As we navigate through the complexities of the 21st century, the United States economy continues to face a myriad of challenges. With 2025 fast approaching, several major economic issues are poised to have a significant impact on the stock market. This article delves into these critical issues and examines how they may influence the market's trajectory.

Rising Inflation and Interest Rates

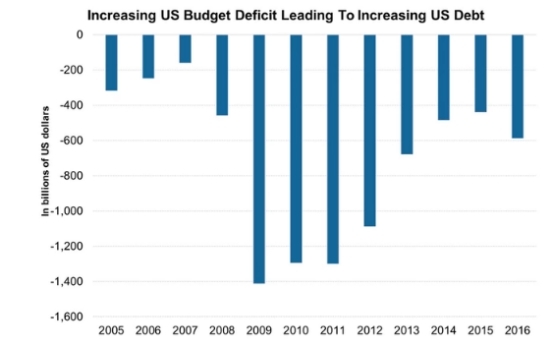

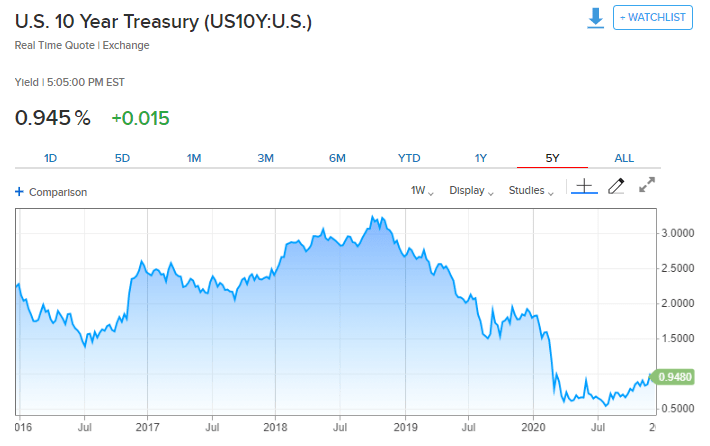

One of the most pressing concerns for the US economy is the rising inflation rate. As of 2025, inflation has been on the rise, largely due to factors such as supply chain disruptions and increased global demand. This rise in inflation has led to a corresponding increase in interest rates, which can have a profound impact on the stock market.

Impact on the Stock Market:

- Higher borrowing costs: As interest rates rise, borrowing costs for corporations increase, leading to higher expenses and potentially lower profits.

- Consumer spending: Rising inflation can erode consumer purchasing power, leading to decreased demand for goods and services, which can negatively impact stock prices.

- Bond yields: As interest rates rise, bond yields also increase, making stocks relatively less attractive compared to fixed-income investments.

Trade Disputes and Tariffs

Trade disputes and tariffs have become a major source of uncertainty in the global economy. With tensions between the United States and other major economies, such as China, the impact on the stock market cannot be ignored.

Impact on the Stock Market:

- Export-dependent industries: Industries that rely heavily on exports may face increased costs due to tariffs, leading to lower profits and stock prices.

- Supply chain disruptions: Trade disputes can lead to supply chain disruptions, causing shortages and higher prices for goods and services, which can negatively impact the stock market.

- Global economic growth: Trade tensions can hinder global economic growth, leading to lower corporate earnings and stock prices.

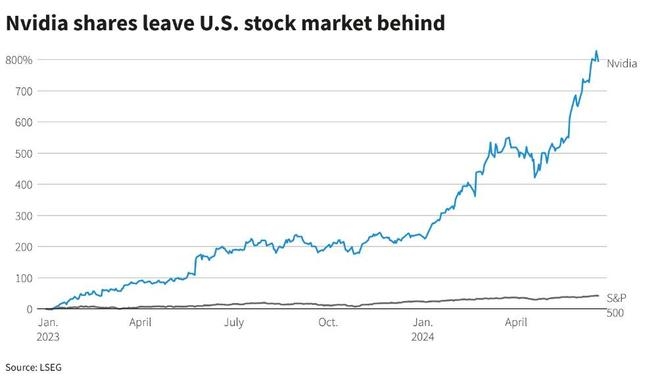

Technological Disruption and Regulatory Changes

The rapid pace of technological innovation and the increasing scrutiny from regulators are creating significant challenges for businesses. As new technologies emerge, traditional industries face the risk of obsolescence, while regulatory changes can impose new costs and constraints.

Impact on the Stock Market:

- Disruption of traditional industries: Industries such as telecommunications, media, and finance are experiencing rapid technological disruption, which can lead to significant stock price volatility.

- Regulatory changes: Increased regulation can lead to higher compliance costs and reduced profitability for affected companies, potentially impacting stock prices.

- Investor sentiment: Uncertainty surrounding technological disruption and regulatory changes can lead to increased volatility in the stock market.

Case Studies:

- Facebook (Meta): The rise of regulatory scrutiny, particularly in the wake of the Cambridge Analytica scandal, has led to significant volatility in Facebook's stock price.

- Tesla: As a leader in the electric vehicle industry, Tesla has faced supply chain disruptions and regulatory challenges, which have impacted its stock price.

In conclusion, the US economy in 2025 is expected to face several major economic issues that could have a significant impact on the stock market. As investors navigate these challenges, it is crucial to stay informed and remain vigilant about the potential risks and opportunities that lie ahead.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....