The dollar value of the US stock market is a critical metric that investors, analysts, and economists alike closely follow. This figure not only reflects the size and performance of the stock market but also provides insights into the broader economic landscape. In this article, we'll delve into what this metric signifies, its impact on the economy, and how it has evolved over time.

What is the Dollar Value of the US Stock Market?

The dollar value of the US stock market refers to the total value of all stocks traded on major exchanges such as the New York Stock Exchange (NYSE) and the NASDAQ. This figure is calculated by multiplying the current share price of each stock by its total number of outstanding shares. For example, if a company has 100 million shares outstanding and its share price is

The Impact of the Dollar Value on the Economy

The dollar value of the US stock market has a significant impact on the broader economy. Here's how:

1. Economic Indicators: The dollar value of the US stock market is considered a key economic indicator. It provides insights into investor confidence, corporate earnings, and overall economic growth.

2. Wealth Creation: When the stock market rises, the dollar value increases, leading to wealth creation for shareholders. This, in turn, can drive consumer spending and boost economic growth.

3. Investment Incentives: A high dollar value can attract both domestic and international investors, leading to increased capital flows and economic activity.

4. Job Creation: The growth of the stock market often correlates with job creation, as companies expand and hire more workers.

The Evolution of the Dollar Value of the US Stock Market

The dollar value of the US stock market has seen significant fluctuations over the years. Here are a few key milestones:

1. 1990s: The 1990s marked a period of rapid growth for the US stock market. The technology boom, led by companies like Microsoft and Apple, significantly contributed to the increase in the dollar value of the stock market.

2. Dot-com Bubble: The early 2000s saw the bursting of the dot-com bubble, which caused a sharp decline in the dollar value of the stock market.

3. Financial Crisis of 2008: The global financial crisis of 2008 led to a massive decline in the dollar value of the US stock market, as investors sold off their stocks amid widespread economic uncertainty.

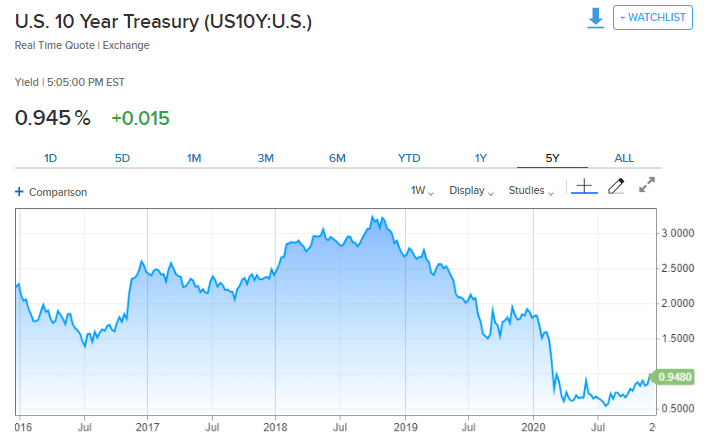

4. Recent Years: In the past few years, the dollar value of the US stock market has seen a significant recovery, driven by factors like low interest rates and strong corporate earnings.

Case Studies: The Dollar Value of the US Stock Market in Action

1. Amazon: Over the years, Amazon has seen its stock price soar, significantly contributing to the dollar value of the US stock market. The company's growth in e-commerce and cloud computing services has made it one of the most valuable companies in the world.

2. Tesla: Tesla's meteoric rise has been a significant driver of the dollar value of the US stock market. The company's innovation in electric vehicles and renewable energy has made it a favorite among investors.

In conclusion, the dollar value of the US stock market is a crucial metric that reflects the size, performance, and overall health of the economy. By understanding this figure, investors and policymakers can gain valuable insights into the economic landscape and make informed decisions.

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....