In today's globalized economy, investors are increasingly looking beyond their borders for investment opportunities. One popular destination for American investors is Indonesia, a country with a rapidly growing economy and a plethora of promising companies. But can U.S. citizens legally own stock in Indonesian companies? Let's dive into this question and explore the ins and outs of investing in Indonesian stocks from the United States.

Understanding the Legal Landscape

The short answer is yes, U.S. citizens can own stock in Indonesian companies. However, there are certain legal and regulatory considerations to keep in mind. The primary authority governing foreign investment in Indonesia is the Investment Coordinating Board (BKPM), which oversees the country's foreign investment regulations.

Regulatory Framework

U.S. investors should be aware of the Investment Negative List (DNI), which outlines sectors and businesses that are restricted or prohibited to foreign ownership. While most sectors are open to foreign investment, some require specific approvals from the government. It's crucial to consult with a legal expert or financial advisor to ensure compliance with these regulations.

Investment Options

U.S. investors have several options when it comes to investing in Indonesian stocks:

Direct Investment: This involves purchasing shares directly from the company. However, this method can be challenging due to language barriers and limited access to information.

Stock Exchange: The Indonesia Stock Exchange (IDX) offers a more accessible option. Investors can buy shares of Indonesian companies listed on the IDX through online brokers or financial institutions that offer international trading services.

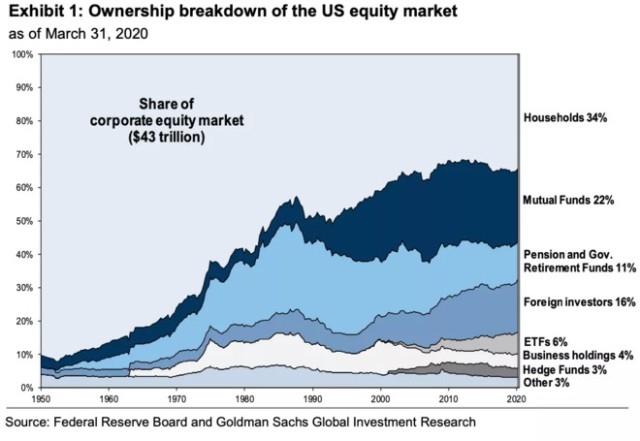

Mutual Funds and ETFs: Many mutual funds and exchange-traded funds (ETFs) invest in international stocks, including those from Indonesia. This is a convenient way to gain exposure to the Indonesian market without the need for extensive research or direct investment.

Risks and Rewards

Investing in Indonesian stocks, like any investment, carries both risks and rewards. Some key factors to consider include:

Economic Stability: Indonesia's economy is influenced by global economic conditions, commodity prices, and domestic political stability.

Currency Fluctuations: The Indonesian Rupiah (IDR) can be volatile, impacting the returns of investments in Indonesian stocks.

Market Volatility: The IDX can be highly volatile, especially during times of economic uncertainty or political instability.

Despite these risks, Indonesia offers several potential rewards, including:

Rapid Economic Growth: Indonesia is one of the fastest-growing economies in the world, with a young and growing population.

Diversification: Investing in Indonesian stocks can provide diversification to a U.S. investor's portfolio, especially if they are looking to gain exposure to emerging markets.

Potential for High Returns: Historically, the IDX has offered higher returns than many developed markets.

Case Study: Astra International

Astra International is one of Indonesia's largest conglomerates, with interests in automotive, financial services, and other sectors. U.S. investors can own shares of Astra International through the IDX. Over the past decade, Astra International has delivered strong returns, making it an attractive investment for those looking to invest in the Indonesian market.

Conclusion

In conclusion, U.S. citizens can own stock in Indonesian companies, but it's essential to understand the legal and regulatory landscape and consider the associated risks and rewards. With careful planning and due diligence, investing in Indonesian stocks can be a valuable addition to a diversified investment portfolio.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....