The US stock market is a vast and dynamic landscape, featuring a wide array of companies across various industries. Understanding the different categories of companies trading on these markets is crucial for investors looking to make informed decisions. In this article, we delve into three primary categories of companies in the US stock market: large-cap, mid-cap, and small-cap.

Large-Cap Companies

Large-cap companies are the giants of the stock market, characterized by their significant market capitalization, typically over $10 billion. These companies are often household names and have a long-established presence in the market. They include industry leaders such as Apple, Microsoft, and ExxonMobil.

Why Invest in Large-Cap Companies?

- Stability: Large-cap companies are usually more stable and have a proven track record of success.

- Dividends: Many large-cap companies offer regular dividends, providing a steady income stream for investors.

- Influence: Large-cap companies often have significant influence over the broader market and industry trends.

Case Study: Apple Inc. Apple is a prime example of a large-cap company. With a market capitalization of over $2 trillion, it is the largest publicly traded company in the world. Its diverse product range, including the iPhone, iPad, and Mac, has helped it maintain its position as a market leader.

Mid-Cap Companies

Mid-cap companies are intermediate in size, with a market capitalization ranging from

Why Invest in Mid-Cap Companies?

- Growth Potential: Mid-cap companies often have higher growth potential compared to large-cap companies.

- Value: Mid-cap companies may offer better value compared to large-cap companies, especially when they are undervalued.

- Risk vs. Reward: Investing in mid-cap companies can offer a balance between stability and growth potential.

Case Study: Tesla, Inc. Tesla is a well-known mid-cap company in the technology sector. Despite its smaller market capitalization compared to large-cap companies like Apple, Tesla has demonstrated significant growth and innovation, particularly in the electric vehicle market.

Small-Cap Companies

Small-cap companies are characterized by their smaller market capitalization, typically under $2 billion. These companies are often younger and less established than mid-cap and large-cap companies. They operate in a variety of industries, from biotech to retail.

Why Invest in Small-Cap Companies?

- High Growth Potential: Small-cap companies often experience rapid growth, offering high potential returns.

- Unique Opportunities: Investing in small-cap companies can provide access to unique and niche markets.

- Risk: However, small-cap companies also come with higher risk, as they are more vulnerable to market fluctuations and industry-specific challenges.

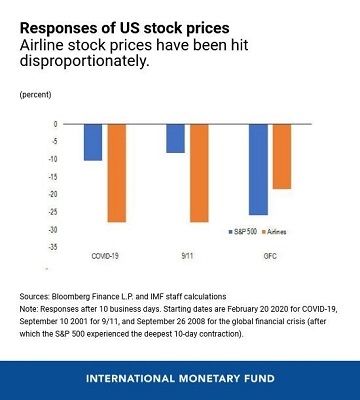

Case Study: Zoom Video Communications, Inc. Zoom, a small-cap company, experienced meteoric growth during the COVID-19 pandemic. Its video conferencing platform became an essential tool for remote work, leading to a significant increase in its market capitalization.

In conclusion, the US stock market offers a diverse range of companies across different categories. Investors should consider their risk tolerance, investment goals, and market trends when selecting companies to invest in. By understanding the characteristics and potential of each category, investors can make more informed decisions and potentially achieve greater success in the stock market.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....