In the ever-evolving global financial landscape, the international stock market has emerged as a significant competitor to the US stock market. This article delves into a comparative analysis of both markets, highlighting their unique features, strengths, and potential risks. By understanding the differences and similarities, investors can make informed decisions about where to allocate their capital.

The US Stock Market: A Leading Global Player

The US stock market, often referred to as the S&P 500, is considered the largest and most influential in the world. It encompasses a diverse range of companies across various sectors, providing a comprehensive view of the US economy. The US stock market has several advantages, including:

- Market Liquidity: The US stock market boasts high liquidity, making it easy for investors to buy and sell stocks without significantly impacting prices.

- Innovation and Growth: The US is a hub of innovation, with numerous tech and biotech companies driving growth.

- Regulatory Framework: The US has a well-established regulatory framework that ensures fair and transparent trading practices.

However, the US stock market also has its drawbacks. For instance, it may be more volatile than other markets, and it can be affected by geopolitical events and economic uncertainties.

The International Stock Market: Diversification and Growth Opportunities

The international stock market offers investors the opportunity to diversify their portfolios and tap into the growth potential of emerging markets. Some key features of the international stock market include:

- Diversification: Investing in international stocks can help mitigate risks associated with investing solely in the US market.

- Emerging Markets: Many emerging markets offer high growth potential, driven by increasing consumer demand and technological advancements.

- Currency Exposure: Investing in international stocks exposes investors to currency fluctuations, which can be both a risk and an opportunity.

However, the international stock market also comes with its challenges. These include:

- Political and Economic Risks: Some countries may have unstable political and economic environments, which can impact the performance of their stock markets.

- Regulatory Differences: Different countries have different regulatory frameworks, which can make investing in international stocks more complex.

Case Studies: Apple and Tencent

To illustrate the differences between the US and international stock markets, let's consider two major companies: Apple and Tencent.

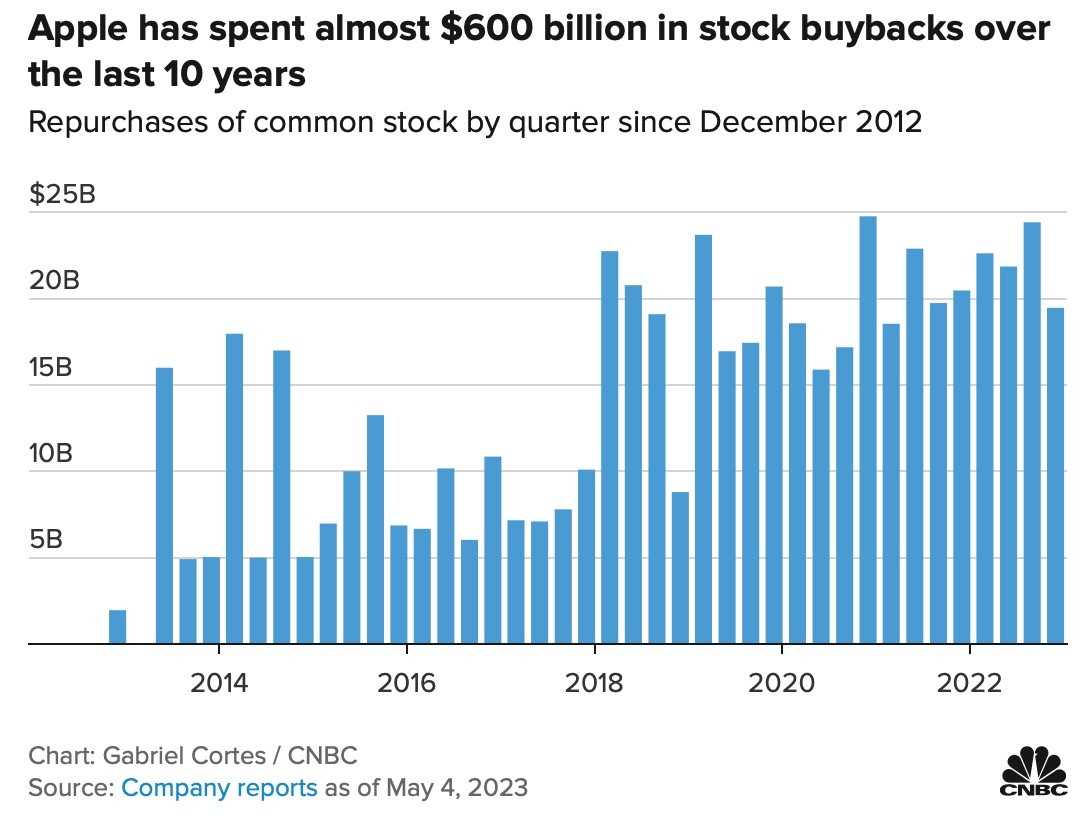

- Apple: As a leading technology company, Apple is listed on the US stock market. It has a strong presence in the US and is well-established in the global market. Apple's stock has experienced significant growth over the years, driven by its innovative products and services.

- Tencent: Tencent, a Chinese tech giant, is listed on the Hong Kong Stock Exchange. It operates in various sectors, including social media, gaming, and e-commerce. Tencent's stock has also seen substantial growth, driven by its success in the Chinese market.

Conclusion

In conclusion, both the international stock market and the US stock market offer unique opportunities and challenges for investors. Understanding the differences and similarities between these markets can help investors make informed decisions about where to allocate their capital. By diversifying their portfolios and considering both domestic and international stocks, investors can maximize their returns while minimizing risks.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....