In the ever-fluctuating world of the stock market, the question of whether U.S. stocks are overvalued has become a hot topic among investors and analysts. With the current market conditions, many are pondering if it's time to take profits or if the bull run is still in full swing. In this article, we'll delve into the factors contributing to the valuation of U.S. stocks and provide an in-depth analysis to help you make informed decisions.

Understanding Stock Valuation

Stock valuation is the process of determining the intrinsic value of a company's stock. It involves analyzing various financial metrics, such as price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and earnings yield, among others. These metrics help investors gauge if a stock is fairly valued, undervalued, or overvalued.

Current Market Conditions

As of the time of writing, the U.S. stock market has been on an impressive bull run for the past several years. The S&P 500, a widely followed index, has seen significant growth, reaching record highs. However, some analysts argue that the market may be overvalued due to the following factors:

1. High Valuation Metrics

The P/E ratio, which compares a company's stock price to its earnings per share (EPS), has been at historically high levels. This suggests that investors are paying a premium for stocks, which may not be justified by the underlying fundamentals.

2. Record Corporate Profits

Corporate profits have reached record highs, fueled by factors such as low interest rates, tax cuts, and strong economic growth. However, some analysts argue that these profits may not be sustainable in the long run.

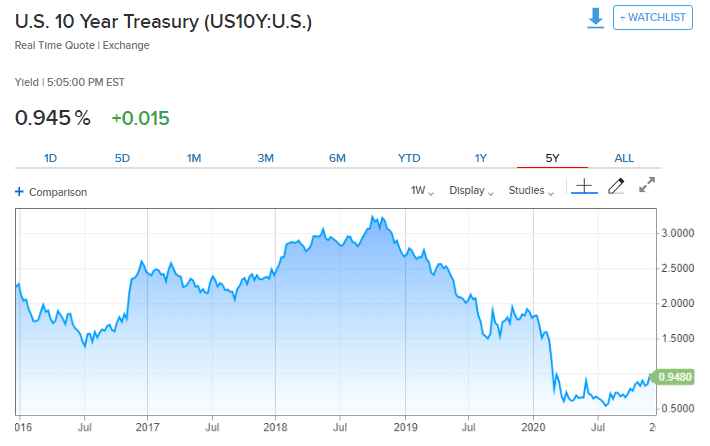

3. Low Interest Rates

Low interest rates have made it easier for companies to borrow money for expansion and investment. While this has been beneficial for the stock market, some investors are concerned about the long-term implications of low interest rates.

4. High Debt Levels

Many companies have taken advantage of low interest rates to increase their debt levels. This has raised concerns about the potential for a debt crisis in the future.

Case Study: Tesla

One case study that highlights the debate over stock valuations is Tesla (TSLA). Despite having significant growth potential, Tesla's stock has seen massive fluctuations, at times trading at a sky-high P/E ratio. This has led to discussions about whether Tesla is overvalued or if its growth potential justifies the premium price.

What Should Investors Do?

Given the current market conditions, investors should consider the following:

- Diversify Your Portfolio: Diversification can help reduce risk by spreading investments across various asset classes.

- Do Your Research: Thoroughly research the companies you're considering investing in to understand their fundamentals and valuation metrics.

- Monitor Market Trends: Stay informed about market trends and economic indicators that may affect stock prices.

Conclusion

The question of whether U.S. stocks are overvalued is complex and depends on various factors. While some argue that the market is overvalued, others believe that the bull run is still in full swing. By understanding the factors contributing to stock valuations and doing thorough research, investors can make informed decisions about their investments.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....