In the ever-evolving world of the stock market, staying informed about the latest trends and movements is crucial for investors. If you're looking for insights into the current SU stock price, this article is a must-read. We'll explore the factors that influence stock prices, recent market trends, and potential future developments. By the end, you'll have a better understanding of what's driving the price of SU stock and how to make informed investment decisions.

Understanding Stock Prices

The SU stock price is determined by the supply and demand for the company's shares in the market. When more investors want to buy shares, the price tends to rise. Conversely, when more investors want to sell, the price tends to fall. Several factors can influence stock prices, including:

- Company Performance: Strong financial results, increased revenue, and improved profitability can drive up stock prices.

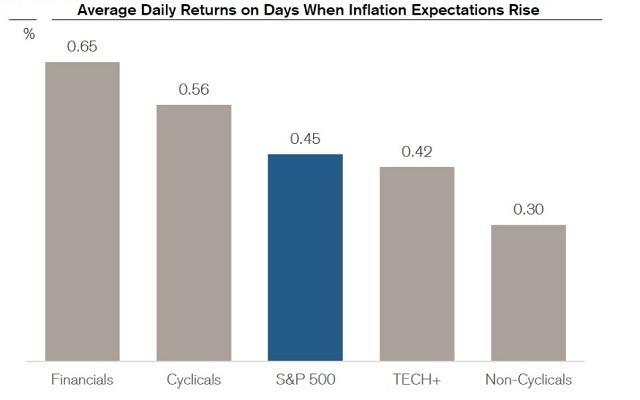

- Economic Factors: Economic indicators such as GDP growth, inflation, and interest rates can impact stock prices.

- Market Sentiment: The overall mood of the market can influence stock prices. For example, during a bull market, investors may be more optimistic, leading to higher stock prices.

- Political Events: Political instability, elections, and other events can cause volatility in stock prices.

Recent Market Trends

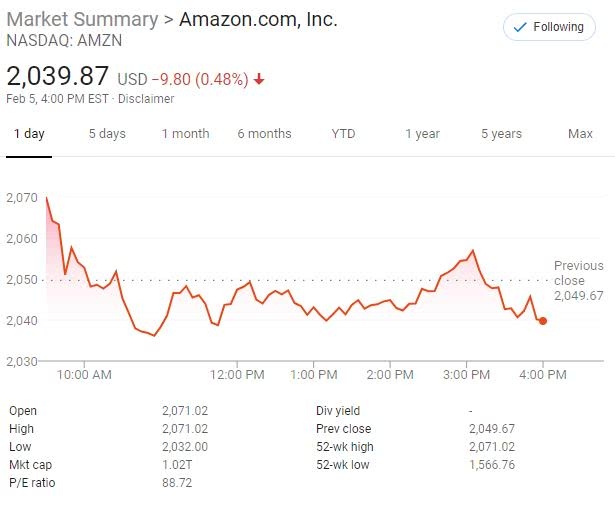

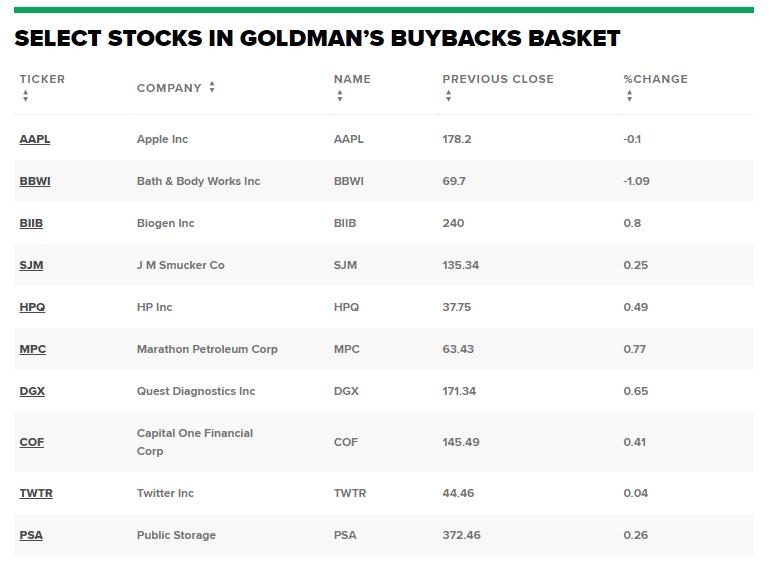

In recent years, the stock market has experienced significant volatility. The SU stock price has been no exception. Here are some key trends to consider:

- Technology Stocks: The technology sector has been a major driver of the stock market's growth. Companies like SU, which operate in this sector, have seen their stock prices rise as investors seek exposure to high-growth industries.

- Economic Recovery: As the global economy recovers from the COVID-19 pandemic, many companies, including SU, are expected to see improved performance and, consequently, higher stock prices.

- Inflation Concerns: Inflation has been a growing concern for investors, as it can erode purchasing power and impact corporate earnings. The SU stock price may be affected by inflation concerns as well.

Potential Future Developments

Several factors could impact the SU stock price in the future:

- Product Launches: If SU plans to launch new products or services, it could drive up demand for its shares and lead to higher stock prices.

- Strategic Partnerships: Collaborations with other companies can provide new growth opportunities for SU and potentially increase its stock price.

- Regulatory Changes: Changes in regulations can impact the profitability and growth prospects of a company, which may affect its stock price.

Case Studies

To illustrate how the SU stock price can be influenced by various factors, let's consider two case studies:

- Product Launch: When SU launched a new line of products, the company's revenue and earnings increased significantly. As a result, the SU stock price rose sharply, reflecting investor optimism about the company's future prospects.

- Strategic Partnership: SU entered into a strategic partnership with a leading tech company, which provided access to new markets and technologies. This partnership led to increased growth and profitability, driving up the SU stock price.

Conclusion

Understanding the SU stock price requires analyzing various factors, including company performance, economic conditions, market sentiment, and future developments. By staying informed and keeping an eye on these factors, investors can make more informed decisions about their investments. Remember, the stock market is unpredictable, and investing always involves risks. Do your research and consult with a financial advisor before making any investment decisions.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....