The total market capitalization of US stocks is a critical indicator that reflects the overall health and growth potential of the American stock market. This figure represents the total value of all publicly-traded companies listed on the major US stock exchanges. In this article, we will delve into the factors influencing total market capitalization, its significance, and its potential implications for investors and the economy.

Understanding Market Capitalization

Market capitalization, often referred to as "market cap," is calculated by multiplying the current share price of a company by the total number of its outstanding shares. The total market capitalization of the US stock market is the sum of market caps of all publicly-traded companies.

Factors Influencing Total Market Capitalization

Several factors can influence the total market capitalization of the US stock market:

- Economic Growth: A robust economy typically leads to higher corporate earnings, which can drive up stock prices and, consequently, market capitalization.

- Interest Rates: Lower interest rates can make borrowing cheaper for companies, leading to increased investment and expansion, which can boost market capitalization.

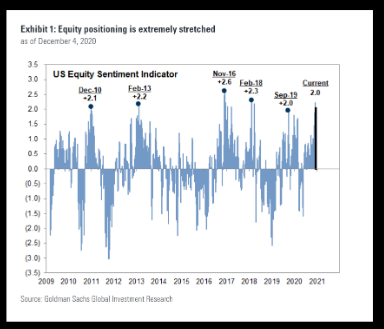

- Market Sentiment: The perception and optimism of investors regarding the stock market can significantly impact market capitalization. A positive sentiment can lead to higher stock prices and increased market capitalization.

- Regulatory Changes: Changes in regulations, such as tax reforms or corporate governance rules, can also affect market capitalization.

Significance of Total Market Capitalization

The total market capitalization of the US stock market serves several purposes:

- Economic Indicator: It provides a snapshot of the overall economic health and growth potential of the country.

- Investment Opportunities: It helps investors identify which sectors or companies may offer attractive investment opportunities.

- Valuation: It provides a benchmark for comparing the valuation of individual stocks or the overall stock market.

Total Market Capitalization: Historical Perspective

Over the past few decades, the total market capitalization of the US stock market has experienced significant fluctuations. For instance, in the late 1990s, during the dot-com bubble, the market cap reached an all-time high. However, it plummeted during the 2008 financial crisis and has since recovered.

Case Study: The Tech Sector

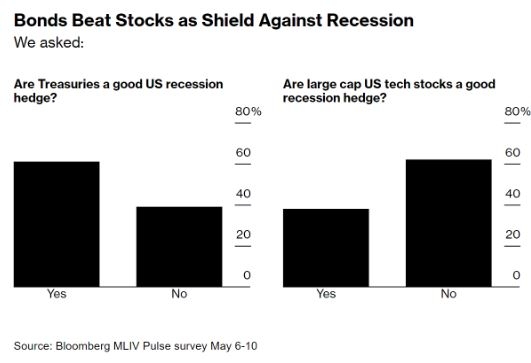

The tech sector has been a significant driver of the US stock market's growth. Companies like Apple, Microsoft, and Amazon have seen their market caps soar over the years. This growth has contributed to the overall increase in the total market capitalization of the US stock market.

Conclusion

The total market capitalization of the US stock market is a vital indicator that reflects the country's economic health and growth potential. Understanding its factors, significance, and historical trends can help investors make informed decisions and gain insights into the market's future direction.

us stock market today

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....