In today's digital age, the stock market plays a pivotal role in the financial landscape. The graph of the US stock market serves as a vital tool for investors, traders, and financial analysts to understand market trends and make informed decisions. This article provides a comprehensive overview of the US stock market graph, its significance, and how it impacts the financial world.

Understanding the Stock Market Graph

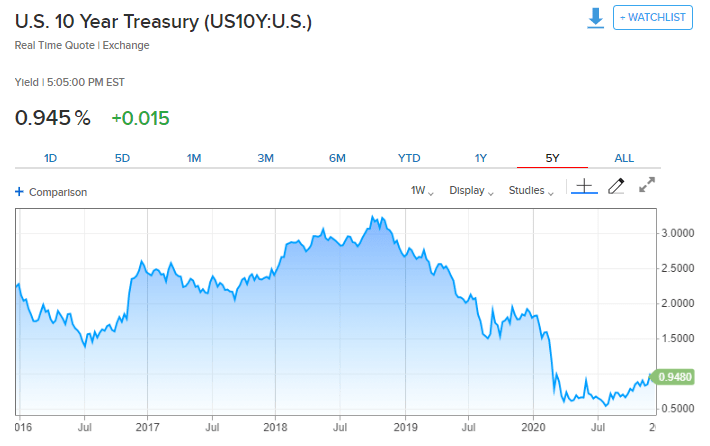

The US stock market graph is a visual representation of stock prices over a specific period. It is typically charted using a line graph, which plots the stock price on the vertical axis and time on the horizontal axis. This graph enables investors to observe patterns, trends, and market movements, making it an indispensable tool for financial analysis.

Importance of the Stock Market Graph

Market Trends Analysis: The stock market graph helps in identifying trends over time. Whether it's a rising or falling market, understanding these trends can assist investors in making strategic decisions.

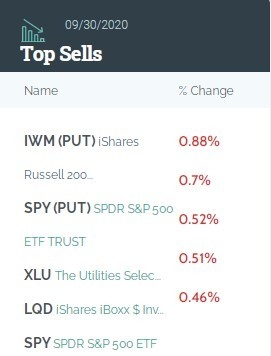

Investment Decisions: Investors use the stock market graph to gauge the performance of a particular stock or a basket of stocks. This information aids in determining whether to buy, hold, or sell.

Risk Management: By analyzing the stock market graph, investors can assess the risk associated with their investments. They can identify stocks that are volatile or stable and adjust their portfolios accordingly.

Key Elements of the Stock Market Graph

Stock Price: The most crucial element of the stock market graph is the stock price. It represents the current value of a share of a company.

Volume: Volume refers to the number of shares traded during a specific period. It indicates the level of interest in a stock and can be a strong indicator of market trends.

Moving Averages: Moving averages are a popular tool used in technical analysis. They are calculated by taking the average stock price over a specified period. They help in smoothing out short-term fluctuations and highlighting long-term trends.

Support and Resistance Levels: These levels indicate the price levels at which buyers and sellers are likely to enter or exit the market. Understanding these levels can help in identifying potential entry and exit points.

Case Studies

Apple Inc. (AAPL): Apple's stock has been on a rollercoaster ride over the past few years. The stock market graph shows that Apple's stock has seen significant growth, with several corrections along the way. Investors who used the graph to analyze market trends and make informed decisions have reaped substantial profits.

Tesla Inc. (TSLA): Tesla's stock has been one of the most volatile in the market. The stock market graph has shown that Tesla's stock has experienced extreme highs and lows. Investors who monitored the graph and were able to time their buys and sells effectively have made significant gains.

Conclusion

The graph of the US stock market is a powerful tool that can help investors navigate the complex financial landscape. By understanding market trends, identifying key elements, and analyzing case studies, investors can make informed decisions and potentially maximize their returns. As the stock market continues to evolve, the stock market graph will remain a crucial resource for financial analysis and investment strategies.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....