Are you a Malaysian investor looking to expand your portfolio beyond local markets? Trading US stocks from Malaysia can be a lucrative opportunity, offering access to a diverse range of companies and potentially higher returns. However, navigating the complexities of international trading can be daunting. This comprehensive guide will help you understand the process, risks, and benefits of trading US stocks from Malaysia.

Understanding the US Stock Market

The US stock market is one of the largest and most liquid in the world, offering a wide range of investment opportunities. It includes the New York Stock Exchange (NYSE) and the NASDAQ, which are home to some of the most well-known and successful companies globally.

How to Trade US Stocks from Malaysia

Open a Brokerage Account: The first step is to open a brokerage account with a reputable online broker that offers access to US stocks. Some popular options for Malaysian investors include TD Ameritrade, E*TRADE, and Charles Schwab.

Understand the Regulations: Before trading, it's crucial to understand the regulatory requirements. The US Securities and Exchange Commission (SEC) oversees the US stock market, and there are specific rules and regulations that you need to follow.

Choose Your Investments: Research and select the US stocks you want to invest in. You can choose from a wide range of sectors, including technology, healthcare, finance, and consumer goods.

Use a Reliable Platform: Use a reliable and secure trading platform to execute your trades. Ensure that the platform offers real-time data, advanced charting tools, and research resources.

Stay Informed: Keep yourself updated with the latest market news and company earnings reports. This will help you make informed investment decisions.

Benefits of Trading US Stocks from Malaysia

Diversification: Investing in US stocks can help diversify your portfolio and reduce risk. The US stock market includes companies from various sectors and industries, offering exposure to different economic conditions.

Potential for Higher Returns: The US stock market has historically offered higher returns compared to local markets. This can be attributed to the presence of large, well-established companies with strong growth potential.

Access to Cutting-Edge Technologies: Investing in US stocks allows you to gain exposure to cutting-edge technologies and innovative companies that may not be available in Malaysia.

Risks to Consider

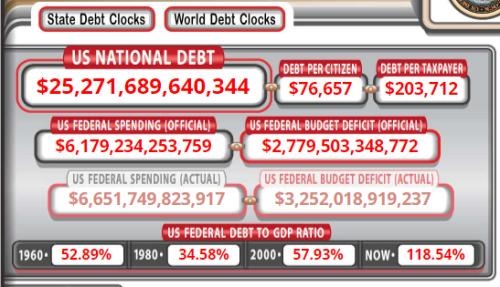

Currency Fluctuations: Trading US stocks from Malaysia involves currency risk, as you'll be dealing with US dollars. Fluctuations in exchange rates can impact your investment returns.

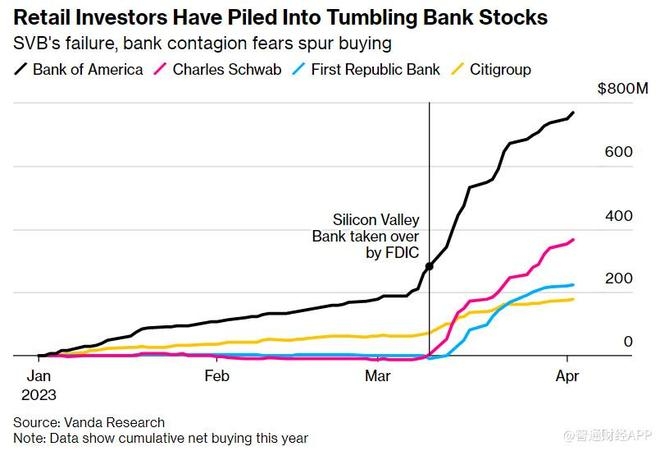

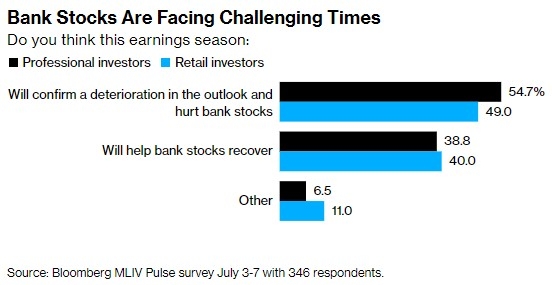

Market Volatility: The US stock market can be highly volatile, especially during economic downturns or geopolitical events. This can lead to significant price swings in your investments.

Regulatory Risks: Non-US investors may face additional regulatory challenges when trading in the US stock market. It's crucial to understand these regulations and comply with them.

Case Study: Investing in US Tech Stocks

Consider a Malaysian investor who decides to invest in US tech stocks, such as Apple and Microsoft. By diversifying their portfolio with these companies, they gain exposure to the rapidly growing technology sector. Over time, their investments in these companies have generated significant returns, despite the currency fluctuations and market volatility.

Conclusion

Trading US stocks from Malaysia can be a rewarding investment strategy. By understanding the process, risks, and benefits, you can make informed decisions and potentially achieve higher returns. Always do thorough research and consult with a financial advisor before making any investment decisions.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....