In the bustling market of the United States, the alcohol industry has long been a staple for investors seeking stable returns and growth potential. This article delves into the world of liquor stocks, examining their current trends, market dynamics, and strategic investment opportunities.

The Liquor Industry in the US

The United States is the largest alcohol-consuming country in the world, with a diverse market that spans from craft beers and spirits to wine and distilled products. The industry is characterized by a mix of large multinational corporations and local craft producers, each playing a crucial role in shaping the market landscape.

Trends in Liquor Stocks

1. Craft Beer Market Expansion

The craft beer market has been witnessing significant growth, driven by a surge in consumer demand for unique, flavorful, and locally sourced beers. This trend has been beneficial for liquor stocks, particularly those with a presence in the craft beer segment.

2. Premiumization and Innovation

Consumers are increasingly gravitating towards premium spirits and wines, seeking higher quality and unique flavor profiles. This trend has led to increased investments in research and development, as well as strategic acquisitions in the industry.

3. E-commerce Growth

The rise of online shopping has opened up new avenues for liquor stocks to reach a wider audience. With the convenience of online ordering and delivery, the industry is poised for further growth in this area.

Strategic Investment Opportunities

Investing in liquor stocks can offer several advantages:

1. Market Stability

The alcohol industry is known for its stability, with demand remaining relatively consistent across economic cycles. This makes it an attractive investment option for risk-averse investors.

2. Diversification

Liquor stocks can be a valuable addition to a diversified investment portfolio, offering exposure to a sector that is often less correlated with broader market movements.

3. Growth Potential

Several liquor stocks have shown impressive growth in recent years, driven by factors such as market expansion, premiumization, and innovation. This growth potential makes these stocks appealing to investors seeking long-term returns.

Key Liquor Stocks to Watch

1. Constellation Brands, Inc. (STZ)

Constellation Brands is a leading beverage alcohol company with a strong presence in the craft beer, wine, and spirits markets. The company has a diverse portfolio, including well-known brands like Corona and Robert Mondavi.

2. Diageo plc (DEO)

Diageo is a global leader in premium spirits and beer, with a robust portfolio of brands, including Johnnie Walker, Smirnoff, and Guinness. The company has a strong focus on innovation and global expansion.

3. Boston Beer Company (SAM)

Boston Beer is a prominent player in the craft beer market, known for its iconic Samuel Adams brand. The company has demonstrated significant growth in recent years, driven by its innovative approach to product development and marketing.

Conclusion

Investing in liquor stocks in the US offers a unique opportunity for investors seeking stability, diversification, and growth potential. By understanding the current trends and strategic opportunities in the industry, investors can make informed decisions and capitalize on this dynamic market segment.

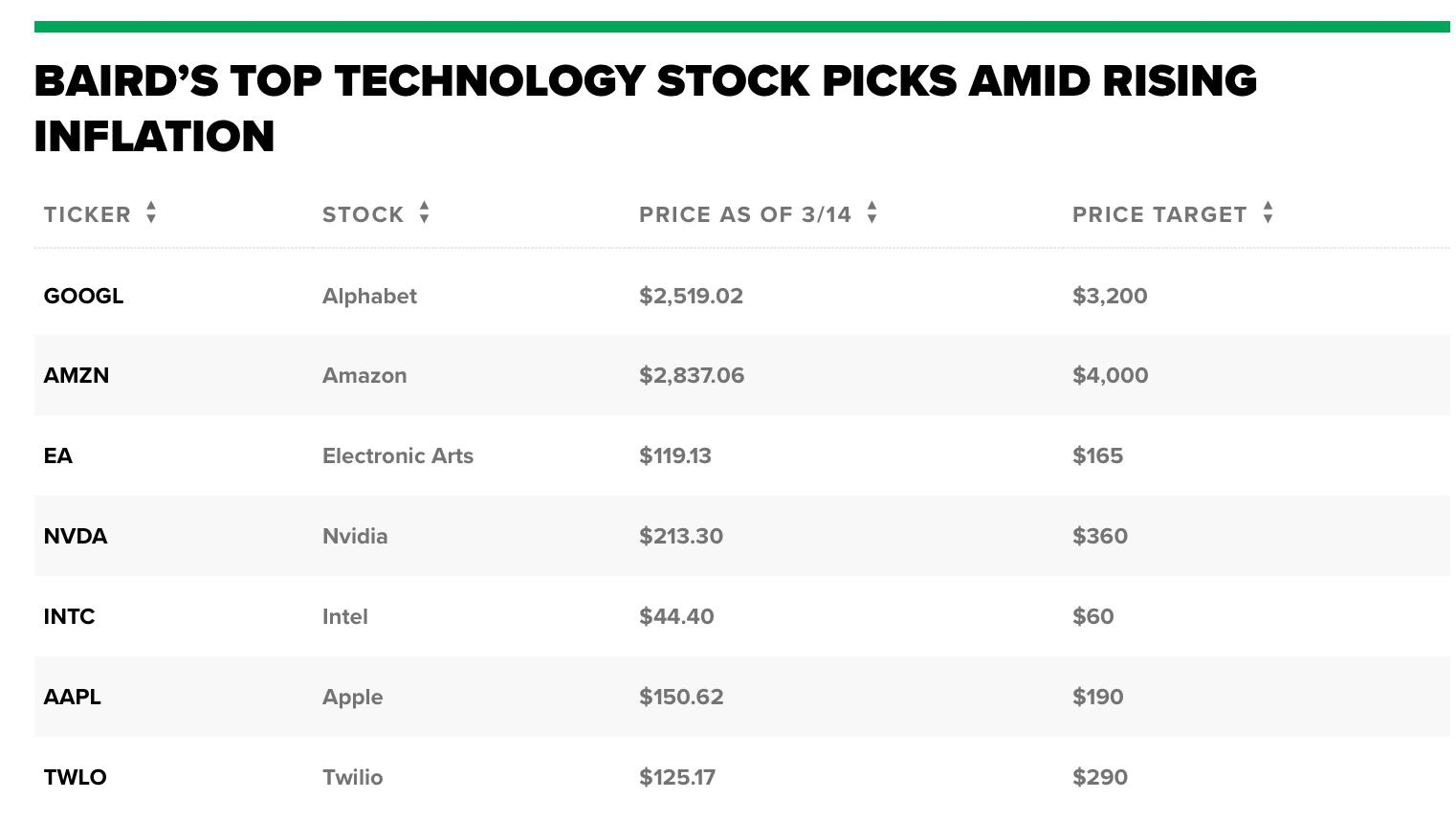

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....