In the vast and dynamic world of finance, the US stock market stands as a cornerstone for investors and traders alike. With its deep roots and unparalleled influence, the US stock market offers a unique platform for wealth creation and investment opportunities. This article aims to provide a comprehensive guide to the US stock market, covering its history, structure, key players, and investment strategies.

The History of the US Stock Market

The US stock market has a rich history that dates back to the early 18th century. The first stock exchange, the New York Stock Exchange (NYSE), was established in 1792. Since then, the market has evolved significantly, with the advent of new technologies, regulatory changes, and the rise of new market players.

The Structure of the US Stock Market

The US stock market is divided into two primary segments: the primary market and the secondary market. The primary market is where companies issue new shares to the public for the first time, often through an Initial Public Offering (IPO). The secondary market, on the other hand, is where existing shares are bought and sold among investors.

The secondary market is further divided into two exchanges: the New York Stock Exchange (NYSE) and the NASDAQ. The NYSE is known for its traditional trading floor, while the NASDAQ operates as an electronic exchange. Both exchanges offer a wide range of investment opportunities, including stocks, bonds, and other financial instruments.

Key Players in the US Stock Market

Several key players play a crucial role in the US stock market. These include:

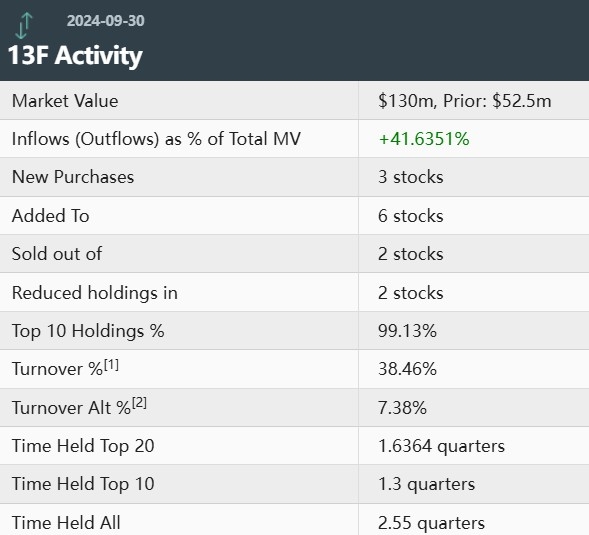

- Investors: Individuals and institutional investors who buy and sell stocks.

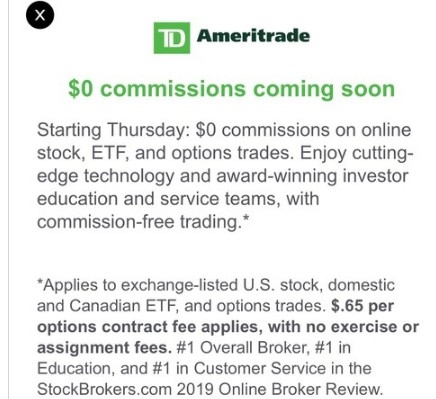

- Brokers: Financial intermediaries who facilitate the buying and selling of stocks.

- Regulators: Government agencies such as the Securities and Exchange Commission (SEC) that oversee the market and protect investors.

- Market Makers: Financial institutions that provide liquidity in the market by buying and selling stocks.

Investment Strategies in the US Stock Market

Investing in the US stock market requires a well-thought-out strategy. Here are some key strategies to consider:

- Diversification: Investing in a variety of stocks across different sectors and industries can help mitigate risks.

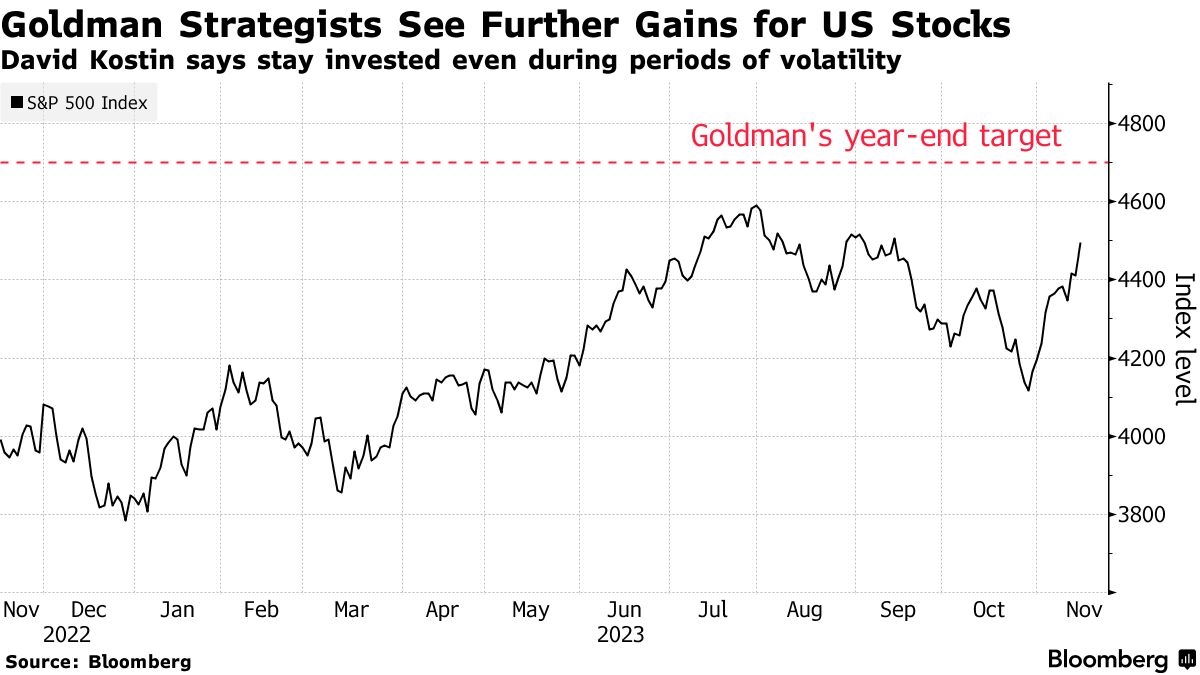

- Long-Term Investing: Investing for the long term can provide better returns and reduce the impact of short-term market fluctuations.

- Technical Analysis: Analyzing historical price and volume data to predict future market movements.

- Fundamental Analysis: Evaluating a company's financial health, business model, and industry position to determine its intrinsic value.

Case Study: Apple Inc.

One of the most iconic companies in the US stock market is Apple Inc. Since its IPO in 1980, Apple has grown to become the world's largest company by market capitalization. Its success can be attributed to several factors, including:

- Innovative Products: Apple's commitment to innovation has led to the development of groundbreaking products like the iPhone, iPad, and MacBook.

- Strong Branding: Apple's strong brand image has helped it maintain a loyal customer base.

- Effective Marketing: Apple's marketing strategies have been instrumental in promoting its products and creating a sense of excitement around them.

In conclusion, the US stock market offers a wealth of investment opportunities for individuals and institutions. By understanding its history, structure, key players, and investment strategies, investors can make informed decisions and achieve their financial goals.

us stock market today

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....