In the ever-evolving financial landscape of the United States, stock prices are a critical indicator of market trends and economic health. Whether you're a seasoned investor or just dipping your toes into the stock market, understanding how stock prices are determined and how they can fluctuate is essential. This article delves into the factors that influence stock prices in the US, providing you with the knowledge to make informed investment decisions.

The Basics of Stock Prices

Stock prices are the value assigned to each share of a publicly traded company. These prices are determined by the supply and demand for the stock, as well as various external factors. When demand for a stock increases, its price typically rises, and vice versa.

Supply and Demand Dynamics

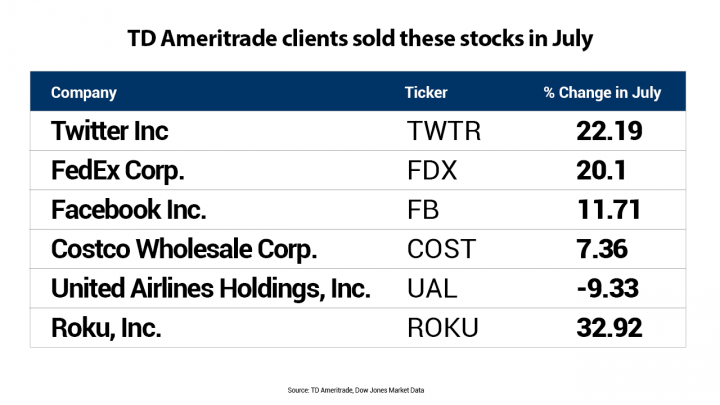

The most fundamental factor influencing stock prices is the basic economic principle of supply and demand. If more investors are interested in buying a particular stock, its price will increase. Conversely, if there are more sellers than buyers, the price will decline.

Market Sentiment

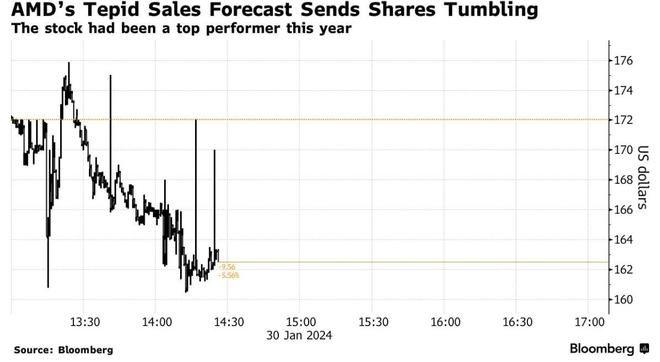

Market sentiment plays a significant role in stock price movements. Positive news about a company or industry can boost investor confidence, leading to higher stock prices. On the other hand, negative news can cause prices to plummet.

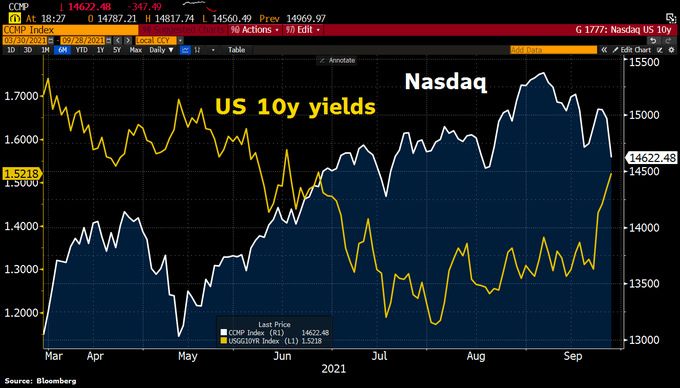

Economic Indicators

Economic indicators, such as GDP growth, unemployment rates, and inflation, can also impact stock prices. For example, a strong GDP growth rate can indicate a healthy economy, potentially leading to higher stock prices. Conversely, high unemployment or inflation can signal economic challenges, which may cause stock prices to fall.

Company Performance

The financial performance of a company is a key driver of its stock price. Strong earnings reports, revenue growth, and positive outlooks can drive stock prices up, while poor performance can lead to declines.

Dividends and Splits

Dividends, which are payments made to shareholders from a company's profits, can also influence stock prices. Companies that increase their dividends are often seen as financially stable and can attract more investors, leading to higher stock prices. Additionally, stock splits, where a company divides its existing shares into multiple shares, can also affect prices.

Market Indexes

Market indexes, such as the S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite, provide a snapshot of the overall stock market. The performance of these indexes can have a significant impact on individual stock prices.

Case Study: Apple Inc.

A prime example of how stock prices can fluctuate is seen in the case of Apple Inc. (AAPL). In the past few years, Apple has seen significant price volatility due to various factors. For instance, in 2020, the company reported strong earnings, leading to a surge in its stock price. However, in 2021, concerns about supply chain disruptions and increased competition caused the stock to experience a brief decline before recovering.

Conclusion

Understanding the factors that influence stock prices in the US is crucial for anyone looking to invest in the stock market. By considering supply and demand dynamics, market sentiment, economic indicators, company performance, dividends, splits, and market indexes, investors can make more informed decisions. Whether you're a beginner or an experienced investor, staying informed and educated about stock prices is the key to success in the stock market.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....