Are you looking to diversify your investment portfolio with Canadian back stocks? If so, you might be wondering if it's possible to purchase these stocks from the United States. The good news is that it is indeed possible to buy Canadian back stocks in the US, and this article will guide you through the process.

Understanding Canadian Back Stocks

Before diving into the details of buying Canadian back stocks in the US, let's first clarify what exactly Canadian back stocks are. Canadian back stocks refer to stocks that are listed on Canadian exchanges but have significant exposure to the US market. These stocks are often of Canadian companies that have a significant portion of their revenue or operations in the United States.

Why Invest in Canadian Back Stocks?

Investing in Canadian back stocks offers several advantages. First, these stocks can provide exposure to both the Canadian and US markets, allowing investors to diversify their portfolios. Additionally, some Canadian back stocks may offer attractive valuations compared to their US counterparts. Furthermore, investing in Canadian back stocks can provide a hedge against currency fluctuations, as the Canadian dollar often moves independently of the US dollar.

How to Buy Canadian Back Stocks in the US

Buying Canadian back stocks in the US is relatively straightforward, but there are a few key steps to keep in mind:

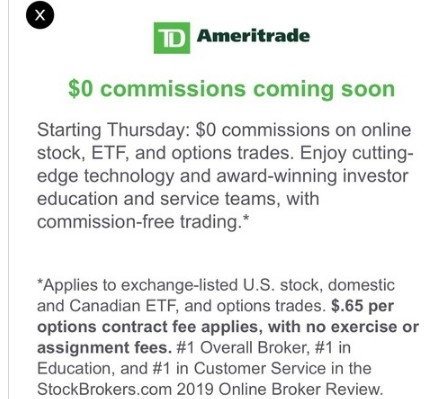

Open a Brokerage Account: The first step is to open a brokerage account with a US-based brokerage firm that offers access to Canadian exchanges. Some popular options include TD Ameritrade, E*TRADE, and Charles Schwab.

Research Canadian Stocks: Once you have your brokerage account set up, it's time to research Canadian stocks that interest you. Look for companies with a significant US market presence and consider factors such as their financial health, growth prospects, and valuation.

Place a Trade: After identifying a Canadian stock you want to purchase, you can place a trade through your brokerage account. Simply enter the stock symbol and the desired quantity, and your broker will execute the trade.

Stay Informed: It's crucial to stay informed about both the Canadian and US markets, as these can have a significant impact on the performance of Canadian back stocks. Monitor financial news, earnings reports, and any regulatory changes that may affect the stocks you own.

Case Study: Canadian National Railway (CNI)

A great example of a Canadian back stock is Canadian National Railway (CNI). CNI is one of the largest freight rail transportation companies in North America, with a significant presence in the US. The company's stock is listed on the Toronto Stock Exchange (TSX) and is widely traded in the US.

By purchasing CNI shares through a US-based brokerage firm, investors can gain exposure to the North American rail industry while benefiting from the liquidity and ease of trading on US exchanges.

Conclusion

In conclusion, buying Canadian back stocks in the US is not only possible but also offers several advantages for investors looking to diversify their portfolios. By following the steps outlined in this article, you can successfully invest in Canadian back stocks and potentially benefit from exposure to both the Canadian and US markets.

us stock market today

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....