The stock market can be a rollercoaster of emotions, and Thursday's trading session was no exception. As investors digest the latest economic news and global events, the major US stock market indexes showcased a mix of gains and losses. In this article, we will delve into how the S&P 500, the Dow Jones Industrial Average, and the Nasdaq Composite performed on Thursday.

S&P 500: A Modest Gain

The S&P 500, a widely followed benchmark index that includes 500 of the largest publicly traded companies in the United States, closed the day with a modest gain. The index rose by 0.3%, driven by strong performance in the technology sector. Companies like Apple and Microsoft, which are part of the index, saw their stocks rise by 1.5% and 0.7%, respectively.

The energy sector also played a crucial role in the S&P 500's performance, with companies like Exxon Mobil and Chevron gaining 2.3% and 1.5%, respectively. The rise in energy stocks can be attributed to the increasing demand for oil and natural gas as the global economy recovers from the COVID-19 pandemic.

Dow Jones Industrial Average: Mixed Results

The Dow Jones Industrial Average, which tracks the stock prices of 30 large companies, experienced a mixed performance on Thursday. The index closed the day with a loss of 0.1%, as shares of companies like Boeing and Home Depot declined by 1.2% and 0.8%, respectively.

However, the index was partially offset by gains in other companies. For instance, Goldman Sachs saw its stock rise by 1.5%, while Visa and Johnson & Johnson gained 0.9% and 0.7%, respectively. The mixed performance of the Dow Jones Industrial Average highlights the diverse nature of the companies it includes.

Nasdaq Composite: A Record High

The Nasdaq Composite, which includes all domestic and international common stocks listed on the Nasdaq Stock Market, closed the day at a new record high. The index rose by 0.9%, driven by strong performance in the technology sector. Companies like Amazon, Apple, and Google's parent company Alphabet saw their stocks rise by 1.2%, 1.5%, and 2.0%, respectively.

The technology sector has been a major driver of the stock market's overall performance in recent years, and Thursday's gains in this sector were a testament to its continued strength. Additionally, the rise in the Nasdaq Composite can be attributed to the growing demand for technology-based products and services, especially during the pandemic.

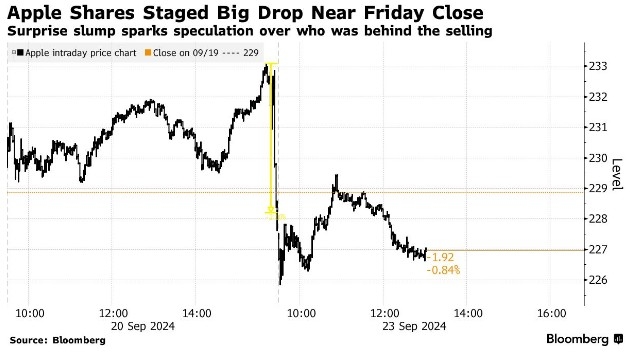

Case Study: Apple's Performance

To illustrate the impact of individual companies on stock market indexes, let's take a closer look at Apple's performance on Thursday. As mentioned earlier, Apple's stock rose by 1.5%, contributing to the S&P 500's modest gain. The company's strong performance can be attributed to several factors, including its growing revenue and market share in various product categories.

Apple's success in the smartphone market, as well as its expansion into other areas such as services and wearables, has made it a dominant player in the technology sector. As a result, the company's strong performance has a significant impact on the broader stock market.

In conclusion, Thursday's trading session showcased a mix of gains and losses across the major US stock market indexes. While the S&P 500 and the Dow Jones Industrial Average experienced modest gains and losses, respectively, the Nasdaq Composite reached a new record high. The technology sector, in particular, played a crucial role in the stock market's performance on Thursday. As investors continue to monitor economic news and global events, it will be interesting to see how the stock market performs in the coming days.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....