In the ever-evolving landscape of the stock market, staying informed about macroeconomic news is crucial for investors. As we approach July 2025, several key economic indicators are poised to impact the stock market significantly. This article delves into the most influential macroeconomic news that could affect stocks in the coming months.

Inflation and Interest Rates

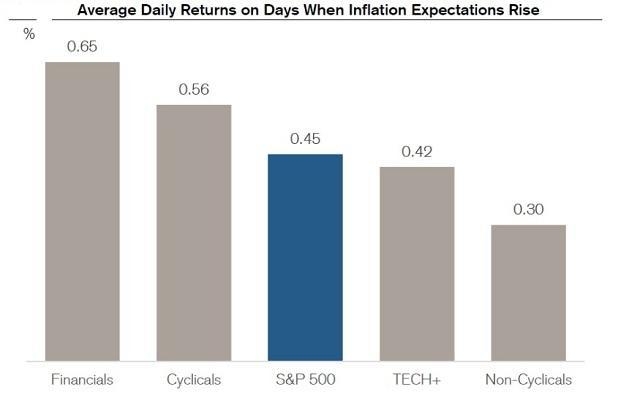

One of the most crucial factors affecting the stock market is inflation and the Federal Reserve's response to it. In July 2025, if inflation remains high, investors should expect the Federal Reserve to continue raising interest rates. This could lead to a slowdown in economic growth and a potential recession. However, if inflation starts to cool down, the Fed may pause or even lower interest rates, which could boost stock prices.

GDP Growth

The Gross Domestic Product (GDP) is a critical indicator of economic health. In July 2025, if the GDP growth rate is strong, it could signal a robust economy and potentially lead to higher stock prices. Conversely, if GDP growth slows down, it could indicate a weakening economy and potentially lower stock prices.

Unemployment Rate

The unemployment rate is another important economic indicator. In July 2025, if the unemployment rate remains low, it could suggest a strong labor market and potentially higher stock prices. However, if the unemployment rate starts to rise, it could signal a weakening economy and potentially lower stock prices.

Trade Policies

Trade policies, both domestic and international, can significantly impact the stock market. In July 2025, if the US implements new trade policies that benefit certain industries, those stocks could see a boost. Conversely, if trade policies are restrictive or protectionist, it could negatively impact certain sectors.

Case Study: Technology Sector

One sector that is particularly sensitive to macroeconomic news is the technology sector. In July 2025, if inflation remains high and interest rates rise, technology stocks, which are often considered riskier, may come under pressure. However, if the Fed starts to lower interest rates, technology stocks could see a significant uptick.

Conclusion

In July 2025, several macroeconomic factors will likely influence the stock market. Investors should closely monitor inflation, GDP growth, the unemployment rate, and trade policies to make informed decisions. While the stock market is unpredictable, staying informed about these key economic indicators can help investors navigate the complexities of the market.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....