In the dynamic world of the stock market, investors are constantly seeking to understand the various factors that can impact stock prices. This article delves into the key factors that influence stock prices, as highlighted by US News, to help investors make informed decisions.

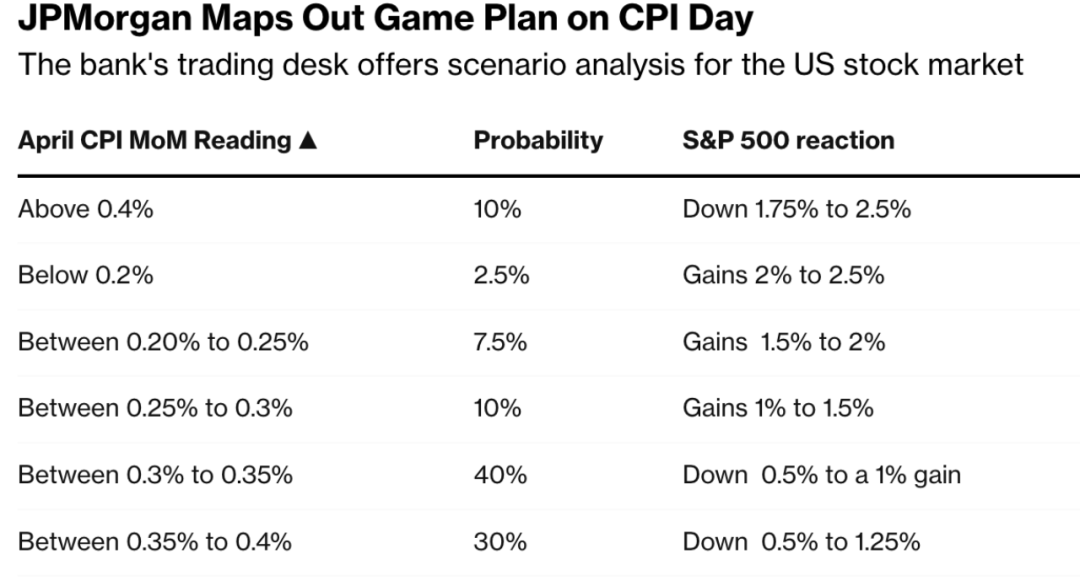

Economic Indicators

One of the most significant factors affecting stock prices is economic indicators. These include unemployment rates, inflation, GDP growth, and consumer spending. For instance, a strong GDP growth rate can indicate a healthy economy, leading to higher stock prices. Conversely, high unemployment or inflation can lead to falling stock prices.

Company Performance

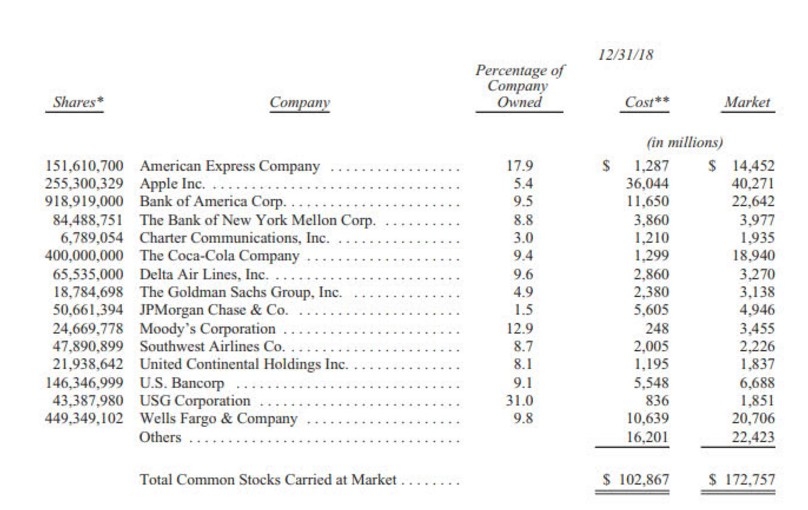

The financial performance of a company is a crucial factor in determining its stock price. Key financial metrics such as revenue, earnings per share (EPS), and profit margins are closely monitored by investors. A company that consistently exceeds earnings expectations or posts strong revenue growth is likely to see its stock price rise.

Sector Trends

The sector in which a company operates can also impact its stock price. For example, the technology sector has been a strong performer in recent years, with companies like Apple and Microsoft leading the charge. Conversely, sectors like energy and telecommunications have faced challenges due to regulatory changes and technological advancements.

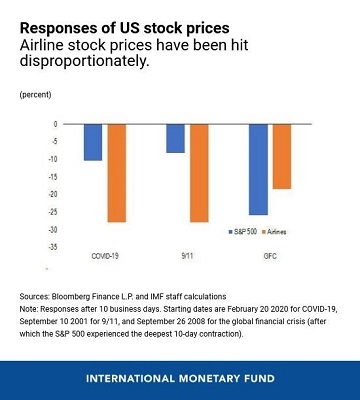

Market Sentiment

Market sentiment refers to the overall mood or outlook of investors in the stock market. This can be influenced by a variety of factors, including news, economic data, and political events. When investors are optimistic about the market, stock prices tend to rise. Conversely, negative sentiment can lead to falling stock prices.

Dividends

Dividends are payments made by companies to their shareholders from their profits. Companies that pay regular dividends are often seen as more stable and reliable, which can attract investors and lead to higher stock prices.

Market Supply and Demand

The basic principles of supply and demand also apply to the stock market. If there is high demand for a stock, its price will likely rise. Conversely, if there is an oversupply of shares, the price may fall.

Regulatory Changes

Regulatory changes can have a significant impact on stock prices. For example, changes in tax laws or regulations affecting a particular industry can lead to significant shifts in stock prices.

Case Studies

To illustrate these factors, let's consider a few case studies:

- Apple (AAPL): Apple's stock price has been on a steady rise over the past few years, driven by strong financial performance, innovation, and market demand for its products.

- Tesla (TSLA): Tesla's stock price has been highly volatile, influenced by factors such as market sentiment, regulatory changes, and the company's growth prospects.

- ExxonMobil (XOM): ExxonMobil's stock price has been affected by the energy sector's challenges, including regulatory changes and technological advancements.

In conclusion, understanding the various factors that impact stock prices is crucial for investors looking to make informed decisions. By considering economic indicators, company performance, market sentiment, and other factors, investors can better navigate the complex world of the stock market.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....