In today's rapidly evolving financial landscape, cryptocurrencies have emerged as a powerful tool for investors looking to diversify their portfolios. One innovative approach gaining traction is the ability to buy stocks with crypto. This article delves into the benefits, processes, and future implications of this cutting-edge investment strategy.

Understanding the Concept

The concept of purchasing stocks with cryptocurrencies is straightforward. Investors can convert their digital assets, such as Bitcoin, Ethereum, or Litecoin, into traditional currency using cryptocurrency exchanges. Once converted, this fiat currency can then be used to buy stocks in various companies.

Benefits of Buying Stocks with Crypto

- Diversification: Cryptocurrency investors can expand their portfolio by adding traditional stocks, reducing their exposure to the volatile crypto market.

- Access to a Broader Market: Buying stocks with crypto allows investors to access a wider range of investment opportunities, including blue-chip companies and emerging startups.

- Convenience: The process of purchasing stocks with crypto is seamless and can be completed within minutes, eliminating the need for traditional banking procedures.

- Security: Cryptocurrency exchanges often offer advanced security measures, such as two-factor authentication and cold storage, to protect investors' digital assets.

How to Buy Stocks with Crypto

- Choose a Cryptocurrency Exchange: Research and select a reputable cryptocurrency exchange that supports the digital assets you wish to convert.

- Convert Crypto to Fiat Currency: Use the exchange to convert your crypto assets into traditional currency.

- Open a Brokerage Account: Sign up for a brokerage account and fund it with the fiat currency you received from the exchange.

- Purchase Stocks: Use the brokerage account to purchase stocks in the companies of your choice.

Case Studies

- Tesla: In August 2021, Tesla CEO Elon Musk announced that the company would accept Bitcoin as payment for its vehicles. This move sparked a surge in interest among crypto investors, leading to a significant increase in Tesla's stock price.

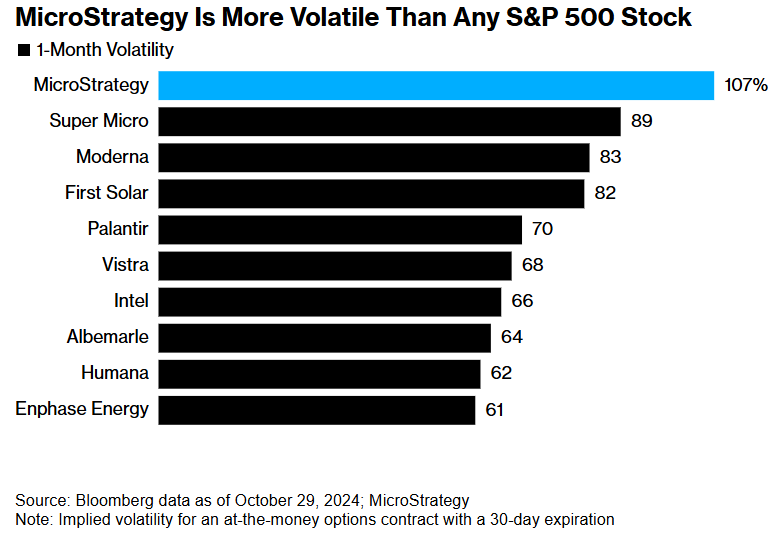

- MicroStrategy: This business intelligence company made headlines in 2020 when it announced a $425 million investment in Bitcoin. Since then, MicroStrategy has continued to buy Bitcoin, resulting in a substantial increase in its market capitalization.

Conclusion

Buying stocks with crypto presents a unique opportunity for investors to diversify their portfolios and take advantage of the growing digital asset market. By following the outlined steps and staying informed about market trends, investors can maximize their returns and position themselves for long-term success.

Key Takeaways:

- Diversification: Combine crypto assets with traditional stocks for a well-rounded portfolio.

- Convenience: Enjoy the ease of purchasing stocks with crypto.

- Security: Utilize advanced security measures to protect your digital assets.

- Market Trends: Stay informed about market developments to make informed investment decisions.

By embracing this innovative investment strategy, you can unlock a world of opportunities and secure your financial future.

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....