In the ever-evolving world of finance, investors are constantly seeking opportunities to grow their portfolios. One such opportunity that has caught the attention of many is US Bank. But is it a good stock to buy? Let's delve into the details to find out.

Understanding US Bank

US Bank, officially known as U.S. Bancorp, is a financial services company with a strong presence in the United States. Headquartered in Minneapolis, Minnesota, the bank offers a wide range of services, including retail banking, corporate banking, wealth management, and investment services.

Financial Performance

One of the key factors to consider when evaluating a stock is its financial performance. Over the years, US Bank has demonstrated a consistent track record of strong financial performance. The bank has consistently reported healthy profits and has been able to grow its revenue and earnings per share (EPS) year after year.

Dividends

Another important aspect to consider is the dividend yield. US Bank has a long history of paying dividends to its shareholders, and the company has a strong dividend yield of around 2.5%. This makes it an attractive investment for income-seeking investors.

Market Position

US Bank holds a strong position in the financial services industry. The bank has a diverse customer base, including individuals, small businesses, and large corporations. This wide customer base provides stability and resilience to the bank's operations.

Growth Prospects

The financial services industry is expected to grow in the coming years, driven by factors such as increasing consumer spending, technological advancements, and regulatory changes. US Bank is well-positioned to benefit from these trends, as the company continues to invest in technology and expand its services.

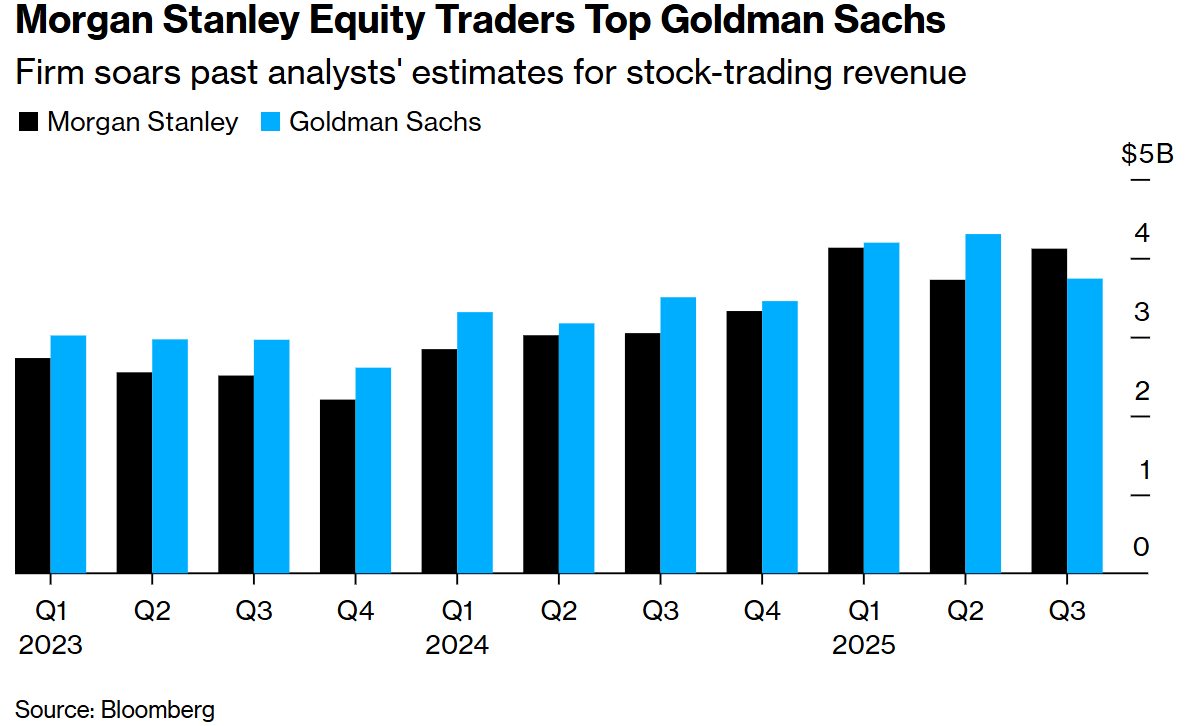

Comparison with Peers

To better understand the potential of US Bank, it's important to compare it with its peers. When compared to other major financial institutions, US Bank stands out in several areas. The bank has a strong capital position, a low level of non-performing loans, and a robust risk management framework.

Case Studies

Let's take a look at a couple of case studies to get a better perspective on US Bank's performance.

Case Study 1: Acquisition of Merrill Edge

In 2011, US Bank acquired Merrill Edge, a retail brokerage firm. This acquisition has been a significant success for the bank, as it has helped expand its wealth management business and attract a younger customer base.

Case Study 2: Expansion into Wealth Management

US Bank has also been actively expanding its wealth management business. The bank has launched several initiatives to attract high-net-worth individuals and institutional clients. This expansion is expected to contribute significantly to the bank's growth in the coming years.

Conclusion

In conclusion, US Bank appears to be a solid investment opportunity. The bank has a strong financial performance, a solid dividend yield, and a well-positioned market. However, as with any investment, it's important to conduct thorough research and consider your own financial goals and risk tolerance before making a decision.

Key Takeaways

- US Bank has a strong financial performance and a long history of paying dividends.

- The bank holds a strong position in the financial services industry and is well-positioned for future growth.

- Conduct thorough research and consider your own financial goals before making a decision.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....