Investing in the stock market can be a daunting task, especially for those new to the game. One of the most critical aspects to understand is the performance of the New York Stock Exchange (NYSE) year to date. This article delves into the current state of the NYSE, analyzing its year-to-date performance, key sectors, and potential investment opportunities.

Understanding the NYSE Year to Date Performance

The NYSE, one of the world's largest stock exchanges, has seen a rollercoaster of a year so far. As of [insert current date], the NYSE has experienced both significant gains and losses. This volatility can be attributed to various factors, including global economic conditions, political uncertainties, and market sentiment.

Key Sectors Driving the NYSE Year to Date Performance

Several sectors have played a pivotal role in shaping the NYSE's year-to-date performance. Here are some of the key sectors to watch:

- Technology: The technology sector has been a major driver of the NYSE's growth this year. Companies like Apple, Microsoft, and Amazon have seen significant gains, contributing to the overall upward trend.

- Healthcare: The healthcare sector has also performed well, with companies focused on biotechnology and pharmaceuticals leading the charge. Companies like Moderna and Regeneron have seen substantial growth due to their innovative drug developments.

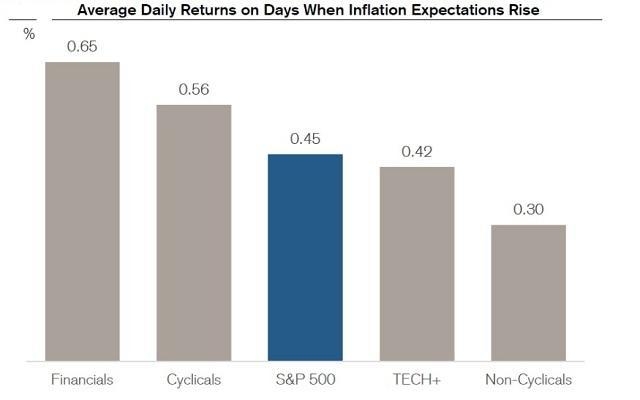

- Financials: The financial sector has experienced mixed results, with some companies performing well while others have struggled. Banks and insurance companies have been impacted by various factors, including interest rate changes and economic uncertainties.

Investment Opportunities and Risks

Investing in the NYSE year to date presents both opportunities and risks. Here are some key considerations:

- Opportunities: The current market conditions offer opportunities for investors to capitalize on undervalued stocks and emerging trends. Diversifying your portfolio across various sectors can help mitigate risks and maximize returns.

- Risks: The volatile nature of the stock market can lead to significant losses. It's crucial to conduct thorough research and consult with a financial advisor before making investment decisions.

Case Studies: Successful Investments in the NYSE Year to Date

Several companies have seen remarkable growth in the NYSE year to date. Here are a few examples:

- Tesla: The electric vehicle manufacturer has seen a significant increase in its stock price, driven by strong sales and innovative products.

- NVIDIA: The semiconductor company has experienced a surge in demand for its graphics processing units (GPUs), particularly due to the growing popularity of cryptocurrency mining.

- Berkshire Hathaway: The conglomerate, led by Warren Buffett, has seen steady growth, with its diverse portfolio of investments performing well across various sectors.

In conclusion, the NYSE year to date has been a dynamic and unpredictable period for investors. By understanding the key sectors, potential opportunities, and risks, investors can make informed decisions and capitalize on the market's volatility. As always, it's crucial to conduct thorough research and consult with a financial advisor before making any investment decisions.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....