Are you a Chinese investor looking to diversify your portfolio with US stocks? You're not alone. The allure of investing in the world's largest economy is undeniable. However, navigating the process of buying US stocks from China can be daunting. Don't worry; we've got you covered. In this guide, we'll walk you through the steps to buy US stocks in China, so you can start investing in American companies today.

Understanding the Basics

Before diving into the process, it's essential to understand some key concepts. US stocks are shares of ownership in a company listed on a US stock exchange, such as the New York Stock Exchange (NYSE) or the NASDAQ. When you buy US stocks, you're essentially purchasing a small piece of that company.

Opening a Brokerage Account

The first step to buying US stocks in China is to open a brokerage account. This account will act as your gateway to the US stock market. Here are a few options to consider:

Overseas Brokerage Accounts: Some foreign brokerage firms offer accounts to Chinese investors. These firms may provide access to a range of US stocks, as well as additional services like research and trading tools.

Local Chinese Brokerage Firms: Some Chinese brokerage firms offer cross-border trading services. This option may be more convenient for investors who already have an account with a local broker.

Online Brokerage Platforms: Online platforms like TD Ameritrade and E*TRADE offer accounts to international investors. These platforms provide access to a wide range of US stocks, as well as advanced trading tools.

When choosing a brokerage, consider factors such as fees, minimum investment requirements, and customer service.

Understanding the Risks

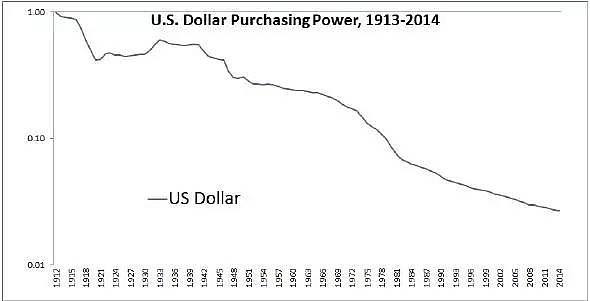

Before investing, it's crucial to understand the risks associated with buying US stocks from China. Currency exchange rates can impact your investment returns, and you may also face additional fees and taxes. Additionally, investing in foreign stocks can be more challenging due to differences in regulations and reporting requirements.

Navigating the Process

Once you've opened a brokerage account, the process of buying US stocks is relatively straightforward. Here's a step-by-step guide:

Research and Analyze: Begin by researching companies you're interested in. Analyze their financial statements, market trends, and competitive position to identify promising investment opportunities.

Place Your Order: Once you've identified a company, log in to your brokerage account and place your order. You can specify the number of shares you want to buy, as well as the type of order (e.g., market order, limit order).

Monitor Your Investment: After purchasing US stocks, keep an eye on your investment's performance. Stay informed about market trends, company news, and economic indicators that may impact your investment.

Case Study: Alibaba

To illustrate the process, let's consider a hypothetical example. Suppose you want to invest in Alibaba, one of China's largest e-commerce platforms. You would research the company, open a brokerage account, and place an order to buy shares of Alibaba on the NYSE.

By following these steps, you can start investing in US stocks from China and potentially benefit from the growth of some of the world's most successful companies.

Conclusion

Buying US stocks from China can be a rewarding investment strategy. By understanding the basics, opening a brokerage account, and conducting thorough research, you can navigate the process and start building a diversified portfolio. Remember to stay informed and monitor your investments to maximize your returns.

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....