In the vast world of stocks, Berkshire Hathaway stands out as one of the most respected and successful companies. If you're considering investing in Berkshire Hathaway stock (US: BRK.A), it's crucial to understand its business model, financial performance, and future prospects. This article delves into the key aspects of Berkshire Hathaway, providing you with the information needed to make an informed decision.

Berkshire Hathaway: A Brief Overview

Berkshire Hathaway is a diversified holding company, founded by Warren Buffett in 1965. The company owns a wide range of businesses, including insurance, utilities, retail, and manufacturing. Its portfolio includes well-known brands such as Geico, Duracell, and See's Candies.

Financial Performance

Berkshire Hathaway has a long history of strong financial performance. Over the past few decades, the company has consistently generated significant profits and returned substantial value to its shareholders. Here are some key financial metrics to consider:

- Revenue: In 2020, Berkshire Hathaway reported revenue of approximately $243 billion.

- Net Income: The company's net income for 2020 was around $36.4 billion.

- Dividend Yield: Berkshire Hathaway offers a dividend yield of around 1.4%, which is relatively low compared to other companies in the market.

Business Model

One of the reasons Berkshire Hathaway has been so successful is its unique business model. The company focuses on acquiring and managing high-quality businesses with strong competitive advantages. This approach has allowed Berkshire Hathaway to generate consistent profits and outperform the market over the long term.

Insurance Operations

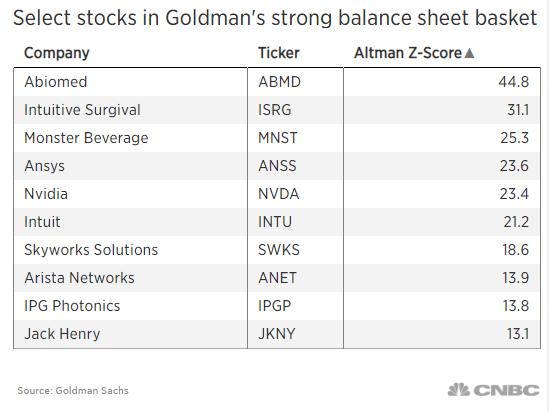

Insurance is a major component of Berkshire Hathaway's business, accounting for a significant portion of its revenue. The company operates through several insurance subsidiaries, including Geico and Berkshire Hathaway Primary Group. Its insurance operations benefit from a strong balance sheet, which allows it to underwrite risks that other companies might avoid.

Investments

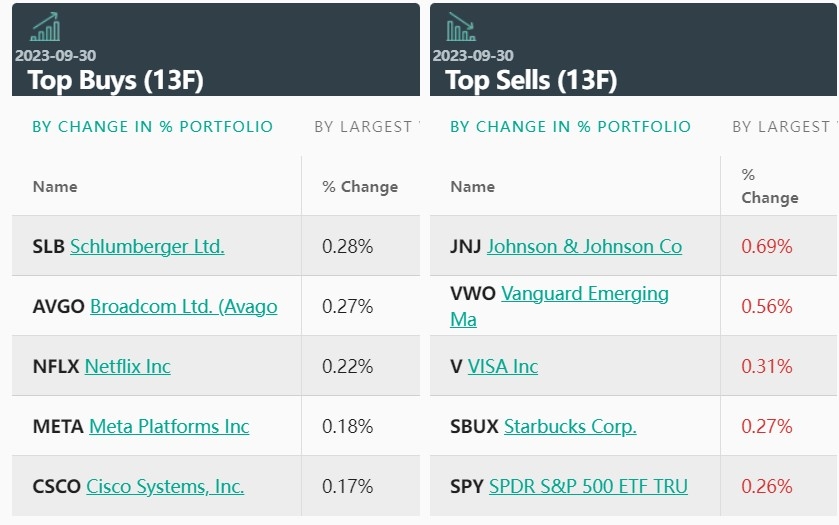

In addition to its insurance and operating businesses, Berkshire Hathaway has a substantial investment portfolio. This portfolio includes stakes in various companies, such as Apple, Bank of America, and American Express. Buffett's investment philosophy, which emphasizes long-term value investing, has driven the company's successful investment strategy.

Future Prospects

Looking ahead, Berkshire Hathaway faces several challenges and opportunities. The insurance industry is highly competitive, and regulatory changes could impact the company's profitability. However, the company's strong balance sheet and diversified business model should enable it to navigate these challenges.

One potential opportunity for Berkshire Hathaway is the growth of its global insurance operations. As emerging markets continue to develop, the company could expand its reach and tap into new revenue streams.

Case Studies

To illustrate the company's success, let's consider two case studies:

- Geico: Since acquiring Geico in 1996, Berkshire Hathaway has transformed the auto insurance industry. By leveraging technology and innovative marketing strategies, Geico has become a leading provider of auto insurance in the United States.

- Duracell: Berkshire Hathaway acquired Duracell in 2015 for $9.7 billion. Since then, the company has continued to invest in Duracell's research and development efforts, ensuring that the brand remains a market leader in battery technology.

Conclusion

Berkshire Hathaway is a well-established and successful company with a strong business model and a solid financial track record. While investing in any stock carries risks, Berkshire Hathaway offers a unique combination of stability, growth potential, and dividends. Before making a decision, consider the company's financial performance, business model, and future prospects to determine if it's a suitable investment for your portfolio.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....