In the ever-evolving world of technology, semiconductor stocks have always been a cornerstone of investment opportunities. As we step into 2023, the semiconductor industry continues to grow at an unprecedented rate, with several US-based companies leading the charge. This article will highlight some of the best US semiconductor stocks to watch, providing insights into their potential for growth and innovation.

Intel Corporation (INTC)

Intel is a household name in the semiconductor industry, and for good reason. As one of the oldest and most established players in the market, Intel has a robust portfolio of products and a strong market position. With a focus on developing advanced computing and communication technologies, Intel is poised to benefit from the increasing demand for high-performance computing solutions.

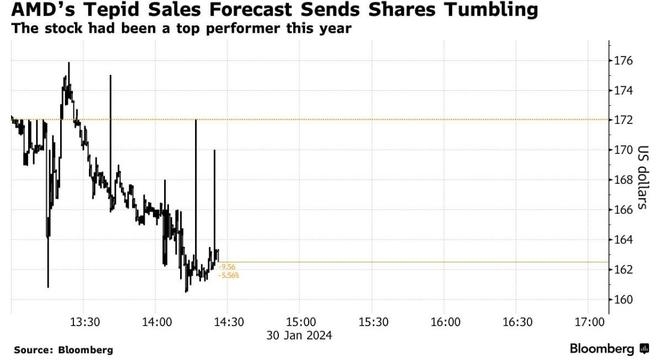

AMD (Advanced Micro Devices)

AMD has been making waves in the semiconductor industry with its competitive offerings. The company has been successful in capturing market share from Intel, particularly in the gaming and data center segments. AMD's Ryzen processors have been praised for their performance and value, making it a compelling investment opportunity.

Texas Instruments (TXN)

Texas Instruments is a leader in the design and manufacture of analog and embedded processing semiconductors. The company's products are used in a wide range of applications, including consumer electronics, automotive, and industrial markets. With a strong financial position and a commitment to innovation, Texas Instruments is well-positioned for continued growth.

NVIDIA Corporation (NVDA)

NVIDIA is a dominant force in the graphics processing unit (GPU) market, with a significant presence in the gaming, professional visualization, and data center segments. The company's GPUs are widely regarded for their performance and capabilities, and NVIDIA has been successful in expanding its offerings to include AI and autonomous driving technologies.

Qualcomm Incorporated (QCOM)

Qualcomm is a leader in the mobile semiconductor market, providing chips for smartphones, tablets, and other wireless devices. The company's Snapdragon processors are known for their performance and power efficiency, making them a preferred choice for many manufacturers. With the increasing demand for 5G connectivity, Qualcomm is well-positioned for continued growth.

Broadcom Inc. (AVGO)

Broadcom is a global leader in semiconductor solutions for wired and wireless communications. The company's products are used in a wide range of applications, including networking, enterprise storage, and mobile devices. Broadcom's recent acquisition of Avago Technologies has further strengthened its position in the market.

Case Study: NVIDIA's Growth

To illustrate the potential of semiconductor stocks, let's take a look at NVIDIA's growth over the past few years. In 2016, NVIDIA's market capitalization was around

In conclusion, the semiconductor industry continues to be a promising sector for investors. With the rapid pace of technological advancements, companies like Intel, AMD, Texas Instruments, NVIDIA, Qualcomm, and Broadcom are well-positioned to capitalize on the growing demand for advanced computing and communication solutions. As you consider your investment strategy, these companies are worth keeping an eye on.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....