The stock market crash of 2020 was a significant event that caught the attention of investors worldwide. Understanding the factors that led to this crash can help us learn from history and better prepare for future market downturns. In this article, we'll explore the causes of the 2020 US stock market crash and discuss the impact it had on investors.

The Onset of the Crisis

The US stock market crash of 2020 began in February when the COVID-19 pandemic forced governments around the world to impose strict lockdown measures. As the pandemic spread, fears of economic downturn and business closures grew, leading to a sharp decline in stock prices.

Market Sentiment and Speculation

One of the primary factors contributing to the stock market crash was the volatile market sentiment. Investors were caught off guard by the rapid spread of the virus, and the subsequent uncertainty led to widespread panic selling. This panic selling was exacerbated by speculative trading on platforms like Robinhood, where retail investors were able to borrow and trade stocks.

Impact of Economic Shutdowns

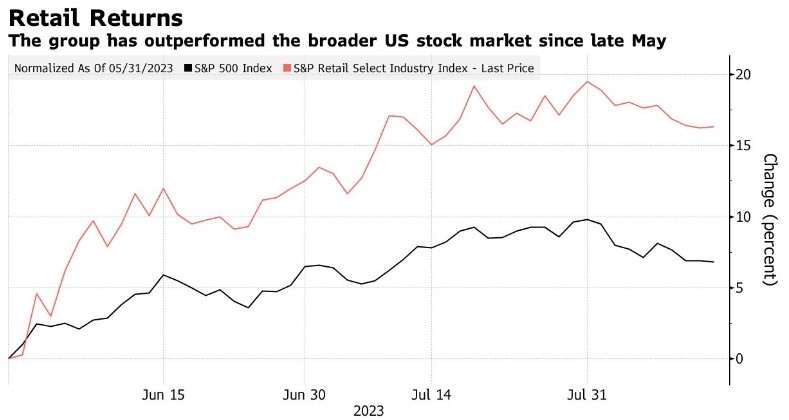

As lockdown measures were implemented, businesses across various sectors were forced to shut down or operate at reduced capacity. This led to a sharp decline in earnings forecasts, which further contributed to the stock market crash. Companies in heavily affected sectors, such as travel, hospitality, and retail, saw their share prices plummet.

Government and Central Bank Actions

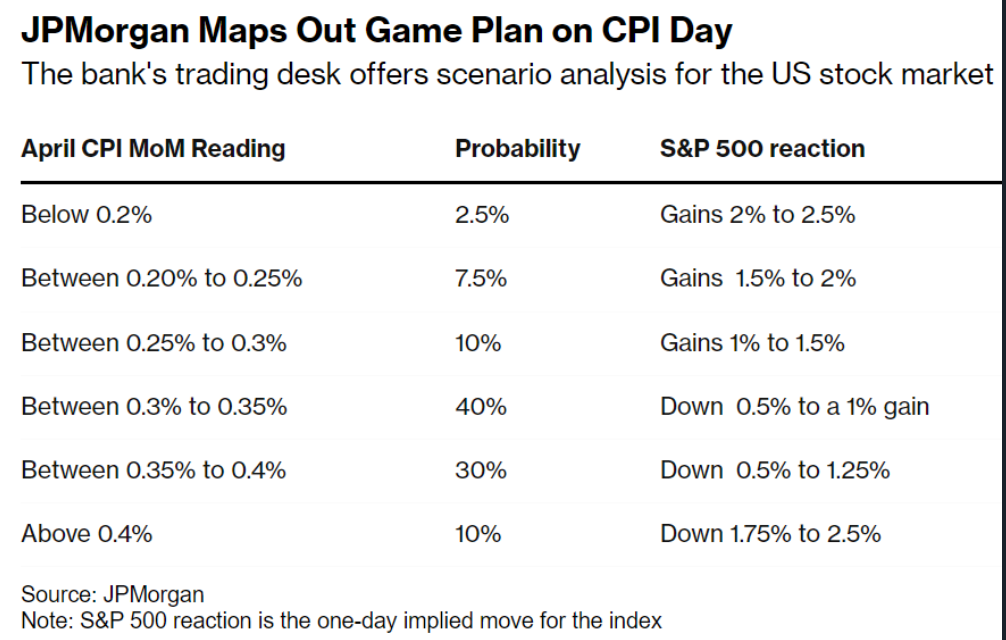

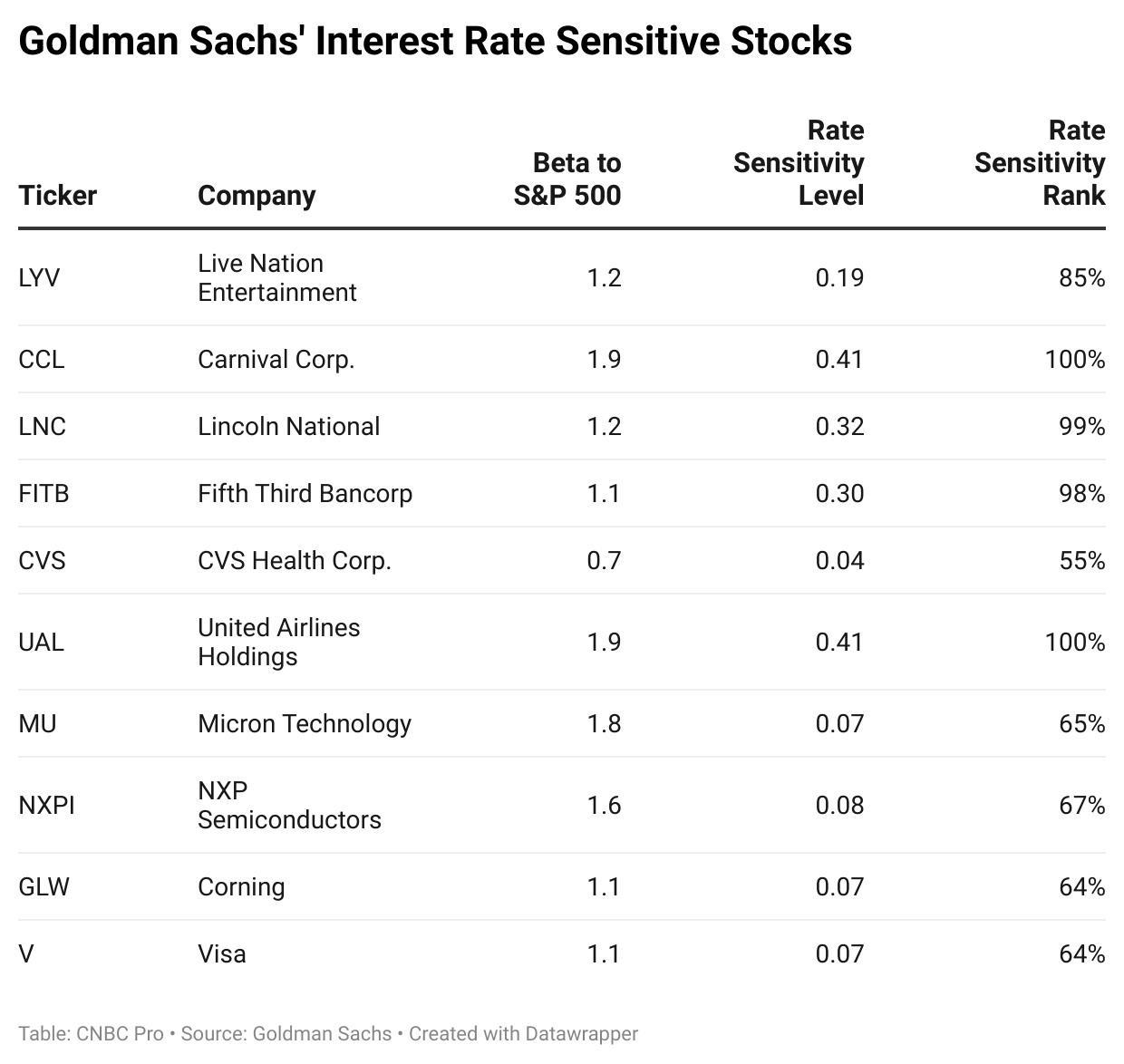

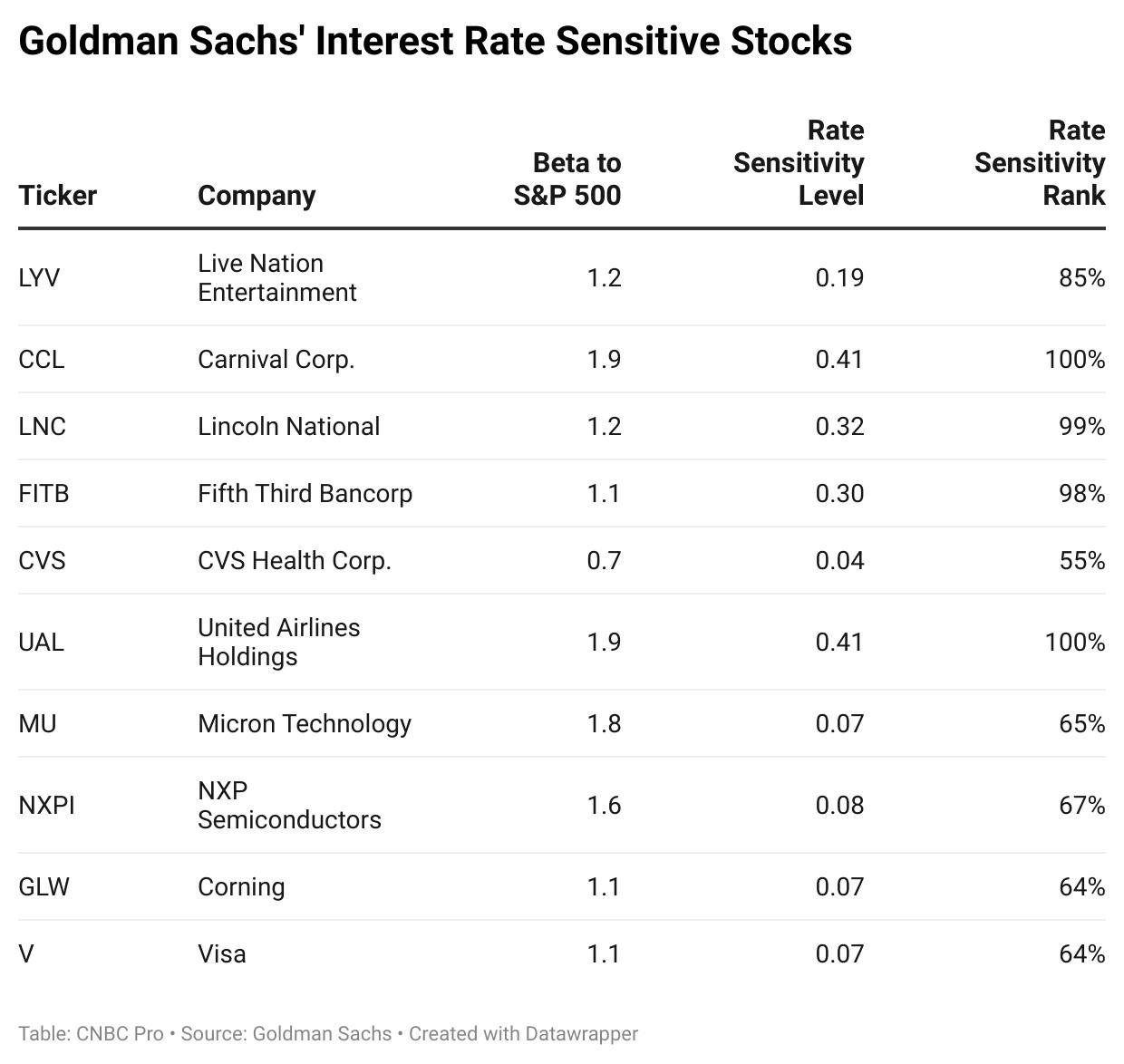

In response to the stock market crash, governments and central banks around the world took unprecedented actions to stabilize the economy. The US Federal Reserve cut interest rates to near-zero and implemented various quantitative easing programs to inject liquidity into the financial system. Additionally, the US government passed the CARES Act to provide financial relief to individuals and businesses affected by the pandemic.

The Role of Technology

The stock market crash of 2020 also highlighted the role of technology in today's financial markets. The rapid adoption of online trading platforms and mobile applications has made it easier for retail investors to participate in the stock market. However, this also made the market more susceptible to short-term volatility.

Case Studies: Tech Stocks and Cryptocurrencies

Several high-profile stocks and cryptocurrencies experienced significant price volatility during the stock market crash. For instance, the stock of video game company Zynga soared in value, reaching a peak of over

Conclusion

The 2020 US stock market crash was a complex event influenced by a combination of factors, including market sentiment, economic shutdowns, and government actions. By understanding the causes of this crash, investors can better prepare for future market downturns and make informed decisions to protect their investments.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....