In the ever-evolving world of finance, the US oil stock market has emerged as a key area of interest for investors and industry enthusiasts alike. With its significant impact on the global economy and the energy sector, understanding the intricacies of this market is crucial. This article delves into the fundamentals of the US oil stock market, highlighting its key components, performance trends, and factors that influence its dynamics.

The Basics of the US Oil Stock Market

The US oil stock market encompasses the trading of stocks related to the exploration, production, refining, and distribution of oil and natural gas. It is a diverse landscape, with companies ranging from small, independent exploration firms to large, multinational oil giants. Key players in this market include ExxonMobil, Chevron, Schlumberger, and Halliburton, among others.

Performance Trends

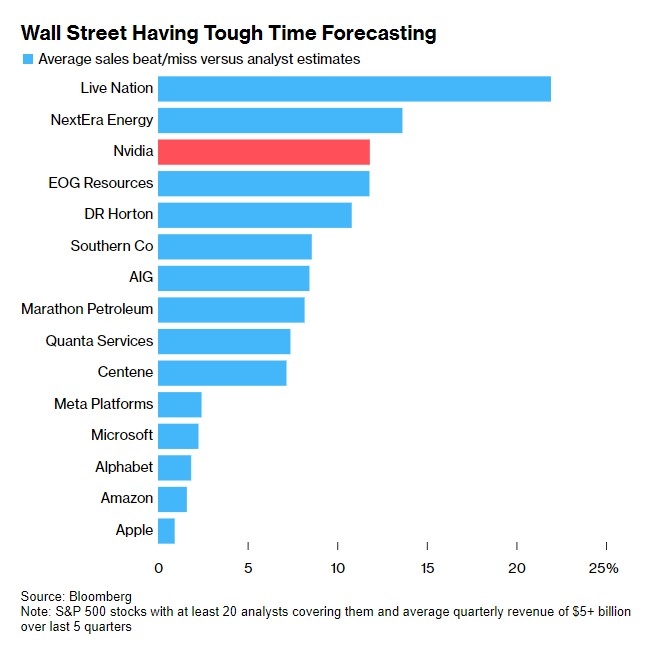

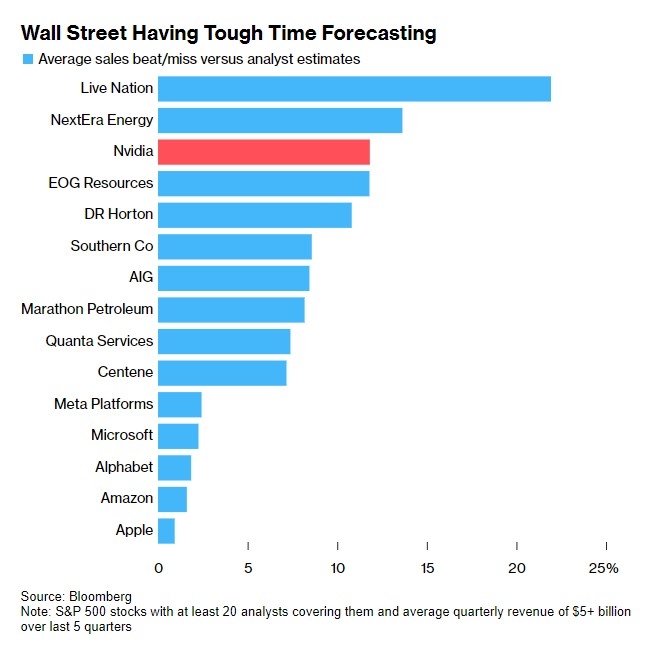

The performance of the US oil stock market is influenced by a variety of factors, including global oil prices, geopolitical events, and economic conditions. Over the past decade, the market has experienced periods of volatility, driven by fluctuations in oil prices and shifts in investor sentiment.

For instance, the 2014 oil price crash, primarily caused by a surge in oil production and a decrease in demand, led to significant declines in the value of oil stocks. Conversely, the subsequent recovery in oil prices in 2016 and 2017 resulted in a rebound in the stock market.

Factors Influencing the Market

Several key factors influence the performance of the US oil stock market:

- Global Oil Prices: The price of oil is the most significant determinant of the market's performance. Higher oil prices generally lead to increased profits for oil companies, while lower prices can result in reduced earnings and stock value.

- Geopolitical Events: Events such as political instability, sanctions, and conflicts in oil-producing regions can disrupt global oil supply and drive up prices.

- Technological Advancements: Innovations in drilling and extraction technologies have increased the efficiency and profitability of oil production, positively impacting the market.

- Economic Conditions: Economic growth, particularly in major oil-consuming countries, can drive up demand for oil and support higher prices.

Case Study: Schlumberger

One notable example of a company that has navigated the complexities of the US oil stock market is Schlumberger. As a leading provider of technology, information, and services to the oil and gas industry, Schlumberger has experienced significant growth over the years.

During the 2014 oil price crash, Schlumberger's stock value plummeted, similar to many other oil companies. However, the company's focus on innovation and diversification allowed it to adapt to the changing market conditions. By investing in new technologies and expanding its service offerings, Schlumberger managed to recover and even grow its market share.

Conclusion

The US oil stock market is a complex and dynamic landscape, influenced by a wide range of factors. Understanding the key components and trends of this market is essential for investors and industry professionals alike. By staying informed and adapting to changing conditions, participants can navigate the complexities of the US oil stock market and potentially achieve significant returns.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....