In a surprising turn of events, Asian stocks have shown a significant rebound despite the recent imposition of tariffs by the United States. This development has sparked a wave of optimism among investors and analysts, as they closely watch the impact of these tariffs on the global market.

Impact of Tariffs on Asian Markets

The United States has been implementing tariffs on a wide range of goods from China, one of the largest trading partners of Asia. These tariffs have led to increased costs for companies and consumers in Asia, as well as causing disruptions in supply chains. However, the recent rebound in Asian stocks suggests that the impact of these tariffs may not be as severe as initially feared.

Reasons for the Rebound

Several factors have contributed to the rebound in Asian stocks. Firstly, the Chinese government has taken measures to boost its economy, including cutting interest rates and increasing infrastructure spending. These measures have helped to stabilize the Chinese stock market and contributed to the overall rebound in Asian stocks.

Secondly, investors have been encouraged by the strong earnings reports from many Asian companies. Despite the tariffs, many companies have managed to achieve strong financial results, which has boosted investor confidence.

Case Study: Tencent

One notable example is Tencent, one of China's largest technology companies. Despite facing challenges from the tariffs, Tencent has continued to post strong earnings. The company's revenue from gaming, advertising, and other businesses has helped to offset the impact of the tariffs, leading to a significant increase in its stock price.

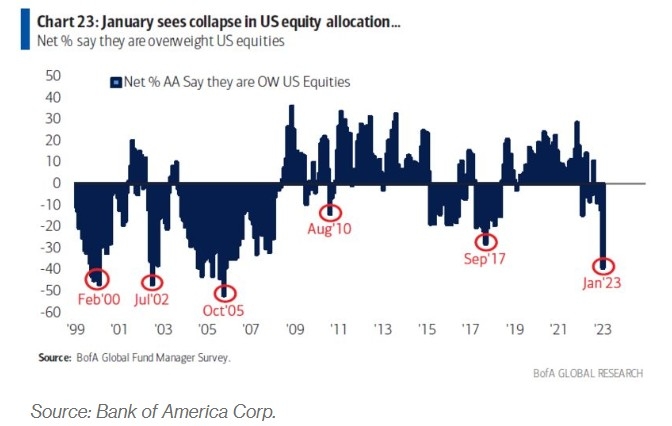

Impact on US Markets

The rebound in Asian stocks has also had a positive impact on US markets. As Asia is a major consumer of US goods and services, the increased demand for US products in the region has helped to boost US exports and contribute to the growth of the US economy.

Challenges Ahead

While the rebound in Asian stocks is a positive sign, challenges remain. The ongoing trade tensions between the United States and China could escalate, leading to further tariffs and disruptions in global trade. Additionally, the global economic environment remains uncertain, with concerns about slowing economic growth and rising inflation.

Conclusion

The recent rebound in Asian stocks amid US tariffs has provided a glimmer of hope for investors and analysts. However, it is important to remain cautious and monitor the evolving situation closely. Despite the challenges ahead, the resilience of Asian stocks and the global economy is a testament to their strength and adaptability.

us stock market today

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....