The stock market has been a rollercoaster ride since its inception, with numerous crashes that have left investors reeling. In this article, we delve into some of the biggest US stock market crashes, exploring their causes, impacts, and lessons learned.

The Great Depression of 1929

The most infamous stock market crash in history, the Great Depression of 1929, began on October 29, 1929, and is often referred to as "Black Tuesday." This crash was caused by a combination of factors, including excessive speculation, a stock market bubble, and the Federal Reserve's tight monetary policy.

The Dow Jones Industrial Average (DJIA) lost nearly 30% of its value on Black Tuesday, and the market continued to plummet over the next few years. The crash led to the Great Depression, which lasted until the late 1930s and resulted in widespread unemployment, poverty, and economic hardship.

The Dot-Com Bubble Burst of 2000

The dot-com bubble burst in 2000, causing the tech-heavy NASDAQ Composite Index to plummet. This crash was primarily driven by the rapid growth of internet companies and the belief that these companies would continue to soar indefinitely.

The NASDAQ Composite Index lost more than 75% of its value between its peak in March 2000 and its trough in October 2002. Many investors lost significant amounts of money, and the crash led to a major restructuring of the tech industry.

The Financial Crisis of 2008

The financial crisis of 2008 was one of the most severe economic downturns in history, with the stock market crashing as a result of the subprime mortgage crisis. This crisis was caused by a combination of factors, including risky lending practices, overleveraged financial institutions, and a lack of regulation.

The DJIA lost more than 50% of its value between its peak in October 2007 and its trough in March 2009. The crisis led to the collapse of several major financial institutions, including Lehman Brothers, and resulted in widespread economic hardship.

Lessons Learned

The biggest US stock market crashes have taught us several important lessons. First, it's crucial to avoid excessive speculation and to conduct thorough research before investing. Second, it's essential to diversify your portfolio to mitigate risk. Third, regulatory oversight is vital to prevent financial crises.

Conclusion

The stock market has experienced numerous crashes throughout history, each with its own unique causes and impacts. By understanding these events, investors can better prepare themselves for the future and avoid making the same mistakes.

new york stock exchange

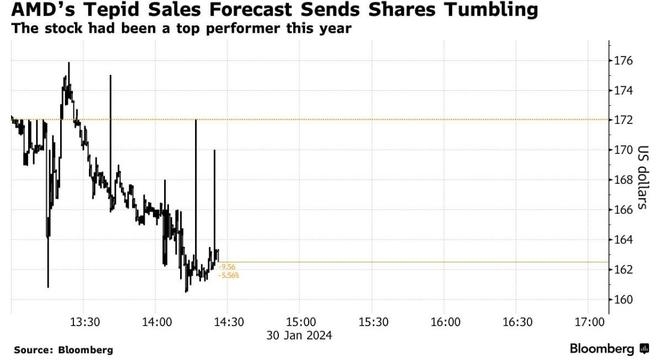

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....