Are you considering investing in Huawei, the leading Chinese technology company, but unsure if you can do so from the United States? The answer is not straightforward, as the current landscape is influenced by various factors. In this article, we'll delve into the complexities surrounding the purchase of Huawei stock in the US, exploring the legal hurdles and alternative investment avenues.

Understanding Huawei's Stock Status in the US

Huawei, known for its smartphones, telecommunications equipment, and consumer electronics, has been a prominent player in the global tech industry. However, the company's stock is not available for direct purchase on major US stock exchanges. This is primarily due to the U.S. government's restrictions imposed on Huawei in 2019.

The U.S. Department of Commerce placed Huawei on its Entity List due to concerns over national security. This action restricted American companies from exporting or transferring items, software, or technology to Huawei. As a result, Huawei's parent company, Huawei Investment & Holding Co., Ltd., is not listed on any U.S. stock exchanges.

Legal Implications and Alternative Investment Options

Despite the restrictions, there are still ways for U.S. investors to indirectly invest in Huawei. One such method is through ETFs (Exchange-Traded Funds) that track the performance of the Hong Kong Stock Exchange, where Huawei's shares are traded. These ETFs may include a small portion of Huawei's stock, allowing investors to gain exposure to the company's performance.

Another option is to invest in Chinese tech companies that have a significant presence in the smartphone and telecommunications sectors. Companies like ZTE and Xiaomi offer alternative investment opportunities within the same industry as Huawei.

Case Study: TAL Education Group

To illustrate this, consider the example of TAL Education Group, a leading online education company based in China. TAL's stock is listed on the New York Stock Exchange (NYSE), making it accessible to U.S. investors. Although TAL is not directly related to Huawei, it represents a similar investment opportunity in the Chinese tech sector.

Conclusion

In conclusion, while you cannot directly purchase Huawei stock on U.S. exchanges, there are alternative ways to invest in the Chinese tech industry. By exploring ETFs and other Chinese tech companies, U.S. investors can still gain exposure to the dynamic and rapidly growing sector. However, it is crucial to stay informed about the legal and regulatory landscape to make informed investment decisions.

vanguard total stock market et

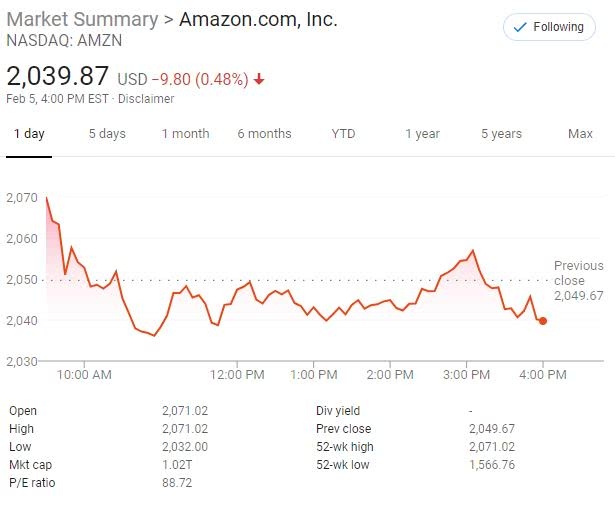

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....