Investment conferences are a pivotal event for stock pickers and financial analysts looking to gain insights into the latest market trends and potential investment opportunities. The Berenberg US Stock Picker Conference is no exception. This esteemed gathering brings together industry experts to share their knowledge and forecasts for the US stock market. In this article, we delve into the key takeaways from the conference and highlight some of the most promising investment picks.

Key Insights from the Conference

The conference featured a variety of sessions, each focusing on different sectors and investment strategies. Here are some of the key insights that emerged:

- Technology Stocks on the Rise: Several panelists highlighted the potential of technology stocks, especially in areas like cloud computing, artificial intelligence, and cybersecurity. They cited the rapid growth of these sectors and the increasing demand for advanced technology solutions as reasons for their optimism.

- Healthcare Industry Outlook: The healthcare sector was also a hot topic, with experts predicting strong growth driven by aging populations and technological advancements. Biotech and pharmaceutical companies were identified as particularly promising investment opportunities.

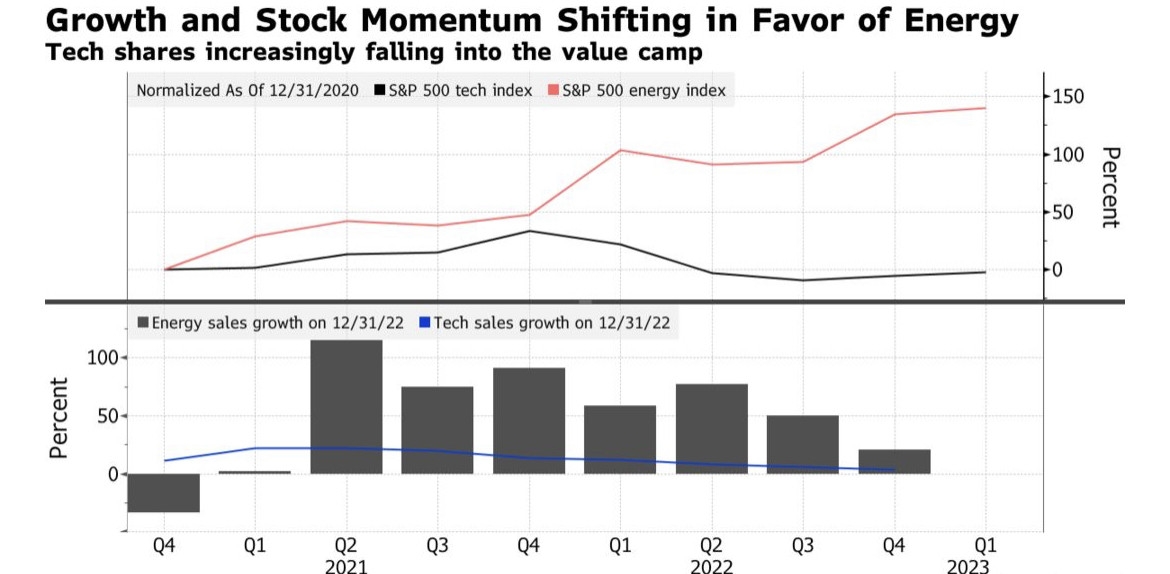

- Value Stocks Making a Comeback: After a prolonged period of growth in the tech sector, many investors are looking to value stocks for better returns. The conference highlighted several value stocks across various sectors, including financials, industrials, and consumer discretionary.

- ESG Investing Gaining Traction: Environmental, social, and governance (ESG) investing continues to gain momentum, with more investors considering the impact of their investments on the world. The conference emphasized the importance of ESG factors in long-term investment decisions.

Investment Picks from the Conference

Several stocks were highlighted as potential winners during the conference. Here are some of the key picks:

- Amazon (AMZN): Despite the recent pullback in tech stocks, Amazon was identified as a long-term winner due to its dominant position in e-commerce and cloud computing.

- Bristol Myers Squibb (BMY): The biotech and pharmaceutical company was praised for its strong pipeline of innovative drugs and its potential to capture significant market share in the oncology and immunology markets.

- Procter & Gamble (PG): The consumer goods giant was cited as a value stock with a strong track record of delivering consistent returns, supported by its diverse product portfolio and global reach.

- Mastercard (MA): The payment processing company was highlighted for its robust growth prospects, driven by the increasing adoption of digital payments and the expansion of its global network.

Case Study: Microsoft (MSFT)

One of the standout picks from the conference was Microsoft, which was praised for its strong fundamentals and innovative approach to technology. Here's a brief case study:

- Company Overview: Microsoft is a global leader in technology, offering a wide range of products and services, including cloud computing, software, and gaming.

- Key Strengths: Microsoft's strengths lie in its dominant position in the cloud computing market, its strong balance sheet, and its ability to innovate and adapt to changing market conditions.

- Investment Potential: The conference highlighted Microsoft's potential to deliver long-term growth and value to investors, making it a compelling pick for stock pickers looking to invest in the technology sector.

In conclusion, the Berenberg US Stock Picker Conference provided valuable insights into the latest market trends and potential investment opportunities. By focusing on key sectors like technology, healthcare, and value stocks, and considering factors like ESG investing, investors can make informed decisions and identify promising investment picks for the future.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....