Are you considering investing in the US lumber market? Do you want to know how to identify the best lumber stocks? This article will provide you with a comprehensive guide to understanding the US lumber market, including insights into the key players, market trends, and investment strategies.

Understanding Lumber Stock

Firstly, it is important to understand what a lumber stock is. A lumber stock represents ownership in a company that produces or sells lumber and related wood products. These companies operate in the construction, manufacturing, and distribution sectors of the wood products industry.

Key Players in the US Lumber Market

Several major companies dominate the US lumber market. Here are some of the key players:

- Weyerhaeuser: One of the largest producers of lumber in the US, Weyerhaeuser also specializes in real estate, tree planting, and wood products.

- Rayonier Inc.: Another significant player in the lumber market, Rayonier focuses on forest management, real estate, and timber production.

- Louisiana-Pacific Corporation (LP): LP produces a variety of wood products, including plywood, oriented strand board (OSB), and engineered wood products.

Market Trends

The US lumber market has been influenced by several factors, including:

- Construction Activity: As the US construction industry continues to grow, demand for lumber has increased.

- Environmental Regulations: The implementation of environmental regulations has impacted the lumber industry, prompting companies to focus on sustainable practices.

- International Trade: The US lumber industry is affected by international trade agreements, which can impact prices and availability.

Investment Strategies

When investing in the US lumber market, it is important to consider the following strategies:

- Diversification: Investing in a mix of lumber stocks can help mitigate risk.

- Long-term Growth: Focus on companies with strong long-term growth potential.

- Dividend Stocks: Consider companies that offer dividend payments for income.

Case Studies

Let's take a look at a couple of case studies to illustrate the potential of investing in the US lumber market:

- Weyerhaeuser: In the past decade, Weyerhaeuser has experienced significant growth in revenue and earnings. This growth can be attributed to its focus on sustainable practices and expansion into new markets.

- Rayonier Inc.: Rayonier has also seen growth in its revenue and earnings over the past few years. The company has successfully diversified its portfolio of forestlands, real estate, and timber production.

Conclusion

Investing in the US lumber market can be a rewarding opportunity for investors looking for long-term growth and income. By understanding the key players, market trends, and investment strategies, you can make informed decisions about your investments.

In summary, the US lumber market is a dynamic industry with opportunities for growth and investment. By focusing on key players, market trends, and investment strategies, you can identify the best lumber stocks to add to your portfolio.

new york stock exchange

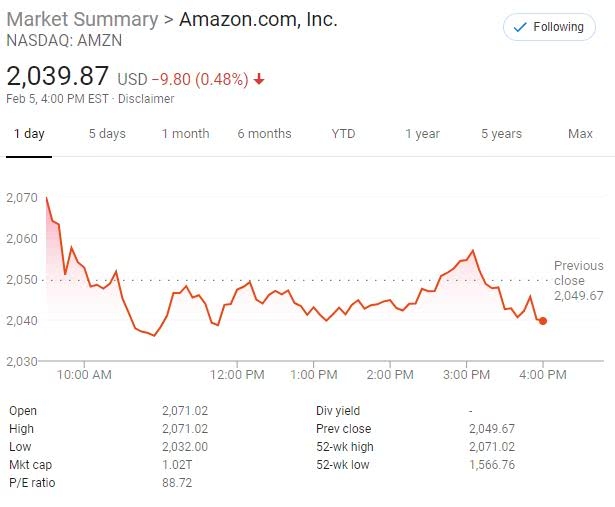

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....