As we approach the final stretch of 2016, many investors are eager to get a glimpse into the potential stock market trends for 2017. The year 2017 holds significant promise for both seasoned investors and newcomers alike, with various sectors poised for growth. In this article, we will delve into the key predictions and analysis for the US stock market in 2017.

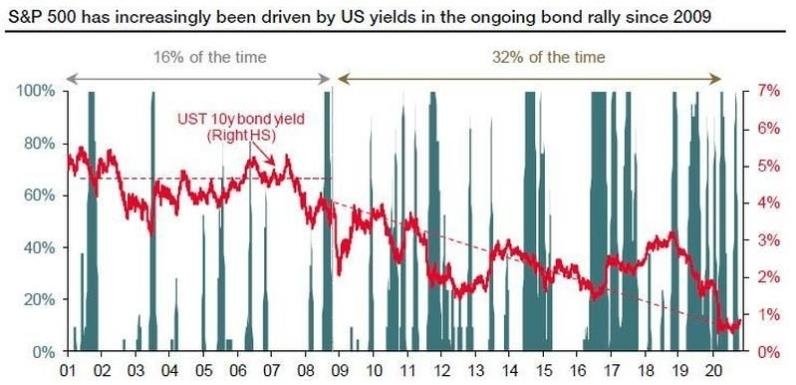

Rising Interest Rates and their Impact on the Market

One of the most anticipated events in 2017 will be the Federal Reserve's decision on interest rates. Analysts predict that the Federal Reserve will raise interest rates in the coming year, which could have a significant impact on the stock market. Higher interest rates typically lead to lower stock prices as borrowing costs increase, but they can also boost the value of bonds and other fixed-income investments.

Investment Tip: Investors looking to hedge against rising interest rates may want to consider dividend-paying stocks or bonds as alternative investments.

Technology and Biotechnology Sectors

The technology and biotechnology sectors are expected to continue their strong performance in 2017. With the rise of artificial intelligence, blockchain technology, and the healthcare industry's focus on personalized medicine, these sectors present numerous opportunities for growth.

Technology Stocks to Watch: Apple, Google, Facebook, and Amazon are among the tech giants that are expected to see significant growth in 2017.

Biotech Stocks to Watch: Amgen, Biogen, and Gilead Sciences are leading biotechnology companies with promising pipeline drugs and strong market positions.

Energy Sector Recovery

The energy sector has been struggling in recent years due to the decline in oil prices. However, there are signs of a potential recovery in 2017, driven by increasing demand for energy and technological advancements in the industry.

Energy Stocks to Watch: ExxonMobil, Chevron, and Royal Dutch Shell are among the largest oil and gas companies that could benefit from a recovering energy sector.

Real Estate Investment Trusts (REITs)

The real estate market has shown steady growth in recent years, and this trend is expected to continue in 2017. REITs offer investors exposure to the real estate market with the added benefit of dividends.

REITs to Watch: Vornado Realty Trust, Prologis, and Public Storage are well-established REITs with strong portfolios and solid dividend yields.

Case Study: Amazon's Stock Performance

To illustrate the potential of the stock market in 2017, let's take a look at Amazon's stock performance. Over the past few years, Amazon has consistently outperformed the market, driven by its expansion into new markets such as cloud computing, streaming services, and physical retail.

Key Takeaways:

- Strong revenue growth: Amazon's revenue has been growing at a double-digit rate for years.

- Innovative business model: Amazon's strategy of diversifying into multiple markets has contributed to its success.

- Competitive advantage: Amazon's strong brand and market position make it a formidable competitor in the tech industry.

By keeping a close eye on these sectors and understanding the potential risks and opportunities, investors can position themselves for success in the US stock market in 2017.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....