 2021, a group of Reddit users, primarily from the r/WallStreetBets community, rallied together to drive up the stock's price. This led to a dramatic increase in share value, causing a stir in the financial world.

The Power of Online Communities

The rise of meme stocks can be attributed to the power of online communities. Platforms like Reddit have allowed investors to band together and exert influence on the stock market. These communities often share information, analyze companies, and collaborate to drive stock prices.

The WallStreetBets community is particularly influential in this regard. This subreddit has become a hub for amateur traders and investors to discuss market trends and share trading strategies. The collective power of this community has been instrumental in the rise of meme stocks.

The Impact of Meme Stocks

The impact of meme stocks has been significant. On one hand, they have brought attention to the stock market and made it more accessible to the average person. On the other hand, they have raised concerns about market manipulation and the potential risks involved.

The dramatic increase in share prices of meme stocks has sparked debates about the role of online communities in the stock market. Some argue that this democratization of investment is a positive development, while others worry about the potential for market manipulation and volatility.

Risks Involved in Investing in Meme Stocks

Investing in meme stocks comes with its own set of risks. These stocks are often highly volatile, and their prices can skyrocket and plummet rapidly. This volatility can make them risky investments for the inexperienced.

Furthermore, meme stocks are often chosen for their unique characteristics rather than their financial stability. This means that they may not be as reliable as traditional investments.

Case Study: Tesla (TSLA)

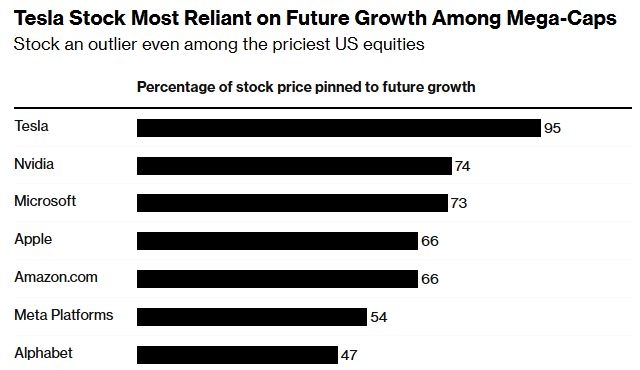

Another notable example of a meme stock is Tesla (TSLA). While not as extreme as GameStop, Tesla has seen its share price surge due to its association with innovation and the electric vehicle market. The company's strong social media presence and charismatic CEO, Elon Musk, have contributed to its popularity.

Tesla's stock has been a subject of intense debate and speculation. While some investors see it as a long-term investment, others view it as a speculative play. The company's share price has been highly volatile, reflecting the market's sentiment towards the company.

Conclusion

The rise of US meme stocks has been a fascinating development in the stock market. While they offer the potential for significant gains, they also come with their own set of risks. As with any investment, it's important to do thorough research and understand the potential risks involved before investing in meme stocks.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....