The graph of the US stock market is a vital tool for investors, analysts, and enthusiasts who seek to understand the performance and trends of the financial landscape. This article delves into the intricacies of the US stock market graph, providing insights into its composition, key indicators, and historical trends. By examining this graph, we can gain a clearer picture of the market's past, present, and future potential.

Understanding the Composition of the US Stock Market Graph

The US stock market graph is a visual representation of the performance of the stock market over a specific period. It typically includes various indices, such as the S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite. These indices are calculated by combining the prices of a selection of stocks that represent a broad range of industries and market capitalizations.

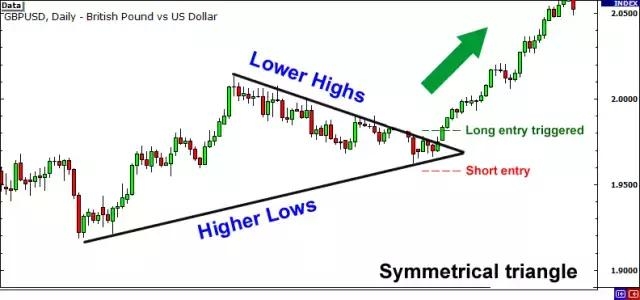

The graph itself is a line chart that plots the closing prices of the selected stocks or indices over time. It allows us to observe trends, patterns, and fluctuations in the market. By analyzing the graph, we can identify periods of growth, decline, and volatility, which are crucial for making informed investment decisions.

Key Indicators in the US Stock Market Graph

Several key indicators are commonly used to analyze the US stock market graph. These indicators provide valuable insights into the market's health and potential future movements. Some of the most important indicators include:

Volume: This indicator measures the number of shares traded during a specific period. High trading volume often indicates significant interest in a particular stock or sector, which can be a sign of market momentum.

Moving Averages: Moving averages are calculated by averaging the closing prices of a stock or index over a specified number of periods. They help identify trends and potential buy or sell signals.

Relative Strength Index (RSI): The RSI is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and is used to identify overbought or oversold conditions in the market.

Bollinger Bands: Bollinger Bands consist of a middle band and two outer bands. The middle band is a moving average, while the outer bands are standard deviations away from the middle band. They help identify potential overbought or oversold levels in the market.

Historical Trends in the US Stock Market Graph

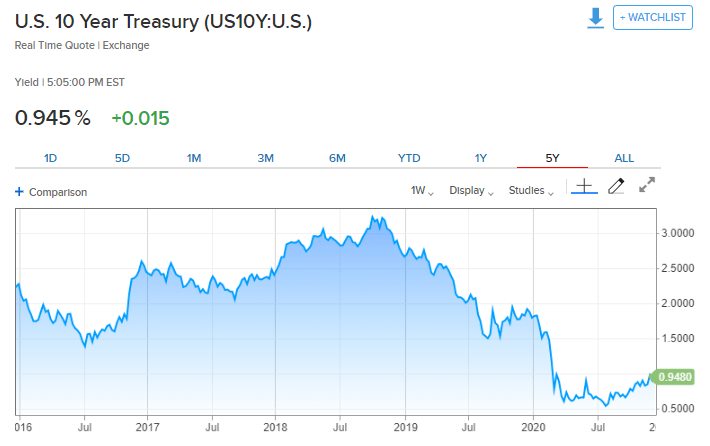

Analyzing the historical trends of the US stock market graph can provide valuable lessons for investors. Over the past century, the market has experienced several bull and bear markets, as well as periods of significant growth and decline.

For example, the dot-com bubble of the late 1990s and the 2008 financial crisis were significant periods of market volatility. By examining these historical trends, we can identify patterns and potential future movements in the market.

Case Studies: Analyzing the US Stock Market Graph

To illustrate the practical application of analyzing the US stock market graph, let's consider two case studies:

Apple Inc. (AAPL): Over the past decade, Apple's stock has experienced significant growth. By analyzing the stock's graph, we can observe periods of strong momentum, as well as periods of consolidation and pullback. Understanding these trends can help investors make informed decisions about buying, holding, or selling the stock.

Tesla Inc. (TSLA): Tesla's stock has been highly volatile over the past few years. By examining the graph, we can identify periods of extreme volatility, as well as potential buy or sell signals based on indicators like the RSI and Bollinger Bands.

In conclusion, the graph of the US stock market is a powerful tool for analyzing market trends and making informed investment decisions. By understanding its composition, key indicators, and historical trends, investors can gain valuable insights into the market's potential. Whether you are a seasoned investor or just starting out, analyzing the US stock market graph is an essential skill for navigating the financial landscape.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....