Are you a foreign investor considering dipping your toes into the US stock market? If so, you're not alone. The US stock market is one of the most robust and liquid in the world, attracting investors from all corners of the globe. But can foreigners invest in the US stock market? The answer is a resounding yes, and in this article, we'll explore how you can do it, the benefits, and some key considerations.

Understanding the Basics

Before we dive into the specifics, let's clarify what it means to invest in the US stock market. When you invest in a stock, you're essentially buying a small piece of a company. The US stock market is home to some of the world's most prominent companies, including tech giants like Apple, Microsoft, and Google, as well as established players in various industries.

Eligibility and Requirements

Foreigners can invest in the US stock market, but there are certain eligibility and requirements to consider:

- Residency: You must have a valid visa or residency status in the United States to open a brokerage account.

- Tax Considerations: Foreign investors must comply with US tax laws, including reporting requirements and potential taxes on dividends and capital gains.

- Brokerage Account: You'll need to open a brokerage account with a reputable brokerage firm. Many online brokers offer accounts specifically for international investors.

How to Invest

Once you have a brokerage account, investing in the US stock market is straightforward:

- Research: Familiarize yourself with the companies and sectors you're interested in. Look at financial statements, market trends, and expert analysis.

- Choose a Stock: Decide which stocks you want to buy. You can purchase individual stocks or consider mutual funds or ETFs for diversification.

- Place an Order: Use your brokerage account to place a buy order. You can do this online through a trading platform or by contacting your broker.

Benefits of Investing in the US Stock Market

Investing in the US stock market offers several benefits:

- Diversification: The US market is home to a wide range of companies across various industries, allowing you to diversify your portfolio.

- Potential for High Returns: The US stock market has historically offered higher returns than many other markets.

- Access to Innovation: The US is a leader in technology and innovation, giving you access to some of the most promising companies in the world.

Key Considerations

While investing in the US stock market offers many benefits, there are also some key considerations to keep in mind:

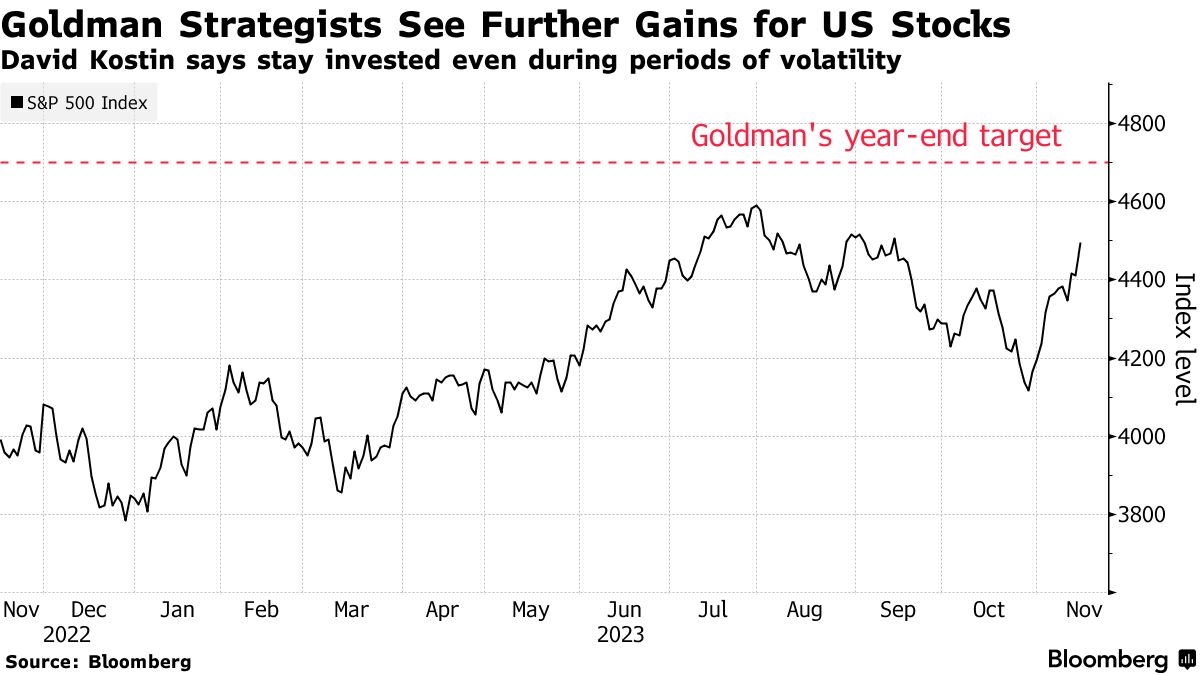

- Volatility: The US stock market can be volatile, with significant price fluctuations.

- Currency Risk: If you're investing in US stocks from another country, currency fluctuations can impact your returns.

- Regulatory Changes: Be aware of any regulatory changes that could affect your investments.

Case Studies

Let's look at a couple of case studies to illustrate the potential of investing in the US stock market:

- Apple: Apple is one of the most successful companies in the world, with a market capitalization of over

2 trillion. An investor who bought 10,000 worth of Apple stock in 2003 would now have over $1 million. - Tesla: Tesla has seen explosive growth in recent years, with its stock price skyrocketing. An investor who bought

10,000 worth of Tesla stock in 2010 would now have over 4 million.

Conclusion

Investing in the US stock market can be a lucrative opportunity for foreign investors. By understanding the basics, complying with requirements, and considering key factors, you can build a diversified portfolio and potentially reap significant returns. Remember to do thorough research and consult with a financial advisor before making any investment decisions.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....