In 2015, the US stock market experienced a rollercoaster of events, marked by significant ups and downs. This summary delves into the key highlights of the year, offering insights into the factors that influenced the market's trajectory.

Early Gains and Volatility

The year began with optimism, as the S&P 500 index surged to record highs. Investors were buoyed by strong economic data, including low unemployment rates and robust consumer spending. However, the market was not without its volatility. In February, the S&P 500 experienced its worst intraday point drop in history, triggered by concerns over China's economic slowdown and a drop in oil prices.

Oil Price Crash and Its Impact

The oil price crash, which began in mid-2014, continued to impact the market throughout 2015. Lower oil prices put pressure on energy stocks and contributed to a broader market downturn. Companies in the energy sector faced reduced revenue and profitability, leading to layoffs and cutbacks.

Federal Reserve Rate Hike

One of the most significant events of the year was the Federal Reserve's decision to raise interest rates in December 2015. This was the first rate hike since 2006. The move was widely anticipated and was seen as a sign of the economy's strength. However, it also sparked concerns about the potential for higher borrowing costs and slower economic growth.

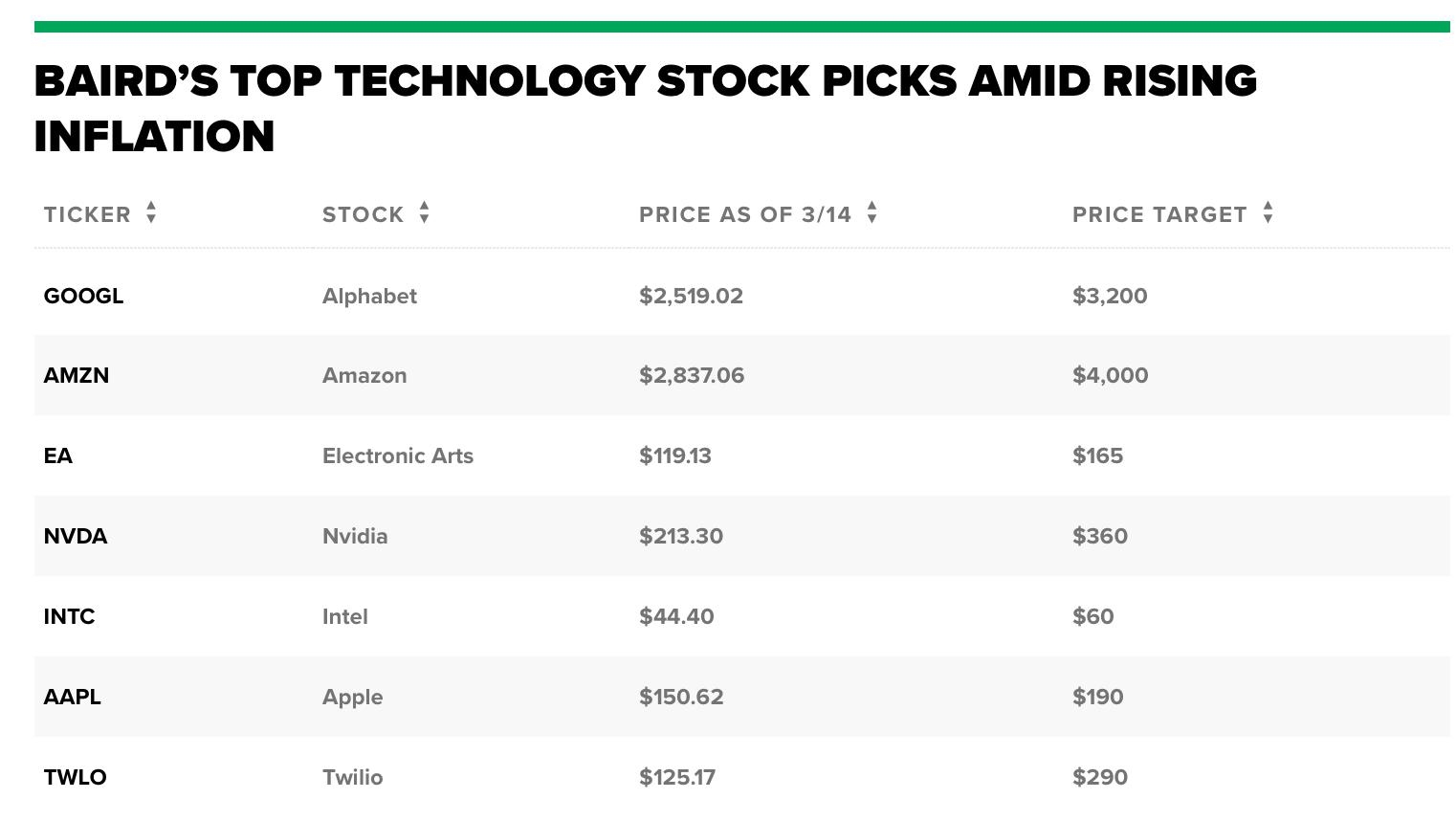

Tech Stocks and the FANGs

2015 was a year of strong performance for tech stocks. The FANGs – Facebook, Amazon, Netflix, and Google (now Alphabet) – were among the top performers, driving the market's overall gains. These companies benefited from strong revenue growth and increasing investor interest in technology stocks.

Market Correction and Volatility

As the year progressed, the market faced increased volatility. In August, the S&P 500 experienced a sharp correction, driven by concerns over global economic growth and corporate earnings. However, the market quickly recovered, with investors optimistic about the long-term outlook.

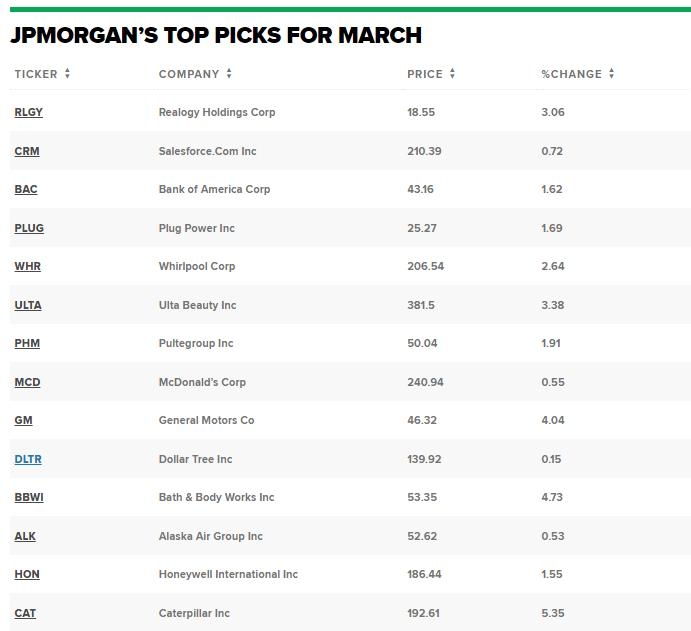

Sector Performance

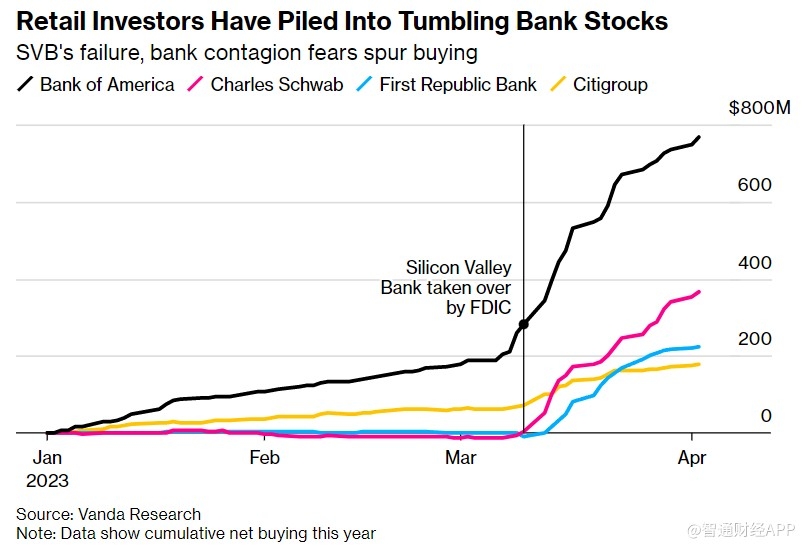

Among the various sectors, financials and healthcare stocks performed well throughout the year, driven by strong earnings growth and low interest rates. Energy stocks, on the other hand, remained under pressure due to the ongoing oil price decline.

Case Study: Apple Inc.

One of the standout performers in 2015 was Apple Inc. The company reported strong revenue growth and earnings, driven by strong demand for its iPhone and other products. Apple's stock price surged throughout the year, making it one of the best-performing stocks in the market.

Conclusion

2015 was a year of mixed fortunes for the US stock market. While the market experienced significant volatility and challenges, it also saw strong performance in certain sectors and companies. Understanding the factors that influenced the market's trajectory is crucial for investors looking to navigate the complexities of the stock market.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....