The stock market is a complex and dynamic place, where the value of shares of public companies is bought and sold. One of the key indicators that investors and analysts watch closely is the average daily volume (ADV) of the US stock market. This metric provides valuable insights into market activity and investor sentiment. In this article, we will delve into what the US stock market average daily volume represents, its importance, and how it can be used to make informed investment decisions.

What is the US Stock Market Average Daily Volume?

The US stock market average daily volume refers to the total number of shares traded on the major US stock exchanges, such as the New York Stock Exchange (NYSE) and the NASDAQ, over a specific period, typically a year. It is calculated by taking the sum of the total volume of shares traded on each day during that period and dividing it by the number of trading days.

Why is the US Stock Market Average Daily Volume Important?

The US stock market average daily volume is a crucial indicator for several reasons:

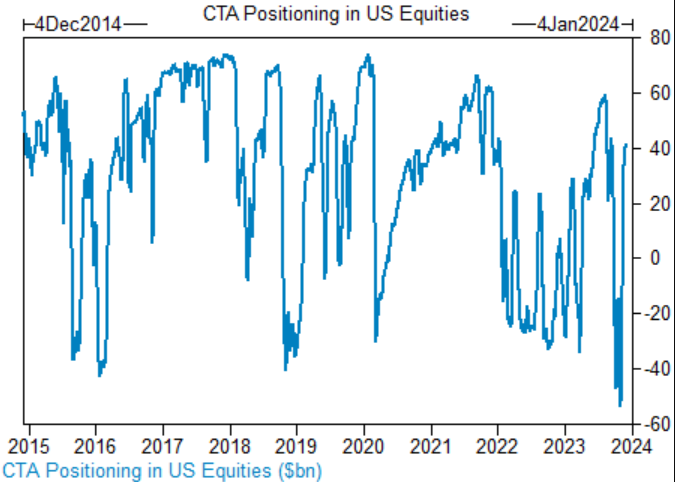

Market Activity: A higher average daily volume suggests that there is greater interest and activity in the market. This can be a sign of a healthy and vibrant market, as it indicates that investors are actively participating in buying and selling stocks.

Investor Sentiment: The average daily volume can provide insights into investor sentiment. For example, a significant increase in volume may indicate that investors are bullish on the market and are buying stocks in anticipation of future gains.

Market Confidence: A high average daily volume can also reflect market confidence. When investors are confident in the market, they are more likely to trade actively, leading to higher volume.

Trading Opportunities: The average daily volume can help investors identify potential trading opportunities. By analyzing the volume, investors can determine which stocks are actively traded and may be more likely to experience price movements.

How to Analyze the US Stock Market Average Daily Volume

To effectively analyze the US stock market average daily volume, investors and analysts can consider the following:

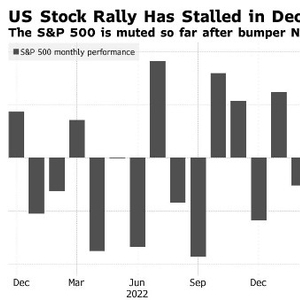

Comparative Analysis: Compare the current average daily volume to historical data to identify trends and patterns. For example, if the current volume is significantly higher than the average volume over the past year, it may indicate increased market activity.

Sector Analysis: Analyze the average daily volume across different sectors to identify which sectors are experiencing higher levels of activity. This can help investors identify potential opportunities or risks in specific sectors.

Price Volatility: Correlate the average daily volume with price volatility. A higher volume may indicate increased volatility, which can lead to greater trading opportunities.

Case Study: The 2020 Stock Market Crash

A notable example of the impact of the US stock market average daily volume is the 2020 stock market crash. In March 2020, the stock market experienced a sharp decline, driven by concerns about the COVID-19 pandemic. The average daily volume increased significantly during this period, reflecting the heightened market activity and volatility. By analyzing the volume, investors could gain insights into the market's sentiment and potential trading opportunities during this tumultuous time.

In conclusion, the US stock market average daily volume is a vital indicator that provides valuable insights into market activity, investor sentiment, and potential trading opportunities. By understanding and analyzing this metric, investors can make more informed decisions and navigate the complex world of the stock market with greater confidence.

us stock market today

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....