The AI market has been experiencing a significant shock lately, but many experts believe that this could actually spark broader gains in the US stock market. As we delve into this intriguing possibility, it's crucial to understand the potential implications and the factors at play.

Understanding the AI Market Shock

The AI market shock refers to the recent downturn in the value of AI stocks. This decline has been attributed to a variety of factors, including concerns about overvaluation, regulatory scrutiny, and a broader economic slowdown. However, despite the initial panic, many investors and analysts are now viewing this as an opportunity for long-term gains.

The Impact on the US Stock Market

The AI market is a significant segment of the US stock market, and its performance has a direct impact on the overall market. As the AI market stabilizes and begins to recover, it's likely to have a positive effect on the broader US stock market. Here's how:

- Increased Investor Confidence: The stabilization of the AI market could boost investor confidence, leading to increased investment in other sectors of the market.

- Sector Rotation: As the AI market stabilizes, investors may rotate their investments into other sectors that have been underperforming, such as technology and healthcare.

- Economic Growth: The growth of the AI market could lead to increased economic growth, which would benefit the broader US stock market.

Key Factors to Consider

Several key factors could influence the potential for broader US stock gains following the AI market shock:

- Regulatory Environment: The regulatory environment for AI is still evolving, and any major changes could have a significant impact on the market.

- Innovation and Adoption: The pace of innovation and adoption of AI technologies could influence the growth of the market and its impact on the broader stock market.

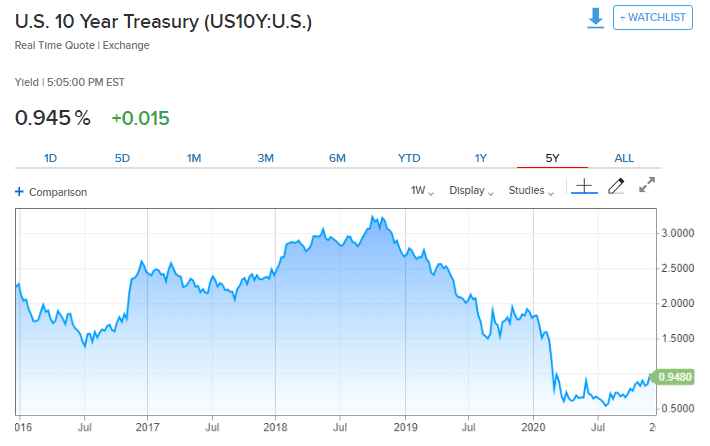

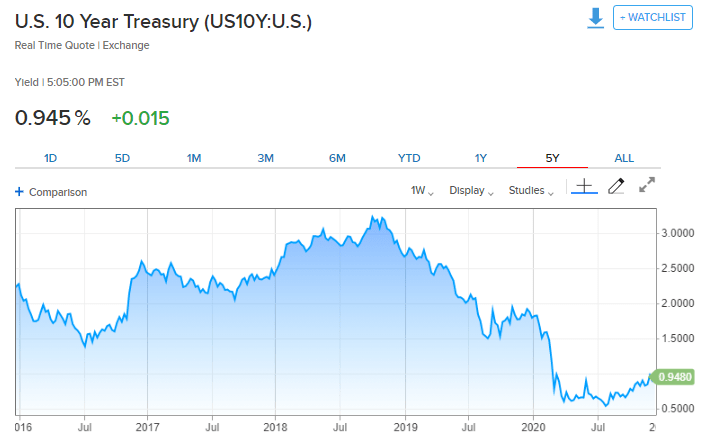

- Economic Conditions: The overall economic conditions, including interest rates and inflation, could also play a role in the market's performance.

Case Studies

To illustrate the potential impact of the AI market shock on the broader US stock market, let's look at a few case studies:

- IBM: IBM has been a leader in AI technology, and its stock has seen significant volatility in recent months. However, as the AI market stabilizes, IBM's stock could benefit from increased investor confidence and sector rotation.

- Google: Google's parent company, Alphabet, has a significant presence in the AI market. As the AI market recovers, Alphabet's stock could see a boost from increased investment in the technology sector.

- Microsoft: Microsoft has been investing heavily in AI, and its stock has seen a positive correlation with the AI market. As the AI market stabilizes, Microsoft's stock could benefit from increased demand for its AI solutions.

Conclusion

While the AI market shock has caused some concern, many experts believe that it could actually spark broader gains in the US stock market. By understanding the factors at play and keeping a close eye on the AI market's performance, investors can position themselves for potential long-term gains.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....