In today's volatile energy market, US coal company stocks have become a significant area of interest for investors. The coal industry, although often criticized for its environmental impact, still plays a vital role in the energy sector. This guide will delve into the factors influencing US coal company stocks, including market trends, industry challenges, and potential investment opportunities.

Understanding the Coal Industry

The coal industry has been a cornerstone of the United States' energy sector for over a century. Coal remains a crucial energy source, particularly in the power generation sector, accounting for about 23% of total energy consumption in the US. Despite growing concerns about climate change and the rise of renewable energy sources, coal still holds its ground in the energy mix.

Factors Influencing US Coal Company Stocks

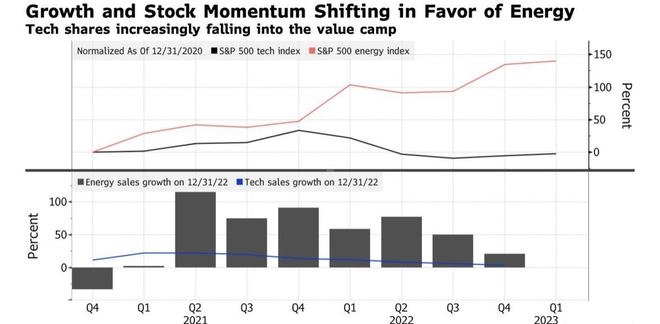

Market Trends: The coal industry is subject to significant fluctuations, primarily driven by global economic conditions, electricity demand, and natural gas prices. Market trends play a crucial role in determining the performance of US coal company stocks. For instance, when the global economy is strong and electricity demand is high, coal stocks tend to perform well.

Regulatory Environment: The regulatory environment is a significant factor affecting coal companies. Environmental regulations, such as the Clean Air Act, can impose substantial costs on coal producers. However, policies supporting clean coal technology can provide a competitive advantage.

Supply and Demand: Supply and demand dynamics in the coal market significantly impact US coal company stocks. High coal prices can boost profits, while low prices can lead to financial strain. Factors such as production costs, labor issues, and geopolitical events can influence coal supply and demand.

Top US Coal Companies

Several leading coal companies dominate the US coal industry. Some of the notable names include:

Peabody Energy: A global coal producer with operations in the US and Australia, Peabody Energy has a diverse portfolio of coal assets.

Cameco: A prominent uranium producer, Cameco also has significant coal assets in Canada and the US.

Cloud Peak Energy: One of the largest coal producers in the US, Cloud Peak Energy focuses on high-quality metallurgical coal for steel production.

Investment Opportunities and Risks

Investing in US coal company stocks can offer potential rewards but also carries significant risks. Here are some key considerations:

Economic Factors: As mentioned earlier, coal prices and electricity demand are heavily influenced by global economic conditions.

Regulatory Risks: Environmental regulations can impose substantial costs on coal companies, affecting their profitability.

Technological Innovation: The coal industry is increasingly focusing on clean coal technology, which can offer a competitive advantage and mitigate environmental concerns.

Competition: The coal industry faces stiff competition from renewable energy sources, particularly natural gas.

Conclusion

US coal company stocks remain a complex and dynamic area of investment. Understanding the factors influencing the industry and the specific risks involved is crucial for making informed investment decisions. As the energy sector continues to evolve, coal companies that adapt and innovate will likely thrive in the long term.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....