In a recent move that has sent shockwaves through the financial community, Citigroup has downgraded US stocks. This decision, which has raised concerns among investors, has sparked a heated debate on the future of the US stock market. This article delves into the reasons behind this downgrade and what it means for investors.

Understanding the Downgrade

Citi's downgrade of US stocks comes amid growing concerns about the US economy. The bank has cited factors such as rising inflation, geopolitical tensions, and a slowing global economy as reasons for the downgrade. This move has caused investors to question the future of the US stock market and whether it's time to reconsider their investment strategies.

Rising Inflation

One of the key reasons behind Citi's downgrade is rising inflation. The US economy has been experiencing high inflation rates, which have eroded purchasing power and increased costs for businesses. This has raised concerns about the sustainability of economic growth and the potential for a recession.

Geopolitical Tensions

Another factor contributing to the downgrade is the growing geopolitical tensions. Conflicts around the world, such as those in Eastern Europe and the Middle East, have raised concerns about global stability and its impact on the US economy.

Slowing Global Economy

The global economy is also slowing down, which has had a negative impact on the US stock market. Many companies are reporting lower revenue and profit growth, which has led to a decline in stock prices.

What It Means for Investors

So, what does this downgrade mean for investors? Here are a few key points to consider:

- Risk Management: Investors should focus on risk management strategies to protect their investments. This may involve diversifying their portfolios and avoiding high-risk investments.

- Quality Over Quantity: Investors should focus on quality stocks with strong fundamentals and solid growth prospects.

- Short-Term Volatility: The stock market is expected to be volatile in the short term, so investors should be prepared for fluctuations in stock prices.

Case Studies

To illustrate the impact of Citi's downgrade, let's look at a few case studies:

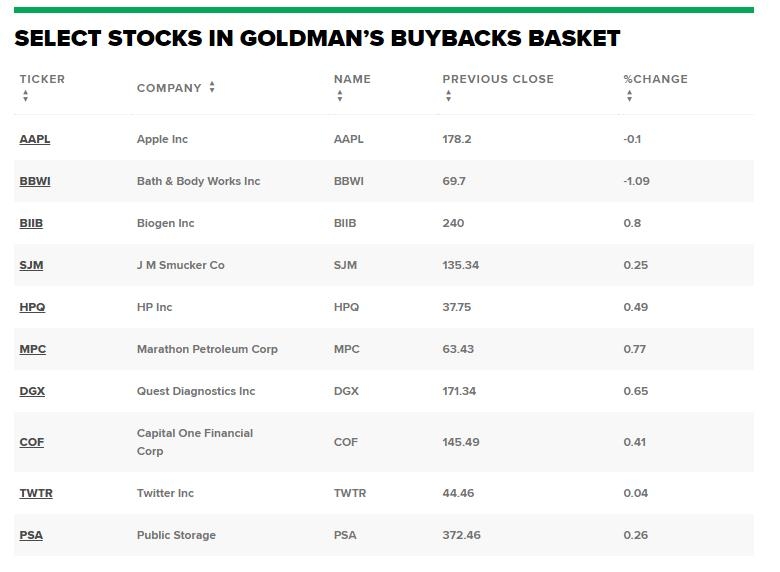

- Apple Inc.: Apple, one of the most valuable companies in the world, has seen its stock price decline since Citi's downgrade. This decline can be attributed to concerns about the company's revenue growth and the overall health of the US economy.

- Walmart Inc.: Walmart, another major company affected by the downgrade, has also seen its stock price decline. This decline can be attributed to concerns about the company's ability to navigate rising inflation and a slowing economy.

Conclusion

Citi's downgrade of US stocks is a significant event that has raised concerns among investors. While it's difficult to predict the future of the stock market, it's important for investors to remain vigilant and adapt their strategies accordingly. By focusing on risk management, quality investments, and being prepared for short-term volatility, investors can navigate the challenges ahead.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....