In the dynamic world of pharmaceuticals, Takeda Pharmaceuticals Co., Ltd. has emerged as a significant player. For investors looking to capitalize on the potential of this Japanese pharmaceutical giant, understanding the value of Takeda stock in US dollars is crucial. This article delves into the factors influencing Takeda's stock price, its performance in the US market, and provides insights for investors considering a stake in this company.

Understanding Takeda Pharmaceuticals

Takeda is a multinational pharmaceutical company headquartered in Japan. It specializes in the development, manufacturing, and marketing of pharmaceutical products. The company's portfolio includes a diverse range of treatments for various medical conditions, from cancer to rare diseases. Takeda's global presence and strong research and development capabilities have made it a key player in the pharmaceutical industry.

Factors Influencing Takeda Stock Price

The value of Takeda stock in US dollars is influenced by several factors:

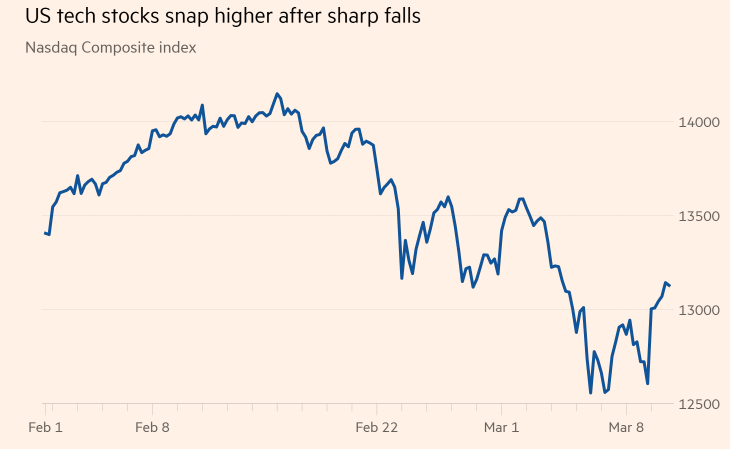

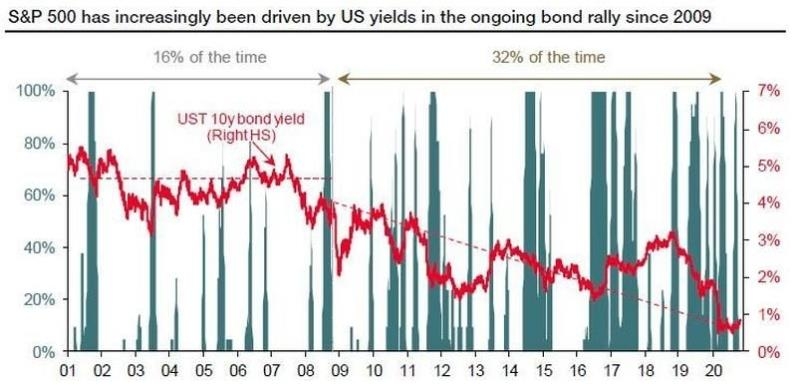

- Market Conditions: Like any other stock, Takeda's stock price is subject to market volatility. Economic indicators, political events, and industry trends can all impact the stock's value.

- Company Performance: Takeda's financial performance, including revenue, earnings, and growth prospects, is a major driver of its stock price. Positive financial results often lead to increased investor confidence and a rise in stock price.

- Product Pipeline: Takeda's pipeline of new drug candidates is another crucial factor. A strong pipeline with promising drugs can significantly boost investor sentiment and drive up the stock price.

- Regulatory Approvals: The approval of new drugs by regulatory authorities like the FDA is a significant milestone for Takeda. Positive news on regulatory approvals can lead to a surge in the stock price.

Takeda Stock Performance in the US Market

Takeda's stock is listed on the New York Stock Exchange (NYSE) under the ticker symbol "TAK." Its performance in the US market has been relatively strong over the years. However, like any stock, it has experienced periods of volatility. Here are some key points to consider:

- Historical Performance: Over the past five years, Takeda's stock has seen significant growth, with some notable ups and downs.

- Dividends: Takeda has a history of paying dividends to its shareholders, which can be an attractive feature for income-oriented investors.

- Market Capitalization: Takeda's market capitalization has fluctuated over time, reflecting changes in investor sentiment and market conditions.

Investing in Takeda Stock

For investors considering investing in Takeda stock, here are some key points to keep in mind:

- Research: Conduct thorough research on Takeda's financials, product pipeline, and market position before making an investment decision.

- Risk Assessment: Like any investment, Takeda stock carries risks. Assess your risk tolerance and investment goals before investing.

- Diversification: Consider diversifying your portfolio to mitigate risk. Investing in a mix of stocks, bonds, and other assets can help reduce the impact of market volatility.

Conclusion

Understanding the value of Takeda stock in US dollars is crucial for investors looking to capitalize on this pharmaceutical giant. By considering factors like market conditions, company performance, and product pipeline, investors can make informed decisions about their investments. As always, thorough research and risk assessment are key to successful investing.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....