In the vast and dynamic world of the stock market, the term "lowest US stock price" often sparks intrigue and curiosity among investors. Understanding what it means and how it can impact your investments is crucial. In this article, we will delve into the concept of the lowest US stock price, its implications, and how it can be a valuable tool for investors.

What is the Lowest US Stock Price?

The lowest US stock price refers to the lowest price at which a particular stock has traded within a given time frame. This can be daily, weekly, or even monthly. It is an essential metric that provides investors with valuable insights into the market dynamics and the stock's performance.

Why is the Lowest US Stock Price Important?

Understanding the lowest US stock price can help investors in several ways:

Market Sentiment: The lowest stock price can indicate market sentiment towards a particular stock. If the price is consistently low, it may suggest that investors are losing confidence in the company's prospects.

Valuation: The lowest stock price can be used to determine if a stock is undervalued. If the price is significantly lower than the stock's intrinsic value, it may present a buying opportunity.

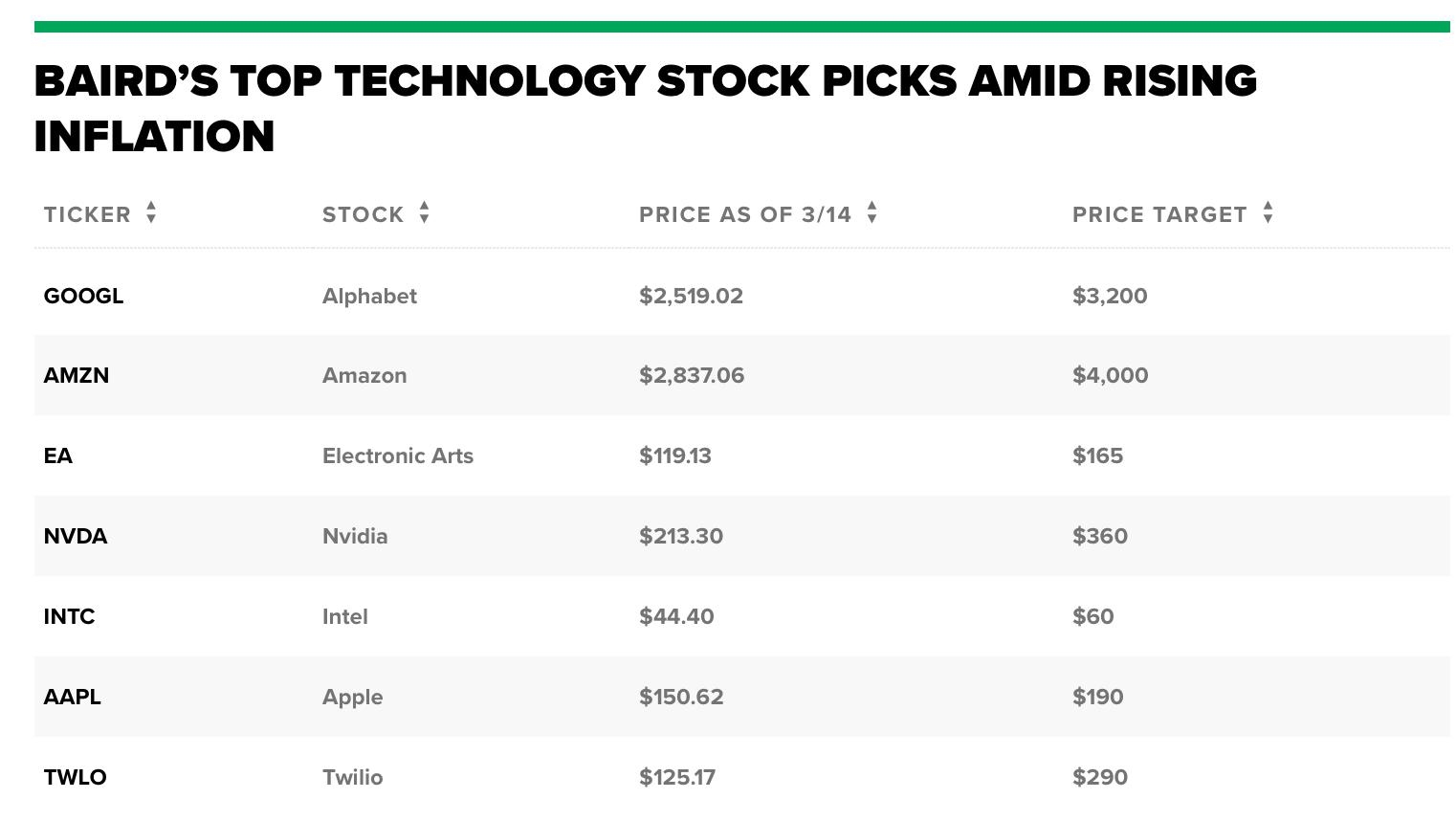

Comparative Analysis: By comparing the lowest stock price of a company with its competitors, investors can gain a better understanding of the company's market position and relative performance.

Factors Influencing the Lowest US Stock Price

Several factors can influence the lowest US stock price:

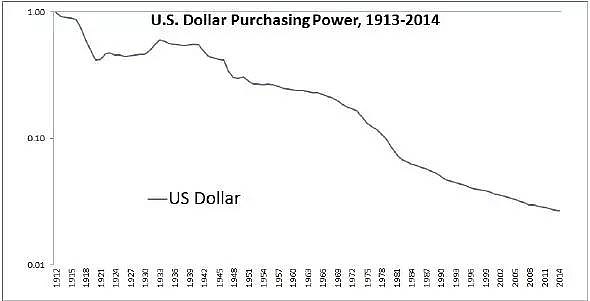

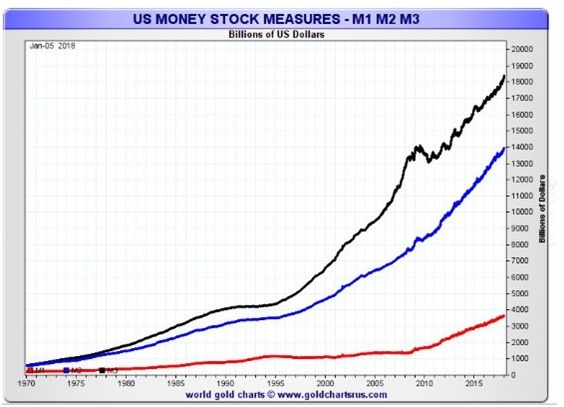

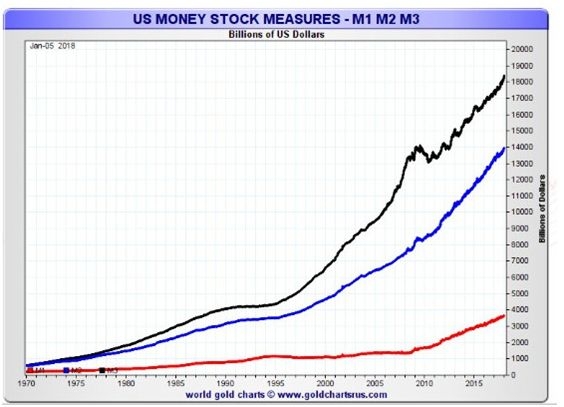

Economic Conditions: The overall economic climate can impact stock prices. During economic downturns, stock prices may plummet, leading to lower prices.

Company Performance: The financial performance of a company, including its revenue, earnings, and growth prospects, can significantly affect its stock price.

Market Sentiment: The perception and sentiment of investors towards a company can lead to fluctuations in its stock price.

Industry Trends: Changes in industry trends can also impact the lowest stock price. For example, a surge in demand for a particular product or service can drive up stock prices.

Case Study: Tesla's Lowest Stock Price

A prime example of how the lowest stock price can impact investor sentiment is Tesla. In 2020, Tesla's stock price plummeted to its lowest level in several years. This was primarily due to concerns about the company's growth prospects and the global economic downturn. However, investors who saw this as an opportunity to buy low ultimately reaped significant returns as the stock price recovered and surged in the following months.

Conclusion

Understanding the concept of the lowest US stock price is essential for investors looking to make informed decisions. By analyzing this metric, investors can gain insights into market sentiment, valuation, and comparative analysis. Remember, the lowest stock price can be a valuable tool, but it should be used in conjunction with other factors to make well-informed investment decisions.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....